-

In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.

-

Join 1,220 other subscribers

Contribute To GMM

Categories

- 3D Printing

- Agriculture

- AI

- Algos

- Apple

- Automation

- Banking

- BFTP

- Bitcoin

- Black Swan Watch

- Bonds

- Brazil

- Brexit

- BRICs

- Budget Deficit

- Capital Flows

- Cartoon of the Day

- Cashless Society

- Chart of the Day

- Charts

- China

- Clean Tech

- Climate Change

- Coach C

- Commodities

- Coronavirus

- COVID

- Credit

- Crude Oil

- Currency

- Cyprus

- Daily Risk Monitor

- Day In History

- Debt

- Demographics

- Disinflaton

- Dollar

- Earnings

- ECB

- Economics

- Economist

- Egypt

- Electric Vehicles

- Emerging Markets

- Employment

- Energy

- Environment

- Equities

- Equity

- Euro

- Eurozone Sovereign Spreads

- Exchange Rates

- Fed

- Finance and the Good Society

- FinTech

- Fiscal Cliff Monitor

- Fiscal Policy

- Food Prices

- France

- Futurist

- Game Theory

- General Interest

- Geopolitical

- Geopolitics

- German Bund

- Germany

- Global Macro Watch

- Global Reset

- Global Risk Monitor

- Global Stock Performance

- Global Trend Indicators

- Gold

- Greece

- Healthcare

- Heat Map

- Hedge Funds

- Housing

- Human Interest

- Immigration

- Impeachment

- India

- Inequality

- Inflation/Deflation

- Infographics

- Innovation

- Institutional Investors

- Interest Rate Monitor

- Interest Rates

- Interviews

- Italian Yields

- Italy

- Japan

- Jobs

- Lectures

- Macro Notes from Conference Calls

- Manufacturing

- Masters

- Mexico

- Monetary Policy

- Movies

- Muni Bonds

- Muni Market

- Natural Gas

- News

- Nonlinear Thinking

- North Korea

- Overbought Markets

- Picture of the Day

- PIIGS

- PMIs

- Policy

- Politics

- Population

- Populism

- Poverty

- President Trump

- Qunat Strategies

- Quote of the Day

- Quotes

- Rare Earth Elements

- Readership

- Reads

- Real Estate

- Relative Strength Index

- Robert Shiller

- RSIs

- S&P500

- Sector ETF Peformance

- Semiconductor prices

- Semiconductors

- Social Media

- Socialism

- Song for the Week

- Sovereign Debt

- Sovereign Risk

- Spain

- Sports

- State and Local Government

- Tail Risk

- Technical Analysis

- Technology

- The Big Reset

- The Weekend Read

- This Day In Financial History

- Trade War

- Trades

- Tweet of the Day

- Ugly Chart Contest

- Uncategorized

- US Releases

- Video

- Volatility

- Wages

- Week Ahead

- Week in Review

- Weekend Reads

- Weekly Eurozone Watch

- Whales

-

Recent Posts

Meta

Follow Your Passion? “What Utter Bullshit!” | Prof G

If you happened to miss it, I highly recommend watching this insightful interview conducted by Michael Smerconish with NYU Professor Scott Galloway. Professor Galloway is an exceptionally intelligent and wise individual, offering up some valuable advice for recent graduates. Smerconish is no less impressive himself.

Click here to view the full interview (9 minutes).

Posted in Uncategorized

Leave a comment

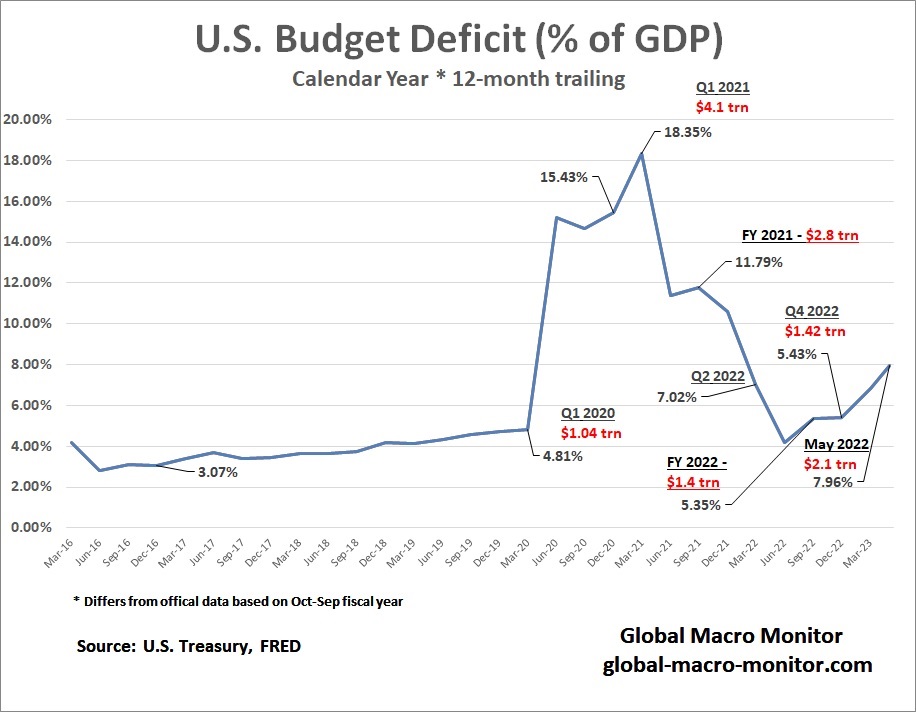

U.S. Budget Deficit Nearing 8% Of GDP

The U.S. budget deficit keeps climbing, approaching 8 percent of GDP as the 12-month trailing shortfall reached $2.1 trillion in May. Budget receipts in May were down 20 percent year-on-year, most likely due to lower tax receipts from a slowing economy, falling capital gains receipts, and some technical factors.

