We hear a lot of chatter these days about how the money supply, as defined by M2, is now contracting at an unprecedented rate. We don’t put much stock in the monetary aggregates as the functional term, and variable “money” is now very difficult to define and measure.

Nevertheless, we don’t entirely dismiss the monetary aggregates but come on, man, they were designed for an economy and financial system in the Flinstone Age where commercial banks ran the show. The advances in FinTech and globalization have rendered the old aggregates…well…maybe just a step above Barney Rubble.

GMM loosely defines money as an asset that can directly or indirectly provide the firepower to purchase goods and services. In our definition, we include changes in wealth, such as stock market capitalization, cryptocurrencies, home equity, and stock options, to name a few.

As a graduate student working for the US G (not quite back in the Flinstone Age), I attended seminars where policy markers contemplated including stock market mutual funds in the monetary aggregates.

M2 Water Levels Are Still Very High

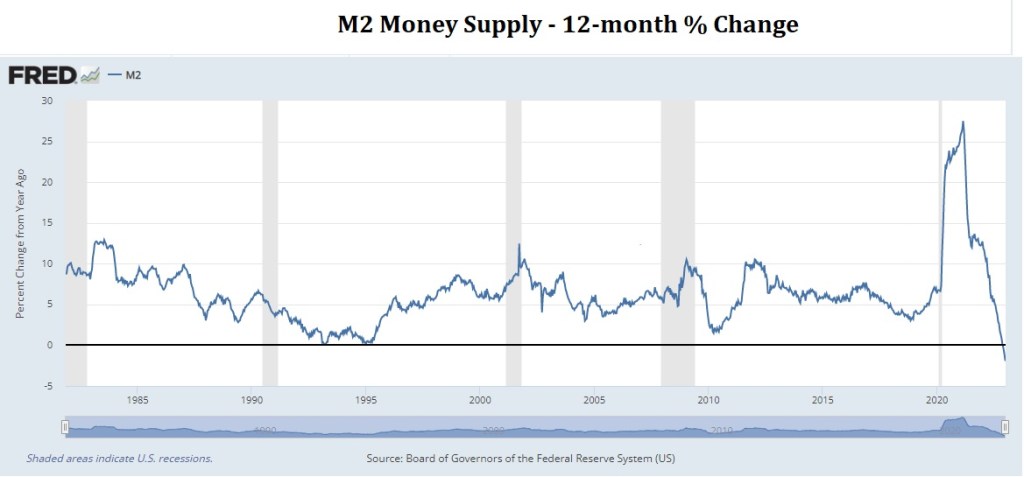

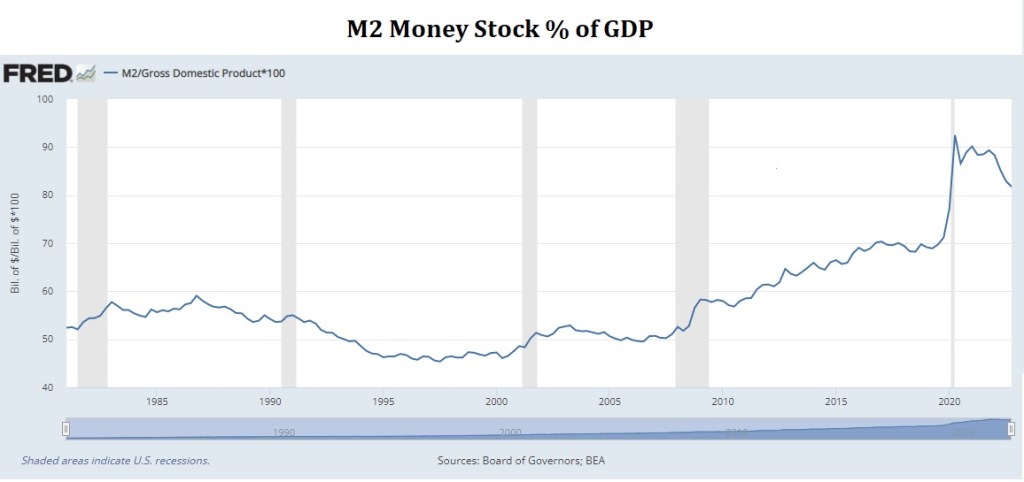

The following charts drill down on the M2 monetary aggregate so wildly touted by the financial media.

Yes, M2 is now contracting year-on-year but from such a high and overflowing level. In other words, measures in M2 changes are affected by a “base effect” as the dam may not be overflowing anymore, but the water (money) levels still remain incredibly high.

Though the Fed has raised the price of money significantly in the past year, the quantity of “money” remains close to historic highs and freakishly above its long-term norm relative to the economy. Coupled with the purchasing firepower of Chinese households, who have accumulated $2.6tn of excess savings in the form of bank deposits last year alone, we believe it’s way too early to break out in song, “Ding Dong! Inflation is dead.”

We must learn and recognize that using flight instruments designed for the Spirit of St. Louis is not a very efficient way to navigate a modern-day F-35 fighter jet through a very foggy economy.

Stay frosty, folks!

ChatGPT Defines “Money”

Here is the result of our ChatGPT query,

GMM: Define in 500 words what is money.

ChatGPT: Money is a medium of exchange, a unit of account, and a store of value that is widely used as a means of payment for goods and services. It is a fundamental concept in economics and plays a critical role in facilitating transactions in an economy.

Money serves as a medium of exchange by providing a common currency that is acceptable to both the buyer and the seller. This eliminates the need for a barter system, where goods and services are traded directly for other goods and services, and enables economic transactions to take place more efficiently.

Money also acts as a unit of account by providing a standard measure of value that is used to price goods and services. This allows for easier comparison between different goods and services and enables individuals to make informed decisions about how to allocate their resources.

Finally, money serves as a store of value by providing a way for individuals to preserve their purchasing power over time. This allows people to save for future expenditures and to invest in assets that may appreciate in value.

There are several forms of money, including physical currency, such as coins and banknotes, and digital money, such as electronic transfers and digital wallets. Central banks and governments play an important role in the supply and regulation of money in an economy.

Throughout history, different forms of money have been used, including precious metals such as gold and silver, as well as paper money and bank deposits. In modern times, most economies operate on a fiat money system, where the money is not backed by a physical commodity but is instead accepted as a means of payment by agreement within the community.

In conclusion, money is a critical component of any modern economy and plays a fundamental role in facilitating transactions, acting as a unit of account, and preserving purchasing power over time. The form of money used, as well as the mechanisms for its supply and regulation, can have a significant impact on the functioning of an economy and its overall stability.

Pingback: The Charts That Explain All Things Macro | Global Macro Monitor