Key Points:

- China’s economy is slowing faster than expected, with analysts predicting it will miss its 5% growth target for 2023.

- Industrial output, retail sales, and real estate investment have all weakened significantly.

- Youth unemployment in urban areas reached 17%, with overall unemployment rising to 5.3%.

- The property market crisis, responsible for about one-quarter of China’s economy, continues to drag down economic growth.

- Real estate investment dropped by more than 10% in 2023, severely impacting family savings and local government revenues.

- The Chinese government has shifted its focus to investment in advanced manufacturing instead of consumer-driven stimulus.

- China’s private sector is facing increased regulatory pressure, reducing both domestic and foreign investor confidence.

- U.S. companies in China have reported record-low profits, and many are shifting investments to Southeast Asia.

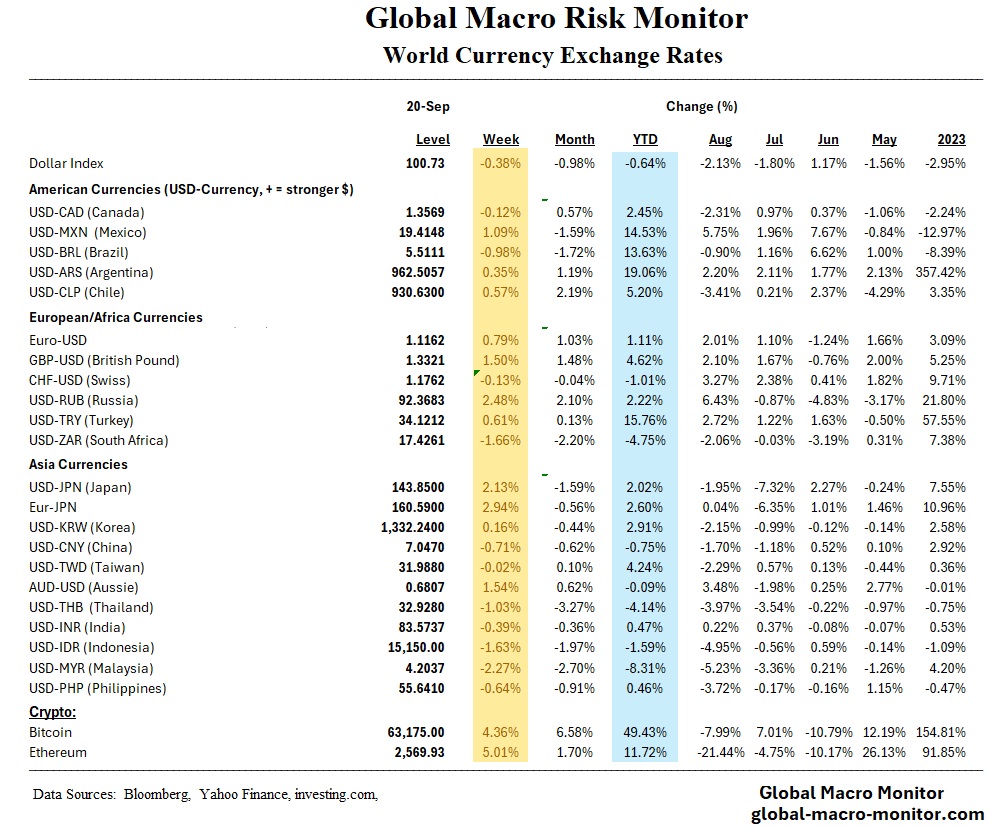

- Global trade tensions are increasing as China boosts exports to offset domestic demand weakness.

- Major financial institutions, including Goldman Sachs and Citigroup, have cut their 2023 Chinese growth forecasts to below 5%.

