Chat GPT, a very efficient code debugger, has already greatly enhanced our coding (R) productivity, making it easier to manipulate data and crunch numbers. We have put together some interesting tables on the seasonality of daily, monthly, and annual returns for the S&P500 since 1950. The data do not include dividends.

It Doesn’t Take A Genius To Be A Bull

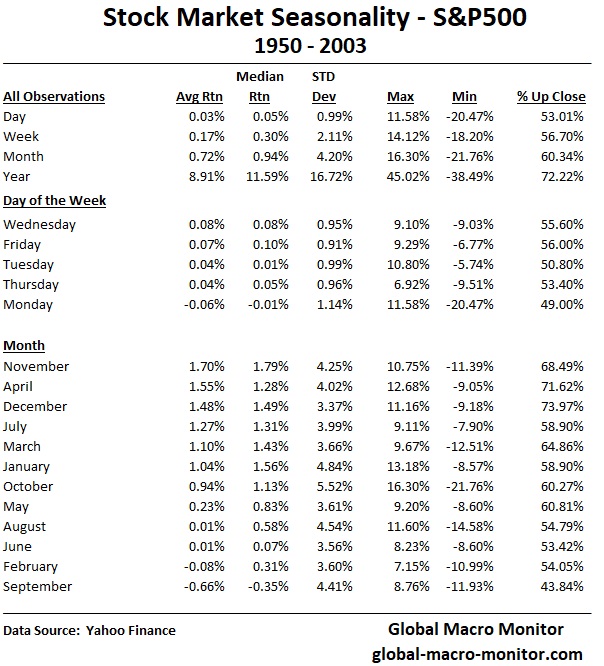

The data show that the S&P500 closes positive 72 percent annually, 60 percent monthly, 57 percent weekly, and 53 percent of the time daily. The average daily return over the past 70 years is 3 basis points. Clearly, the data are tough on long-term bears and why so few own Park Avenue penthouses.

Manic Mondays

Mondays, on average, are the only day of the week to generate a negative daily return, close down more than 50 percent of the time, and are, by far, the most volatile. Note the max/min moves took place on a Monday. We did check the Monday daily return by excluding the outlier Black Monday, October 1987 20 percent crash, which had little effect on the results.

So far this year, the Manic Monday data does not hold.

In fact, quite the opposite, which we discuss below.

Monthly Seasonality: Buy Santa Claus

November, April, and December generate the highest returns. We find it quite stunning the S&P500 closes up daily 74 percent of the time in December, a day trader’s dream.

2023 – Buy Wednesday Close, Sell Monday Close

Mondays are acting quite differently in 2023 than the 70-year averages, have closed higher 70 percent of the time, and returned 0.4 percent on average. Today’s close validated the data.

Note also the horrendous performance of Tuesdays and Wednesdays this year, closing lower 65 percent of the time and generating negative returns. Our good friend, Harry The K., points out all the CPI releases this year have taken place on a Tuesday or Wednesday except for the January release. The inflation data is squarely on the market’s radar. In addition, the FOMC announcements generally take place on Tuesday or Wednesday, and the Fed has been far from market friendly in 2023.

The data suggest selling Monday at the close and buying the Wednesday close — that is, staying out of the S&P on Tuesdays and Wednesdays — has generated excess returns. Hindsight is always golden.

We have calculated the relative return in 2023 of a strategy of selling the S&P500 at the Monday close and buying at the Wednesday close. The relative performance is significant and illustrated below.

Is Past Prologue?

Maybe, maybe not. It’s not entirely out of the realm of possibilities machine learning algos have already picked up the pattern and are now reinforcing it. The pattern will continue until it won’t.

The Wednesday/Monday strategy shall be tested with tomorrow’s CPI release.

I used ChatGpt the other day, asked it a question. It gave me a very detailed and convincing—but what turned out to be—wrong answer. When I pointed this out, it said it was sorry, asked for patience because it was still learning, then said it felt like it should terminate the conversation.

As I understand it, AI today, generally speaking, gets it right about 85% of the time. So, my question is: how certain are you about those stats? 🙂

Good question, I trust it 100% assuming the data is not corrupted. Mike. I wrote all of the code and used Chat GPT as an editor. The data does confirm the data resulting from my analysis back in 2019 (see link). I do take your point, however, Chat GPT does sometimes make shit up and needs fact checking.