-

In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.

-

Join 1,215 other subscribers

Contribute To GMM

Categories

- 3D Printing

- Agriculture

- AI

- Algos

- Apple

- Automation

- Banking

- BFTP

- Bitcoin

- Black Swan Watch

- Bonds

- Brazil

- Brexit

- BRICs

- Budget Deficit

- Capital Flows

- Cartoon of the Day

- Cashless Society

- Chart of the Day

- Charts

- China

- Clean Tech

- Climate Change

- Coach C

- Commodities

- Coronavirus

- COVID

- Credit

- Crude Oil

- Currency

- Cyprus

- Daily Risk Monitor

- Day In History

- Debt

- Demographics

- Disinflaton

- Dollar

- Earnings

- ECB

- Economics

- Economist

- Egypt

- Electric Vehicles

- Emerging Markets

- Employment

- Energy

- Environment

- Equities

- Equity

- Euro

- Eurozone Sovereign Spreads

- Exchange Rates

- Fed

- Finance and the Good Society

- FinTech

- Fiscal Cliff Monitor

- Fiscal Policy

- Food Prices

- France

- Futurist

- Game Theory

- General Interest

- Geopolitical

- Geopolitics

- German Bund

- Germany

- Global Macro Watch

- Global Reset

- Global Risk Monitor

- Global Stock Performance

- Global Trend Indicators

- Gold

- Greece

- Healthcare

- Heat Map

- Hedge Funds

- Housing

- Human Interest

- Immigration

- Impeachment

- India

- Inequality

- Inflation/Deflation

- Infographics

- Innovation

- Institutional Investors

- Interest Rate Monitor

- Interest Rates

- Interviews

- Italian Yields

- Italy

- Japan

- Jobs

- Lectures

- Macro Notes from Conference Calls

- Manufacturing

- Masters

- Mexico

- Monetary Policy

- Movies

- Muni Bonds

- Muni Market

- Natural Gas

- News

- Nonlinear Thinking

- North Korea

- Overbought Markets

- Picture of the Day

- PIIGS

- PMIs

- Policy

- Politics

- Population

- Populism

- Poverty

- President Trump

- Qunat Strategies

- Quote of the Day

- Quotes

- Rare Earth Elements

- Readership

- Reads

- Real Estate

- Relative Strength Index

- Robert Shiller

- RSIs

- S&P500

- Sector ETF Peformance

- Semiconductor prices

- Semiconductors

- Social Media

- Socialism

- Song for the Week

- Sovereign Debt

- Sovereign Risk

- Spain

- Sports

- State and Local Government

- Tail Risk

- Technical Analysis

- Technology

- The Big Reset

- The Weekend Read

- This Day In Financial History

- Trade War

- Trades

- Tweet of the Day

- Ugly Chart Contest

- Uncategorized

- US Releases

- Video

- Volatility

- Wages

- Week Ahead

- Week in Review

- Weekend Reads

- Weekly Eurozone Watch

- Whales

-

Recent Posts

Meta

China’s Overcapacity Problem

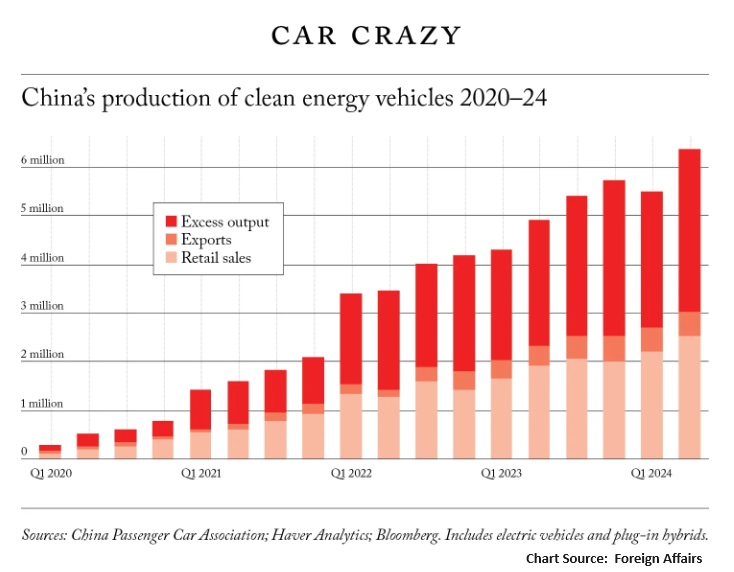

With electric vehicles, for instance, carmakers in Europe are already facing stiff competition from cheap Chinese imports. Factories in this and other emerging technology sectors in the West may close or, worse, never get built. – Foreign Affairs

China’s economic strategy of relying on global markets to absorb its excess production has led to significant overcapacity across multiple sectors, including steel, aluminum, electric vehicle batteries, and solar panels. This overinvestment has saturated domestic markets and strained international relations as foreign governments become wary of China unloading its surplus production, not to mention the country’s supply chain dominance. The consequences are concerning. Globally, Western manufacturing faces heightened competition, risking closures and stifling innovation. Domestically, overproduction has triggered price wars, depressed profits, and led to near-zero inflation, heightening the risk of China entering a deflationary spiral.