Financing all this without the central banks or a spike in real interest rates will be challenging. Stay tuned.

Posted in Uncategorized

Leave a comment

Seasonal Greetings: Sell Monday, Buy Thursday

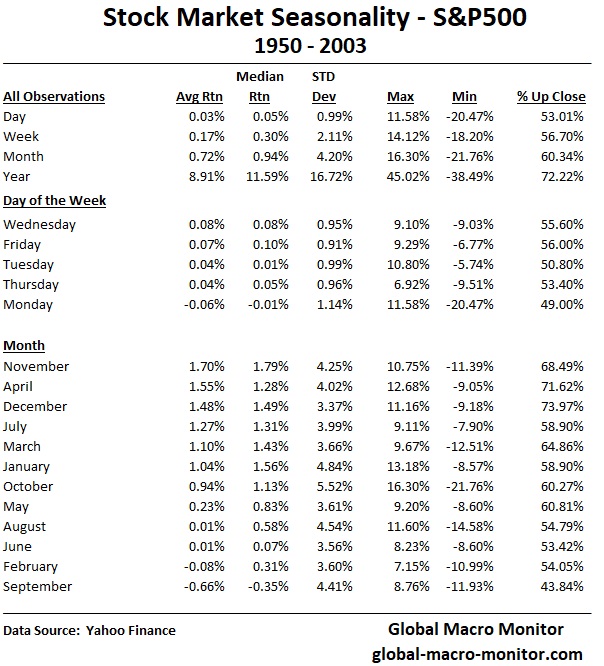

Chat GPT, a very efficient code debugger, has already greatly enhanced our coding (R) productivity, making it easier to manipulate data and crunch numbers. We have put together some interesting tables on the seasonality of daily, monthly, and annual returns for the S&P500 since 1950. The data do not include dividends.

It Doesn’t Take A Genius To Be A Bull

The data show that the S&P500 closes positive 72 percent annually, 60 percent monthly, 57 percent weekly, and 53 percent of the time daily. The average daily return over the past 70 years is 3 basis points. Clearly, the data are tough on long-term bears and why so few own Park Avenue penthouses.

Manic Mondays

Mondays, on average, are the only day of the week to generate a negative daily return, close down more than 50 percent of the time, and are, by far, the most volatile. Note the max/min moves took place on a Monday. We did check the Monday daily return by excluding the outlier Black Monday, October 1987 20 percent crash, which had little effect on the results.

So far this year, the Manic Monday data does not hold.

In fact, quite the opposite, which we discuss below.

Monthly Seasonality: Buy Santa Claus

November, April, and December generate the highest returns. We find it quite stunning the S&P500 closes up daily 74 percent of the time in December, a day trader’s dream.

2023 – Buy Wednesday Close, Sell Monday Close

Mondays are acting quite differently in 2023 than the 70-year averages, have closed higher 70 percent of the time, and returned 0.4 percent on average. Today’s close validated the data.

Note also the horrendous performance of Tuesdays and Wednesdays this year, closing lower 65 percent of the time and generating negative returns. Our good friend, Harry The K., points out all the CPI releases this year have taken place on a Tuesday or Wednesday except for the January release. The inflation data is squarely on the market’s radar. In addition, the FOMC announcements generally take place on Tuesday or Wednesday, and the Fed has been far from market friendly in 2023.

The data suggest selling Monday at the close and buying the Wednesday close — that is, staying out of the S&P on Tuesdays and Wednesdays — has generated excess returns. Hindsight is always golden.

We have calculated the relative return in 2023 of a strategy of selling the S&P500 at the Monday close and buying at the Wednesday close. The relative performance is significant and illustrated below.

Is Past Prologue?

Maybe, maybe not. It’s not entirely out of the realm of possibilities machine learning algos have already picked up the pattern and are now reinforcing it. The pattern will continue until it won’t.

The Wednesday/Monday strategy shall be tested with tomorrow’s CPI release.

