This is a big deal, folks, which should be front and center on your radar.

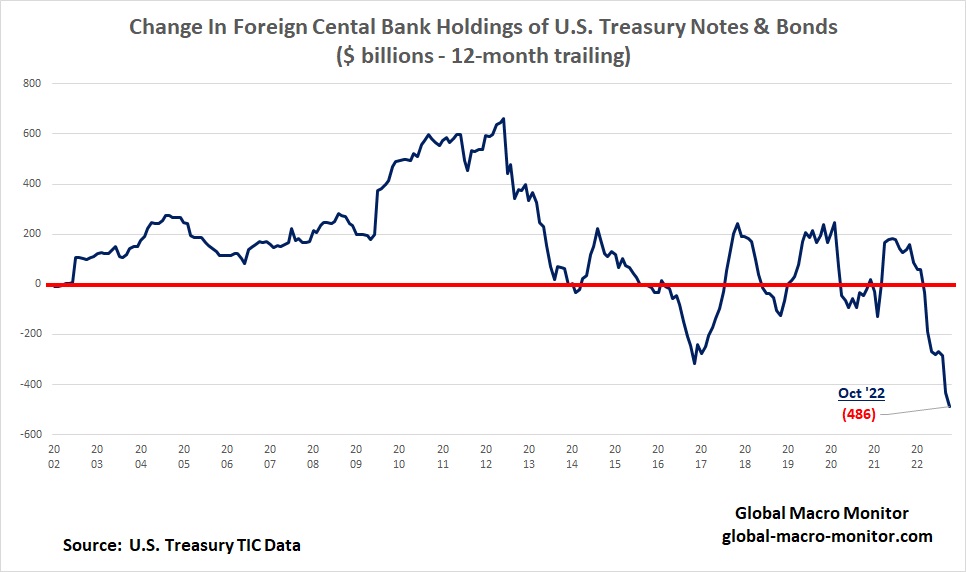

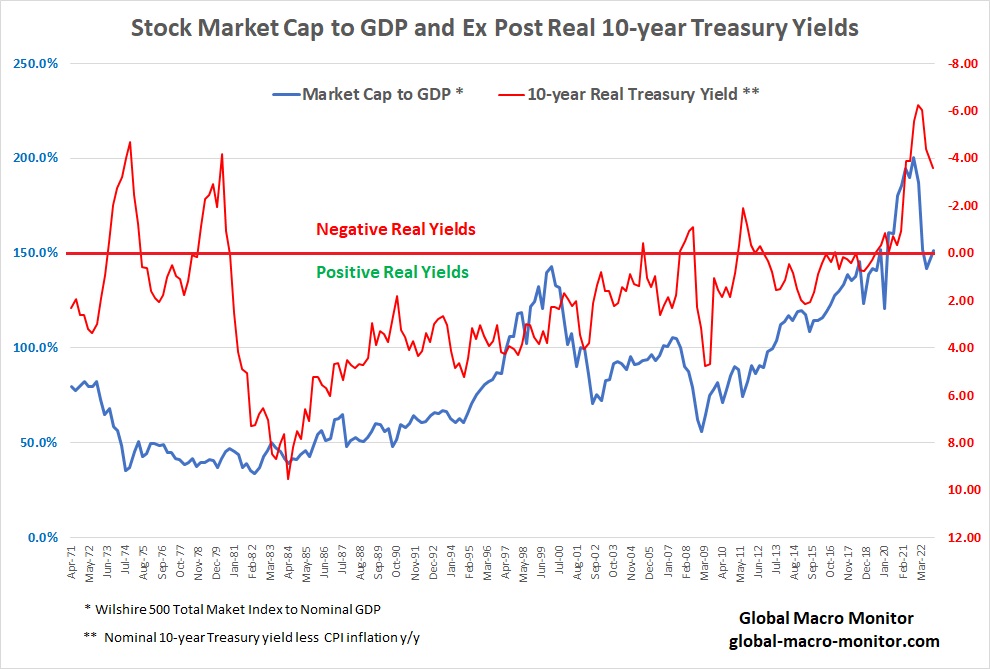

Without the central banks, including the Federal Reserve, taking down a large chunk of the effective net new issuance of Treasury notes and bonds (indirectly w.r.t the Fed) to finance the budget deficits, risk markets will struggle. Central banks have morphed from the largest buyers of Treasury securities over the past two decades into the largest net sellers.

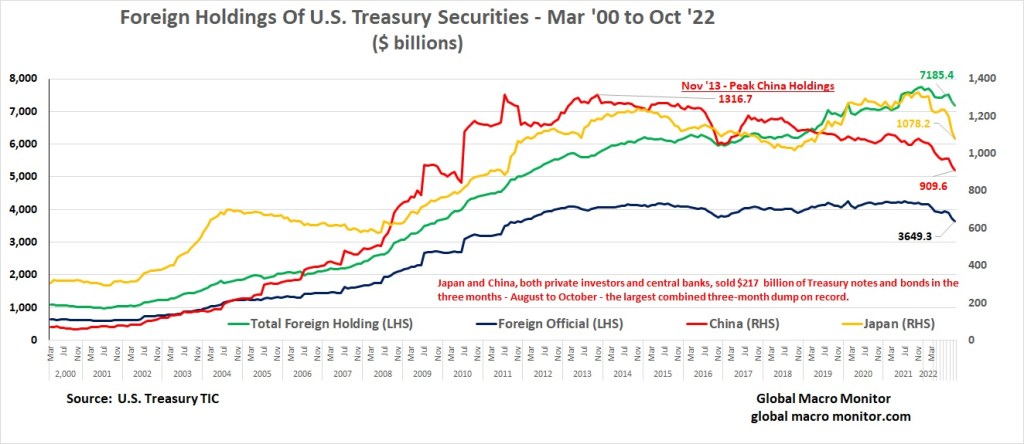

Japan and China Selling

Last week’s TIC data confirms foreign central banks are still dumping their Treasury note and bond holdings. Japan and China, both private and official, and the two largest foreign creditors to the U.S. Treasury, reduced their note and bond holdings by $217 billion from August to October, the largest three-month dump on record (see chart below).

There are several reasons for the foreign selling, such as central banks raising dollars to execute fx interventions to ease the pressure on their home currency and a general diversification away from the U.S. currency after the West weaponized reserves as part of the sanctions against Russia’s invasion of Ukraine.

Zero-Sum Game

Flows into the various markets are a zero-sum game without the central bank injections and purchases or a substantial increase in private sector leverage.

Why Are Treasury Yields Moving Lower?

Why are Treasury yields currently moving lower with the central bank selling? In large part because the markets are selling stocks to buy Treasuries as a safe-haven trade and the duration jockeys betting on a U.S. recession.

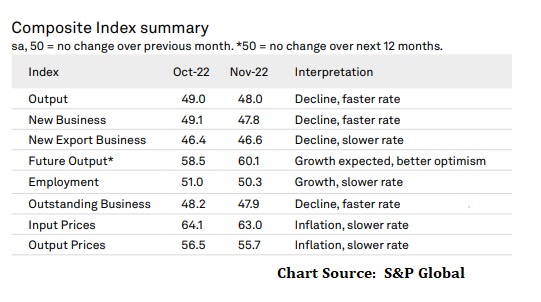

Keep this on your radar. We suspect it will soon begin to dominate the tape.