Key Facts

- Excess Capacity: China has overproduced in key industries, including steel, aluminum, and electric vehicle batteries.

- Global Impact: Western industries face stiff competition from cheap Chinese imports, threatening local manufacturing.

- Economic Consequences: Overproduction is depressing prices and leading to near-zero inflation in China.

- Price Wars: Domestic markets are saturated, leading to intense price competition and reduced profitability.

- Sectoral Impact: 27% of Chinese automobile manufacturers were unprofitable in May 2024.

- Innovation Risk: Overcapacity threatens the sustainability of high-value manufacturing industries in the West.

- Debt Burden: China’s debt service ratio in the private nonfinancial sector is at an all-time high.

- Consumer Confidence: Erosion of consumer confidence leads to further domestic consumption declines.

Posted in Uncategorized

Leave a comment

The Great China Credit Contraction

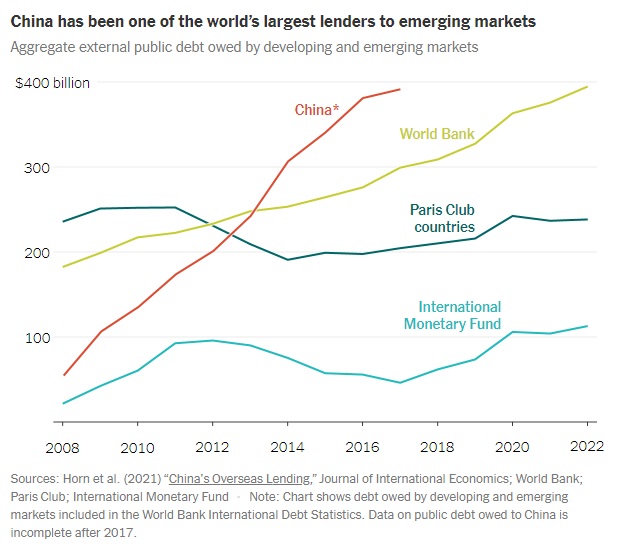

China’s collapse in foreign lending has contributed to a world of hurt and burdensome debt.

China also lent more than $1 trillion abroad, largely for infrastructure projects to be built by Chinese companies under its Belt and Road Initiative. Over the past two decades, one in three infrastructure projects in Africa was built by Chinese entities. The long-term debt risks for fragile developing economies were often ignored.

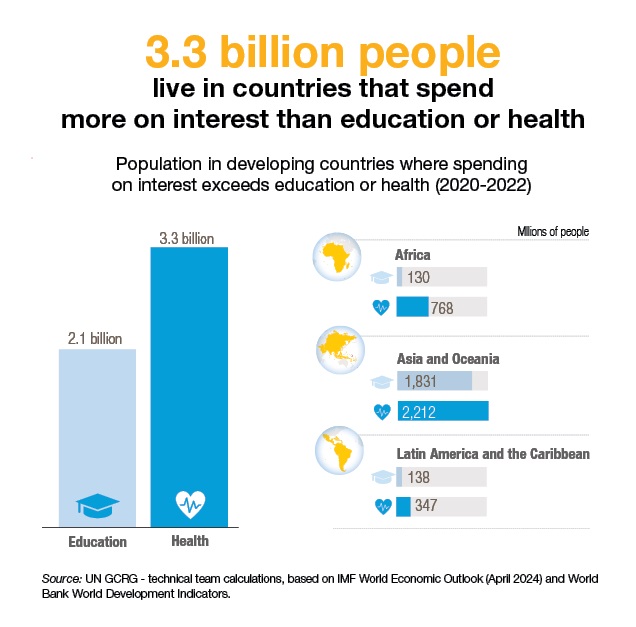

…China, now by far the world’s largest sovereign lender, has played a leading role in saddling many countries with levels of debt, often through nontransparent arrangements, that are comparable with those seen in the 1980s. The situation is becoming perilous. Over the past decade, during which China doled out more lending than the Paris Club — a grouping of 22 of the world’s largest creditor nations — the total value of interest payments of the 75 poorest countries in the world have quadrupled and will outstrip their total annual spending on health, education and infrastructure combined, according to the World Bank. An estimated 3.3 billion people live in countries where interest payments exceed investments in either education or health, the United Nations said. – NY Times