Posted in Uncategorized

2 Comments

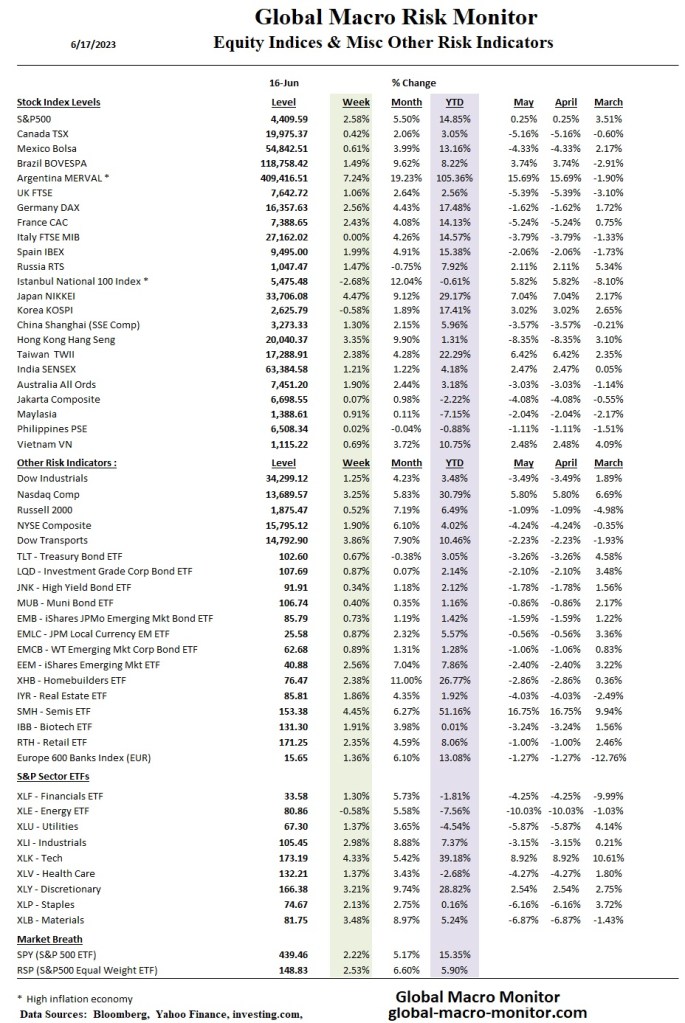

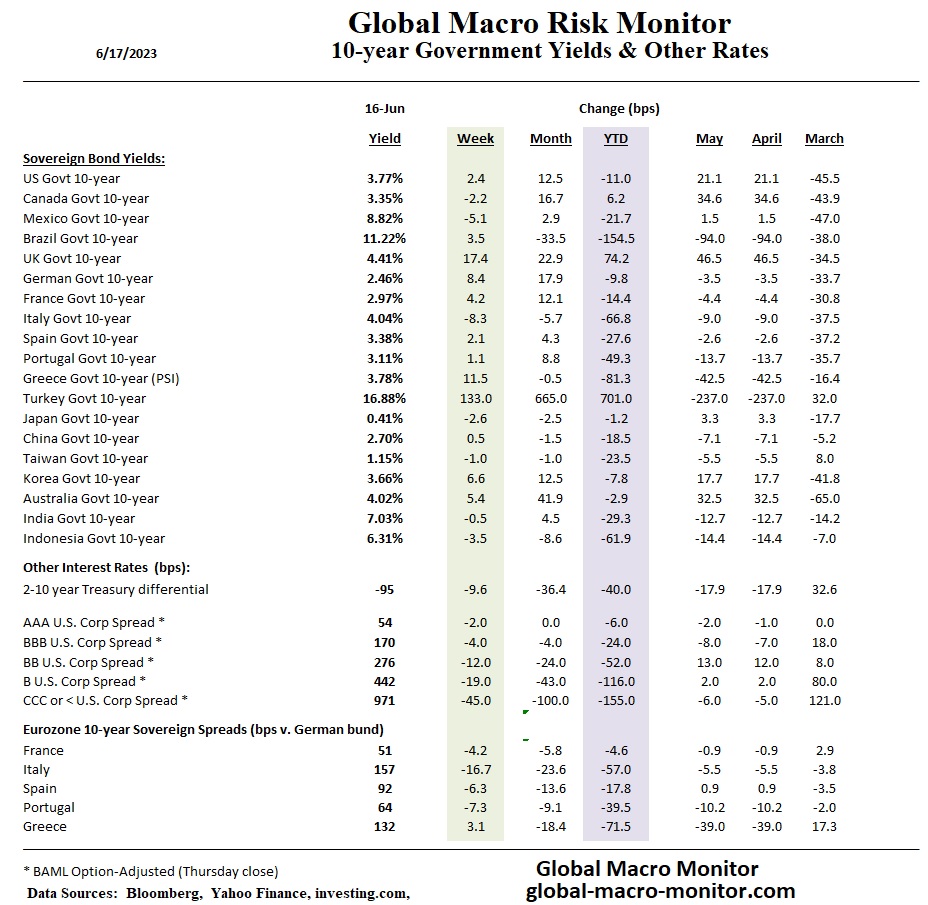

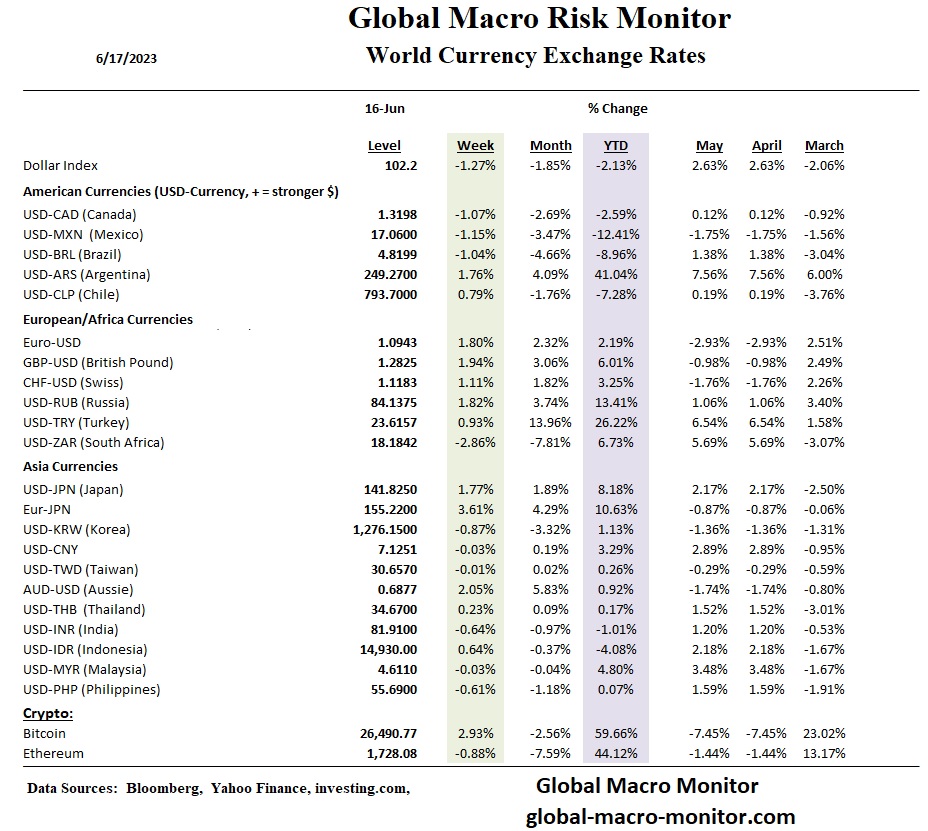

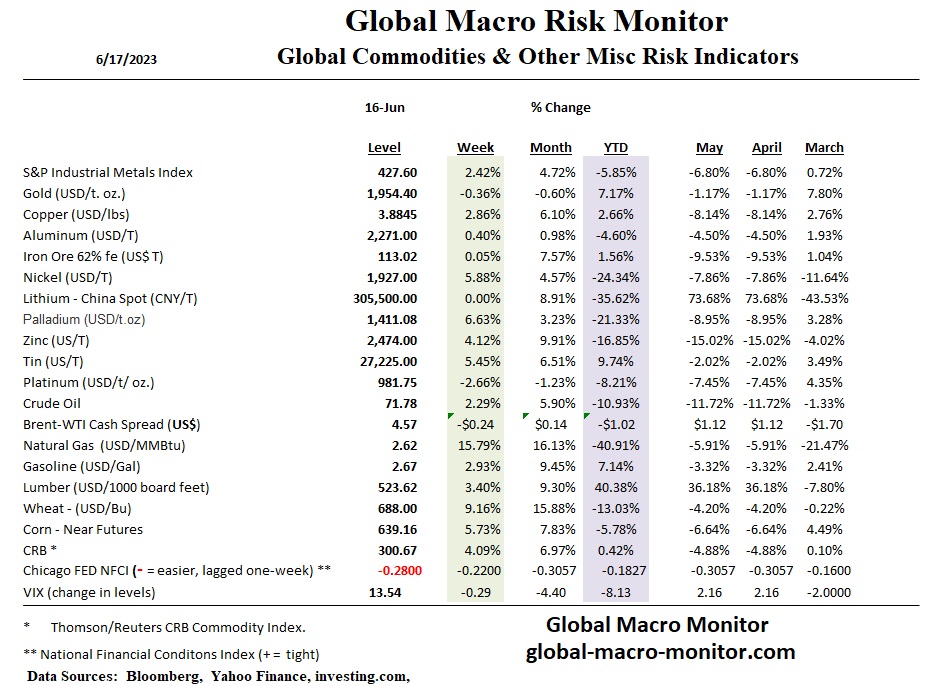

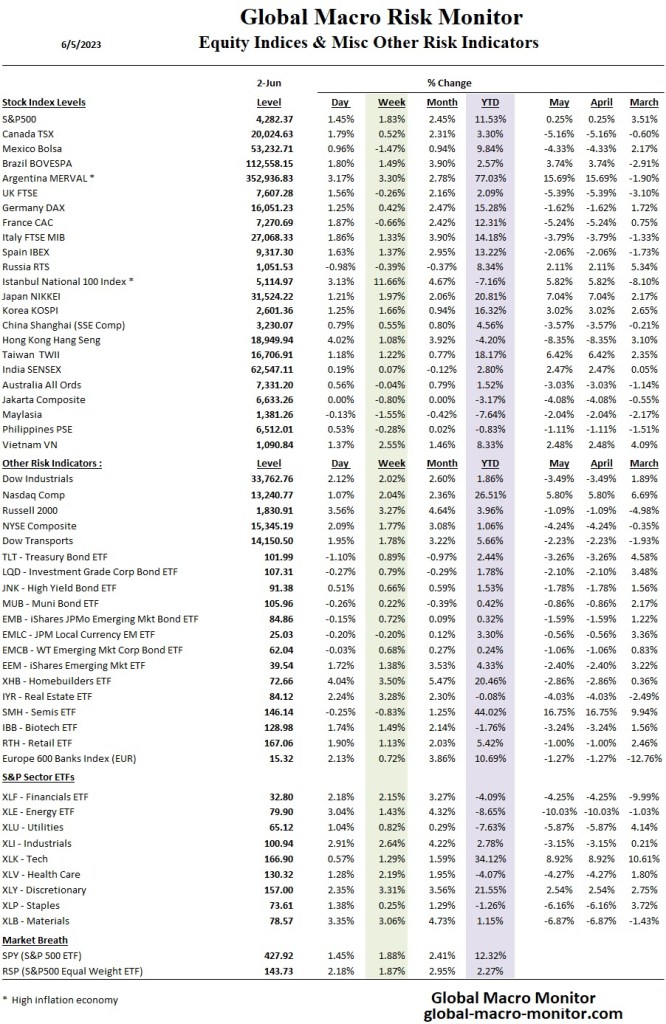

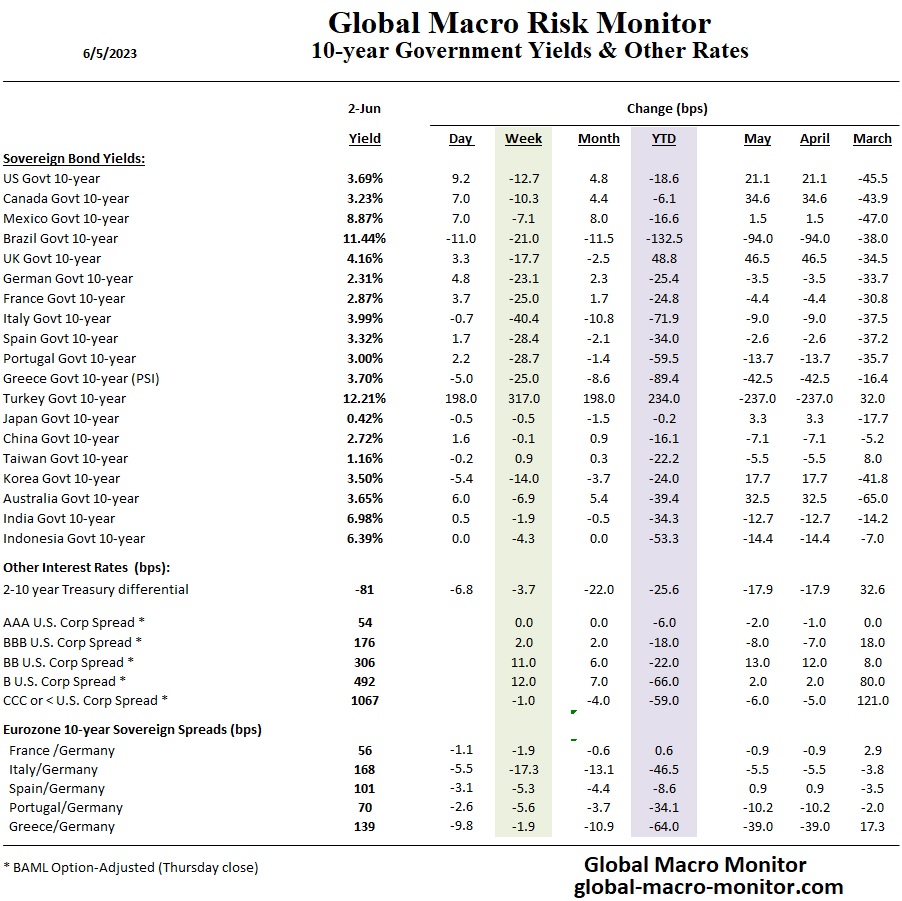

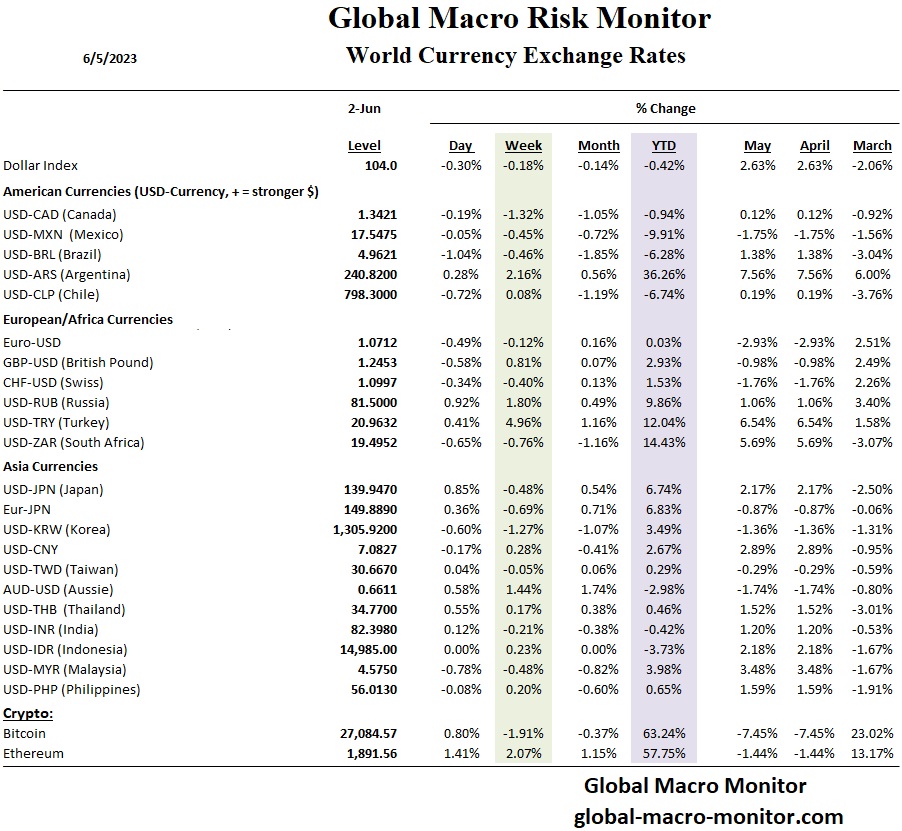

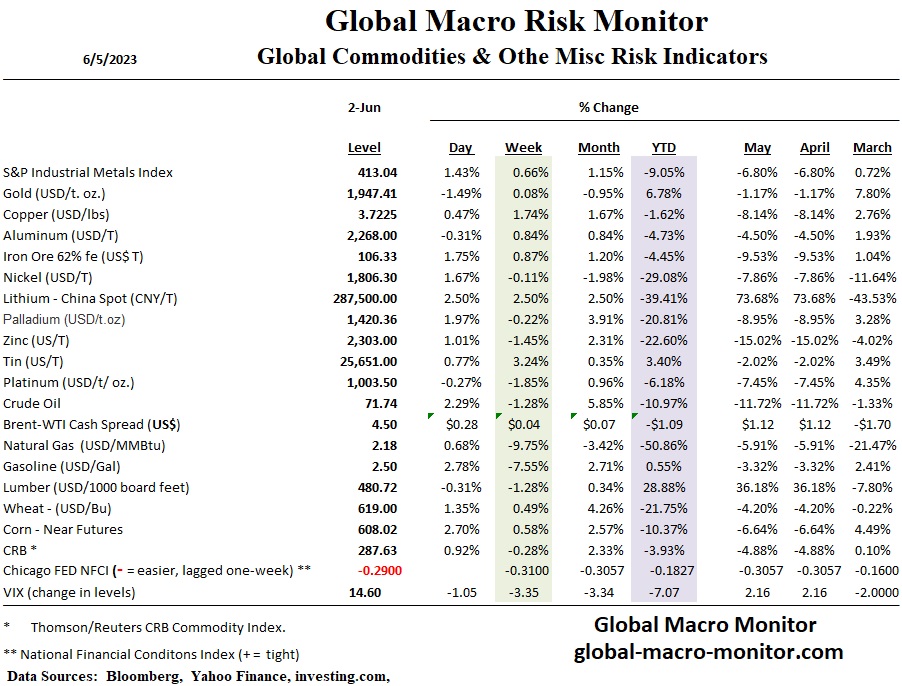

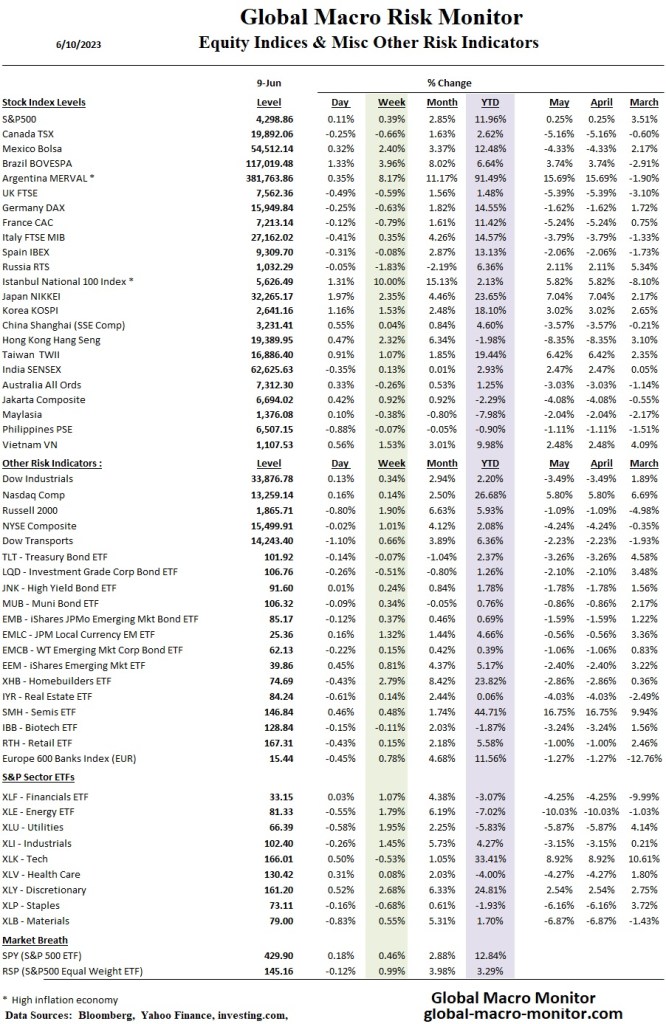

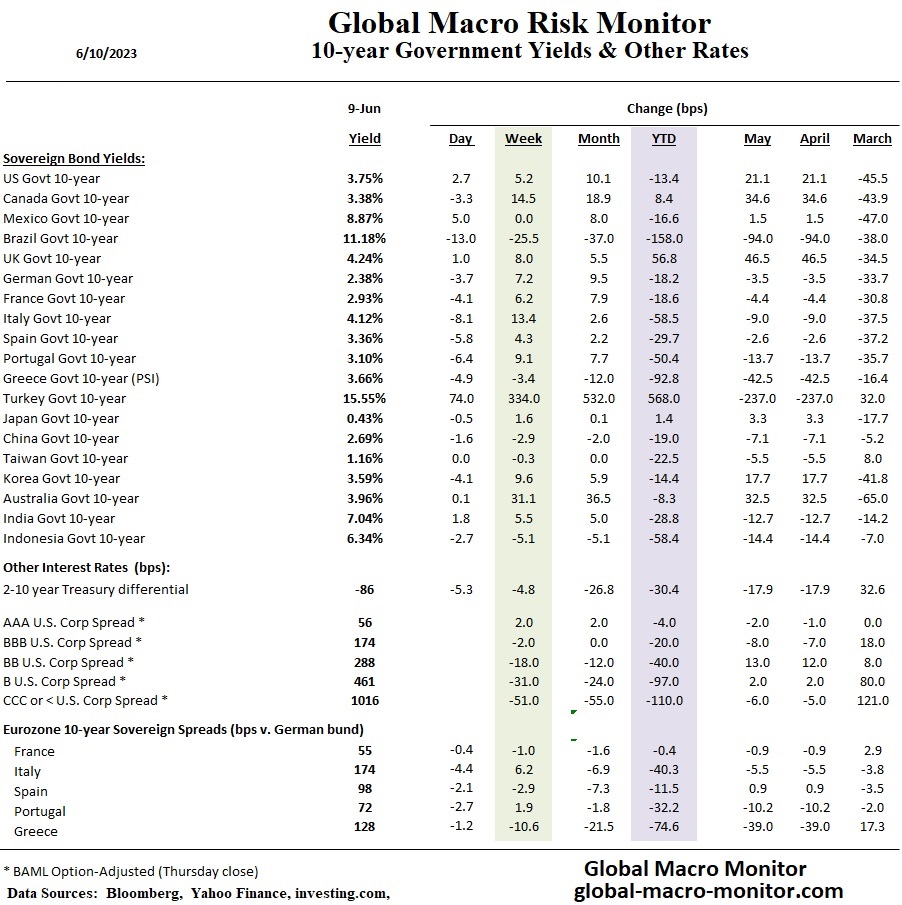

