In our Monday post, we stated,

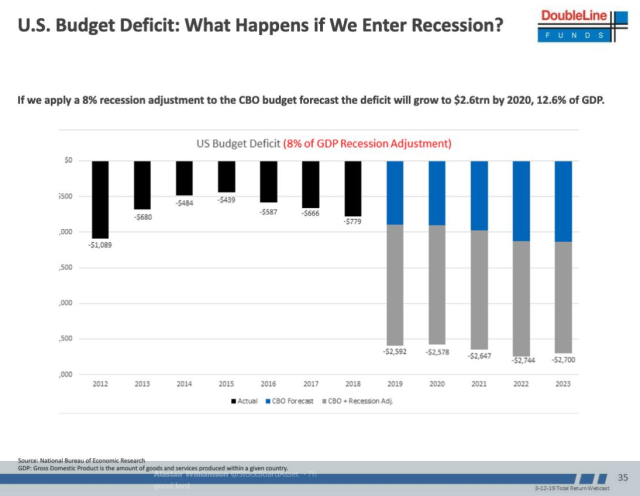

Absolutely stunning to see such large budget deficits as far as the eye can see with the actual and projected unemployment rate under 5 percent. What kind of budget deficit beast will we run if we have a recession? Will demand for Treasury securities be there to finance, say, a $2 trillion deficit? – GMM

Jeff Gundlach illustrates our concern in a chart from his presentation today, Highway To Hell

What Does Ray Dalio Think?

Wow, more than $2.5 trillion-plus in new Treasury issuance hitting the market during the next recession. No wonder Fed Chair Jay Powell looked a little pale during his 60 Minutes on Sunday night.

Given the structural changes taking place in the Treasury market, we are not so sure the markets can absorb such a large supply shock, which would overwhelm even the massive increase in haven inflows into Treasuries during a recession. The Fed would be forced to finance a yuuge portion just as they did indirectly during the first few rounds of QE.

The question is how will a new round of the effective monetization of potentially $2.5-3.0 trillion annual deficits impact confidence in/and the demand for the dollar? Especially after it is evident the Fed can’t normalize its balance sheet without a major market disruption even with a 3.8 percent unemployment rate. Beijing and Tokyo, we have a problem.

This is how emerging markets get into trouble, folks. Money demand collapses when the citizenry and its foreign creditors lose confidence in their currency and central bank. And ”confidence is a very fragile thing.”

Hedge fund great Ray Dalio also has some thoughts on the topic,

Billionaire hedge fund manager Ray Dalio predicted the U.S. economy is about two years from a downturn, which will see the dollar plunge as the government prints money to fund a swelling deficit…

“We have to sell a lot of Treasury bonds, and we as Americans will not be able to buy all those treasury bonds,” he said. “The Federal Reserve will have to print more money to make up for the deficit, will have to monetize more, and that’ll cause a depreciation in the value of the dollar.”

…The currency may “easily” weaken by as much as 30 percent, creating a “dollar crisis,” he said, though the economic contraction won’t be as sharp or severe as it was after the 2008 financial crisis. – Ray Dalio, Bloomberg, Sept 2018

That is just about Game Over, folks. No one cares, anymore.

That is why we all should worry even more.