Posted in Uncategorized

Leave a comment

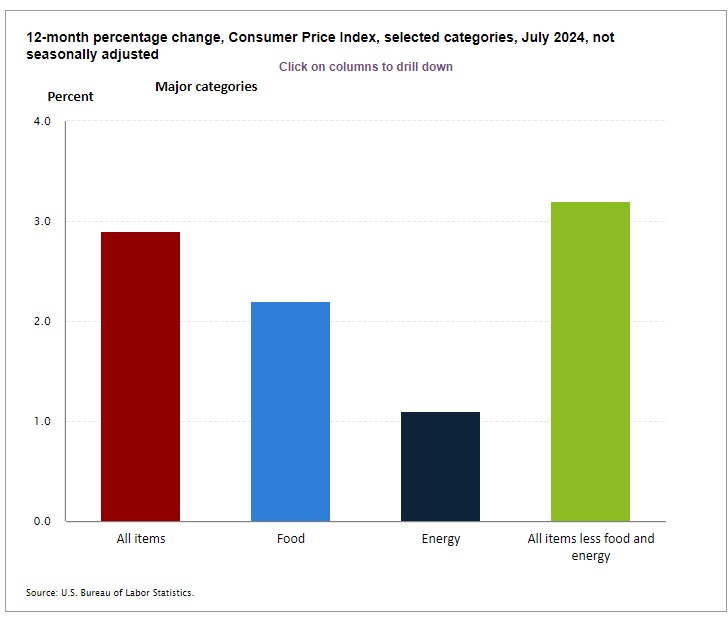

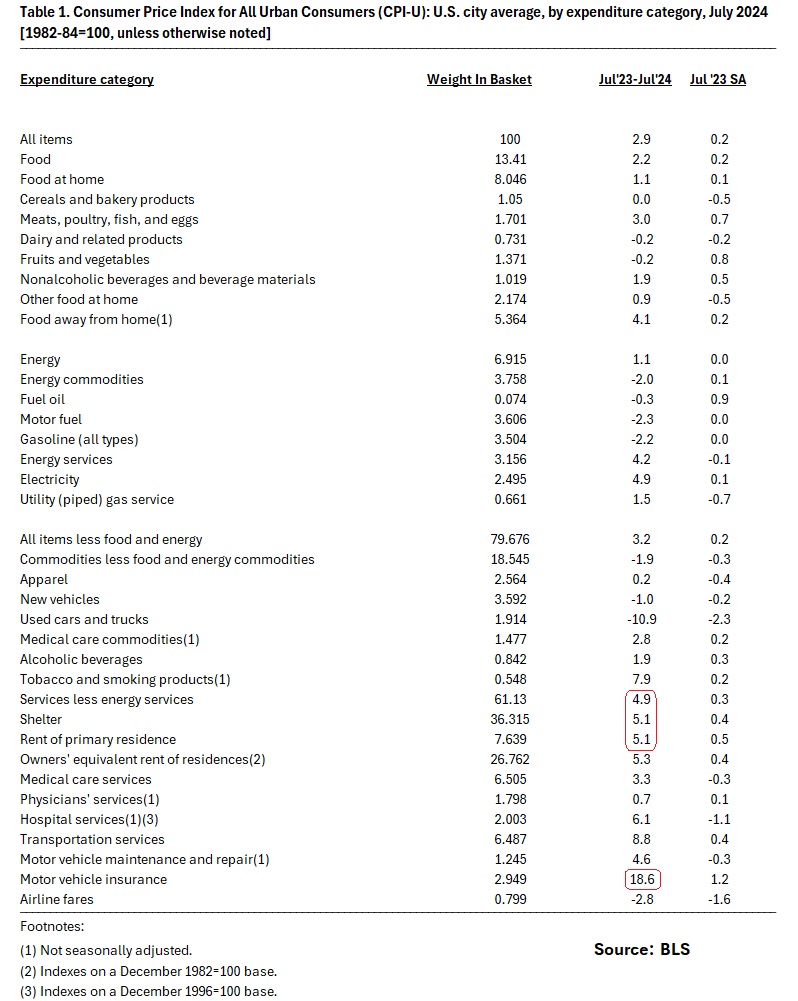

Annual Consumer Price Inflation Below 3%

The Consumer Price Index for All Urban Consumers (CPI-U) rose by 0.2% in July on a seasonally adjusted basis, reversing the 0.1% decline in June. The annual increase was 2.9%, the smallest since March 2021. The shelter index was the main driver, contributing nearly 90% of the monthly rise, with a 0.4% increase. Energy prices remained flat after two months of decline, and food prices also saw a modest increase of 0.2%.