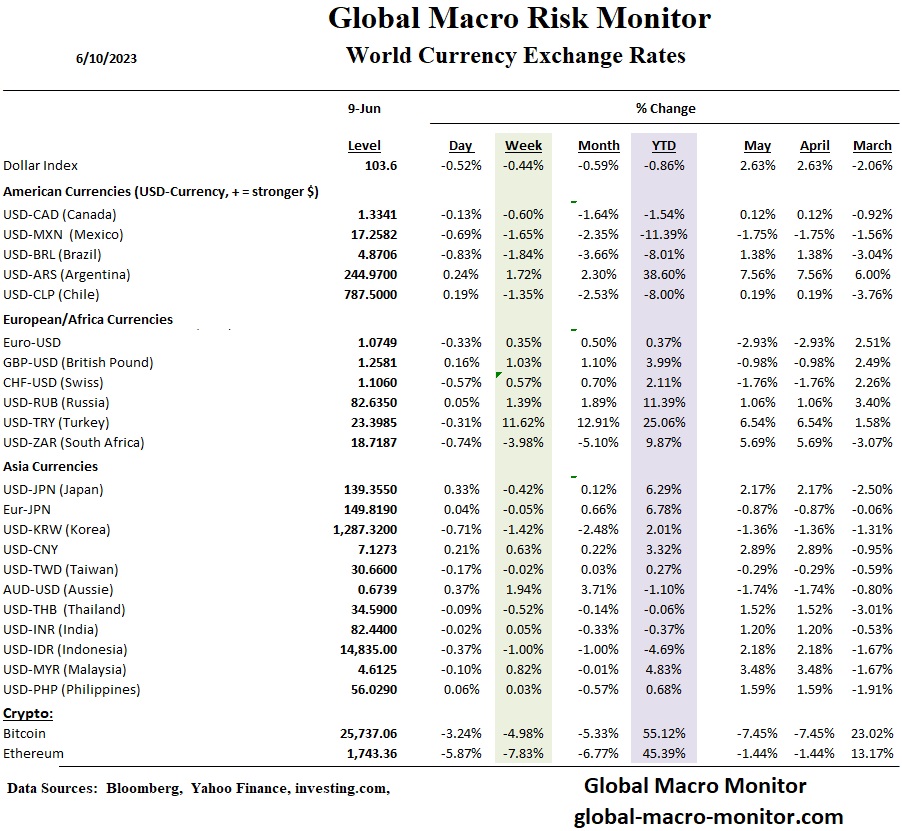

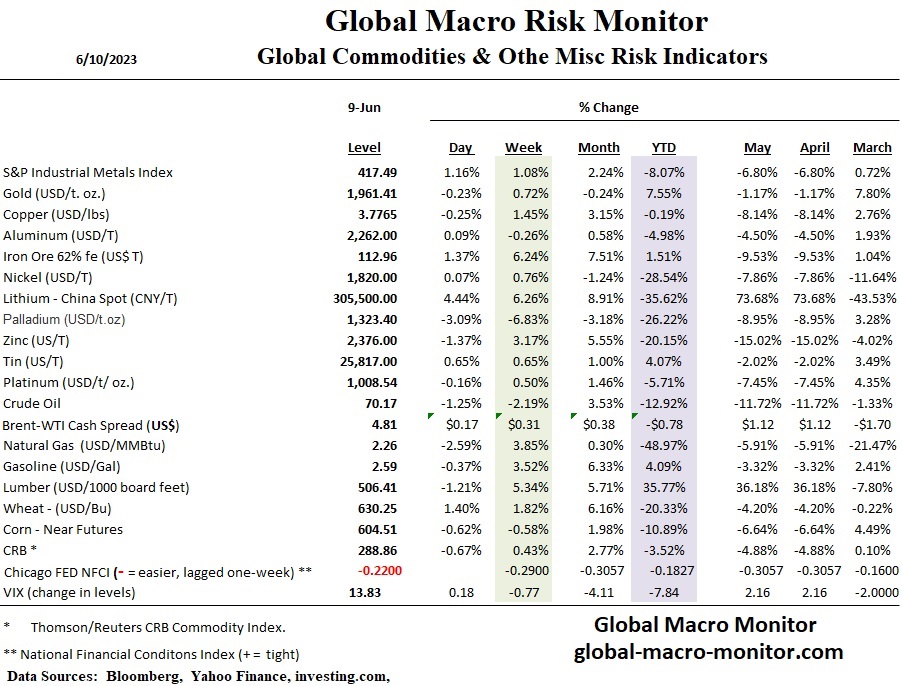

Global Risk Monitor: Week In Review – June 9

A couple of quick observations on this past week’s data.

First, the big contraction in corporate credit spreads and the rise in industrial metals. Ergo, Mr. Market signaling no recession.

Second the meltdown in Turkey’s currency and bond market. Stocks were up big as an inflation hedge, the same reason Argentina’s stock market nominal returns are high.