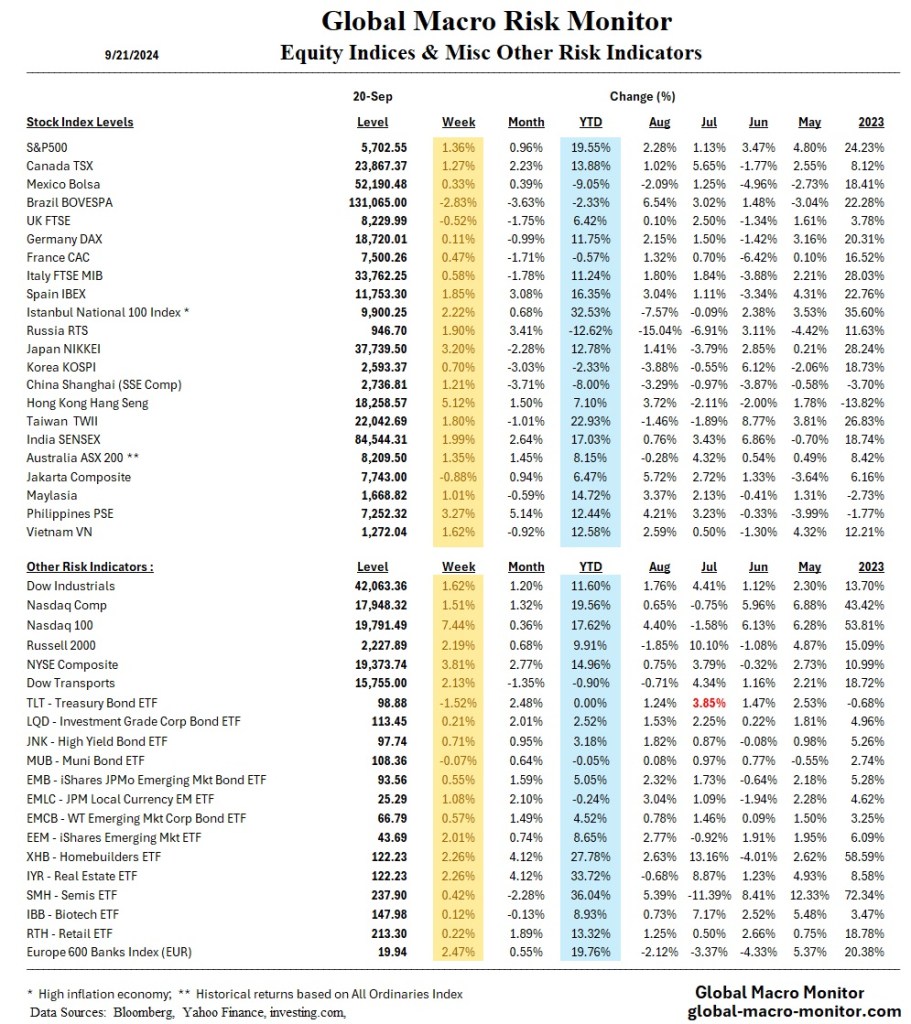

China’s economy is facing a sharper-than-expected slowdown, with analysts predicting that it will fail to meet its modest 5% growth target for the year. A broad range of economic indicators show significant declines, including industrial output, retail sales, and real estate investment. The Chinese stock market has also suffered, with a benchmark for Chinese equities dropping approximately 14% since May. In addition, unemployment rates have risen, with the overall urban jobless rate reaching 5.3%, the highest level in six months. More alarming is the youth unemployment rate, which reached 17% before the government stopped releasing that statistic. Deflationary pressures further exacerbate these economic difficulties, signaling deeper structural issues.