Core inflation, excluding food and energy, rose by 0.2% and 3.2% year-on-year, driven by gains in shelter, motor vehicle insurance, and household furnishings. Despite these increases, some areas like used cars, medical care, and airline fares saw price declines.

Cue the Fed.

Key Facts:

- Monthly CPI-U increase: 0.2% in July 2024.

- Annual CPI-U increase: 2.9%, the smallest since March 2021.

- Shelter index: Increased by 0.4%, accounting for nearly 90% of the overall rise.

- Energy index: Unchanged in July, following two months of decline.

- Food index: Increased by 0.2%, consistent with June’s growth.

- Core inflation (less food and energy): Up 0.2% in July, with annual growth of 3.2%.

- Declining sectors: Used cars, medical care, airline fares, and apparel saw price drops.

Posted in Uncategorized

Leave a comment

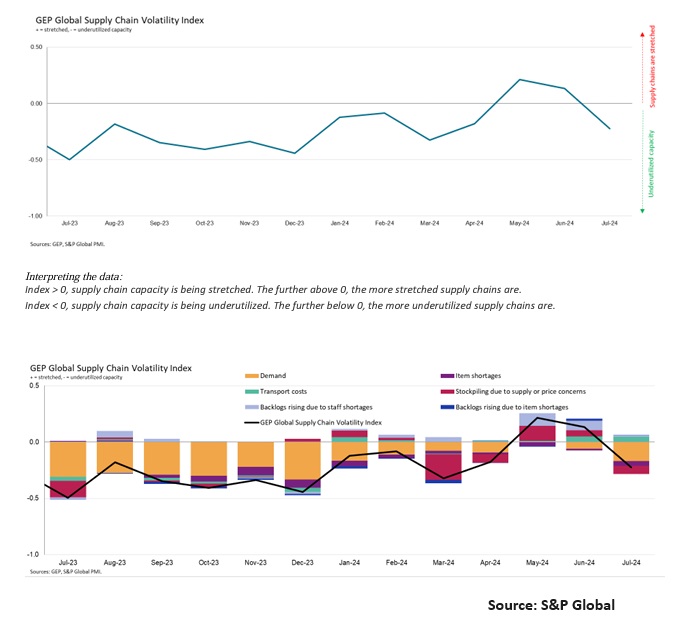

Global Supply Chain Showing Slack

The latest release from S&P Global regarding the GEP Global Supply Chain Volatility Index for July underscores a marked decrease in supplier capacity utilization, falling to a four-month low not observed since April. This downturn indicates an alleviation of strains across international supply chains concurrently with a general softening in demand across multiple regions.

Europe stands out with pronounced underutilization, driven predominantly by a manufacturing sector grappling with recessionary forces. Germany, in particular, has seen a significant contraction in factory purchasing activity, exemplifying the region’s economic challenges.

Similarly, growth in Asia has slowed, with factory demand plummeting to the lowest levels since December 2023. Chinese manufacturing sectors have notably reduced purchasing activity for the first time in nine months, marking significant economic softening. Japan’s manufacturing malaise has further exacerbated the region’s declining performance.

Conversely, North America’s supply chain utilization has seen only marginal changes from June. Nevertheless, the region is not without difficulties, evidenced by a slowdown in purchasing across the United States, Mexico, and Canada. Canada, in particular, has experienced the most severe contraction within the region, whereas earlier growth observed in Mexican factories has abated somewhat, marking the first downturn in demand since October 2023.

Despite these challenges, global supply chains have maintained a degree of operational efficiency, with negligible disturbances in stock levels, shortages, or undue price fluctuations. However, global transportation costs have escalated to a 21-month peak, largely propelled by increased expenses in Asia.

The diminished purchasing activities reflect broader economic slowdowns, prompting intensified discussions about the necessity for the Federal Reserve to reduce interest rates to bolster demand and mitigate further economic deceleration in the latter half of the year.

Overall, the July 2024 S&P Global report signals growing concerns over deteriorating economic conditions globally, with particular emphasis on critical areas such as Europe and Asia and the subsequent impact on the efficiency of international supply chains.

Posted in Uncategorized

Leave a comment