The meltdown in Turkey’s currency is dramatic and scary. It compels the nation’s new economic managers to embark on a wholesale shift in policy. One thing the lira’s swoon shouldn’t be is a surprise: Loose monetary settings and years of flawed prescriptions for scandalously high inflation have been storing up big problems. A comprehensive solution will take time. – Bloomberg

Posted in Uncategorized

Leave a comment

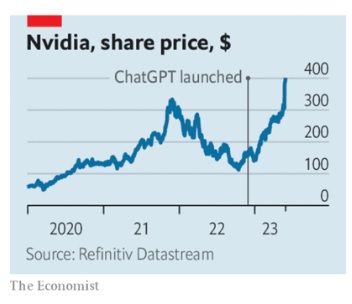

The AI Driven Stockmarket Ramp

Whoever becomes the leader in this sphere [A.I.] will become the ruler of the world – Vladimir Putin

Since the end of November the firm’s market capitalisation has soared from under $400bn to $925bn—accounting for a fifth of the rally. Add Nvidia’s surge to the growing market capitalisations of the 13 other firms with AI exposure and a remarkable 73% of the broader rally is explained. The boom in AI stocks has comfortably outstripped the wider tech rebound. The nasdaq is up by a fifth since November, compared with a third for the most AI-exposed firms. – Economist

Posted in Uncategorized

2 Comments

QOTD: The Fabless Nvidia

QOTD: Quote of the Day

Today it holds over 80% of the market in specialist AI chips…Even if AI mania cools, the technology is bound to be more useful than crypto, another craze that Nvidia cashed in on. – Economist

Fabless chip makers are companies that produce semiconductors for use in various types of electronics, such as digital cameras, smartphones, and the new technologically sophisticated “smart” cars.

The term “fabless” means that the company designs and sells the hardware and semiconductor chips but does not manufacture the silicon wafers, or chips, used in its products; instead, it outsources the fabrication to a manufacturing plant or foundry. – Investopedia

Posted in Uncategorized

Leave a comment