Weakening Real Estate Sector

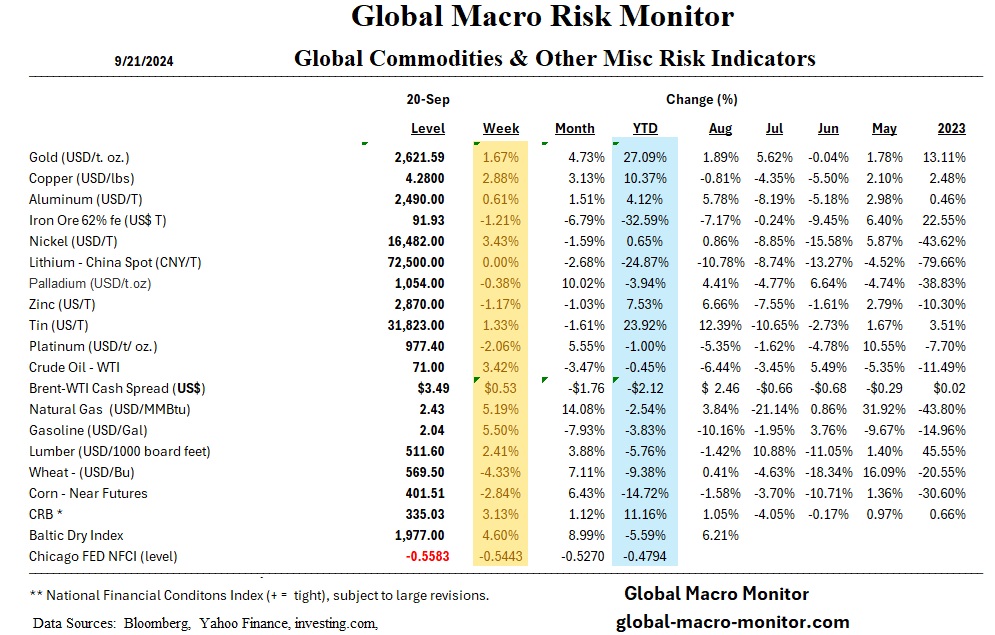

One of the primary factors behind China’s economic troubles is the real estate sector, which accounted for nearly a quarter of the country’s GDP until recently. A 2020 government policy that limited developers’ ability to borrow has resulted in a series of defaults, triggering a broader crisis. Investment in real estate has dropped by over 10% since January, compared to the same period last year. This downturn has impacted middle-class wealth as property values decline, eroding household savings and straining local governments, which rely on land sales for revenue. The double blow to both consumer wealth and public investment has significantly hindered economic momentum.

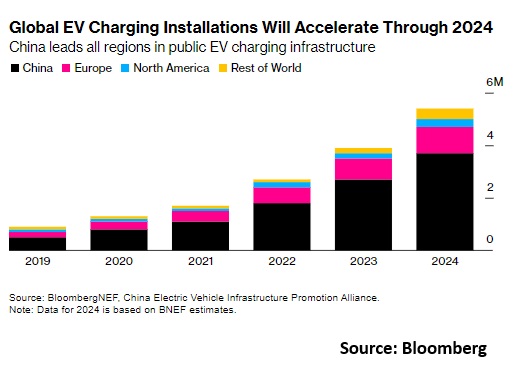

In response to these challenges, Chinese officials have resisted implementing large-scale stimulus packages akin to those used after the 2008 global financial crisis. Instead, the government is focused on boosting investment in advanced manufacturing and technology. A key priority is achieving self-sufficiency in critical industries, such as semiconductors, electric vehicles, and artificial intelligence.

Manufacturing investment has grown by 9% in 2023, and exports have risen for five consecutive months, reflecting some success in China’s export-led growth strategy. However, trade tensions with the United States and Europe are intensifying, as Western nations accuse China of using state subsidies to support industries and flood global markets with low-cost products.

Internationally, the implications of China’s economic slowdown are significant. A weaker Chinese economy means that domestic demand is declining, prompting Chinese firms to increase exports. This has led to mounting concerns in the U.S. and Europe about unfair trade practices. The Biden administration, for example, has responded by imposing tariffs on Chinese goods, including electric vehicles and solar panels. As China’s domestic challenges grow, its economic policies and export strategies are likely to have far-reaching consequences for global trade, investment, and political relations in the coming years.

Stay tuned.