No commentary this week as the charts are doing all the shouting.

Heigh-Ho, Silver (and Platinum): The Great Fiat Exit of 2025

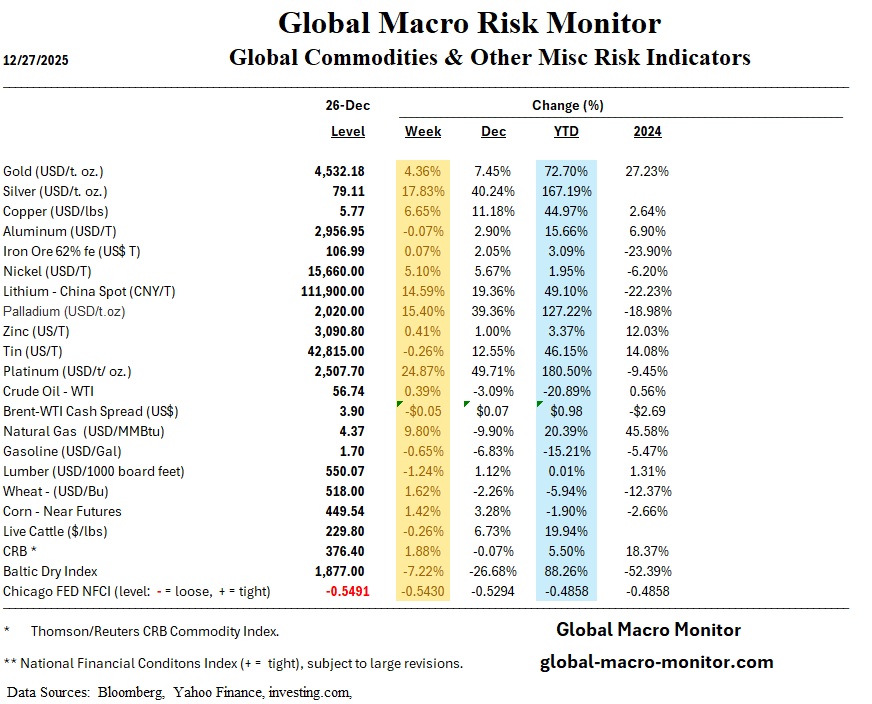

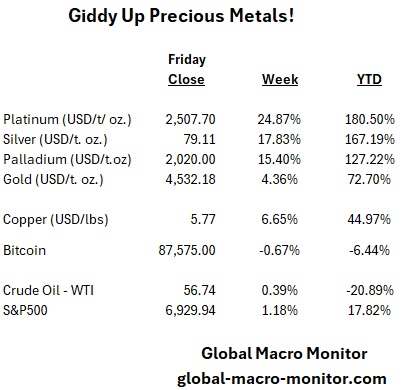

Are you actually watching this? Silver just capped an 18% weekly surge, only to be made look sluggish by Platinum’s violent 25% spike. As we head into the final days of 2025, the “Everything Rally” has officially narrowed into a “Physical Rally,” with silver closing in on $79/oz and platinum reclaiming its throne at $2,500/oz.

The Post-Mortem on the Melt-Up:

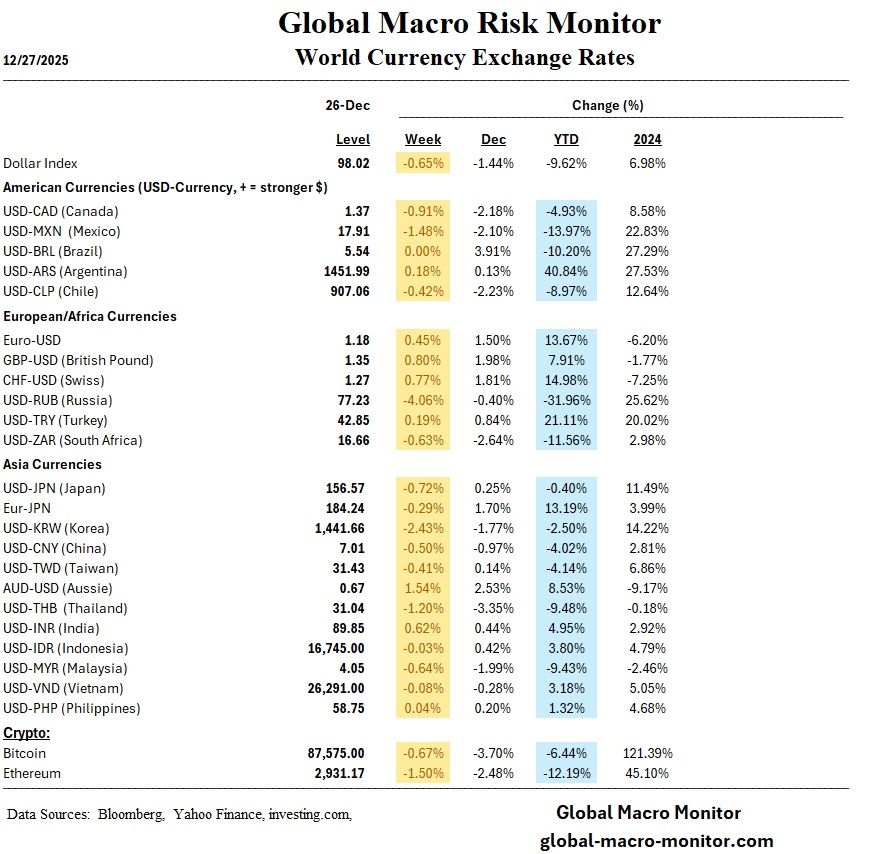

- The “Fiat Exit”: This isn’t just a garden-variety inflation hedge. This is a full-scale exodus. Between aggressive Fed rate-cut fever and a geopolitical map that looks like a game of Risk gone wrong, investors are fleeing the paper theater for assets they can actually drop on their foot.

- The Digital Gold Delusion: For years, we were told Bitcoin was the new gold. Yet, in the face of true global macro instability, the “crypt story” is looking a bit… skeletal. Precious metals have decisively lapped BTC this year, proving that when the world gets twitchy, capital prefers centuries-old certainty over digital allure.

- Tangible Supremacy: In a world of naval blockades and supply-chain “oopsies,” physical scarcity and geopolitical neutrality aren’t just features—they’re the only insurance policies that matter.

The Bottom Line: While the crypto crowd waits for a software update, the boomer rocks (gold and silver) are riding away. When confidence wanes, the smart money trades pixels for physical.

Heigh-Ho, Silver! Away!