After falling to a low of 2.33 percent on October 8th, the 10-day Treasury has sold-off closing today at a yield of 2.64 percent. The recent high is around 2.83 percent, which we will be watching closely.

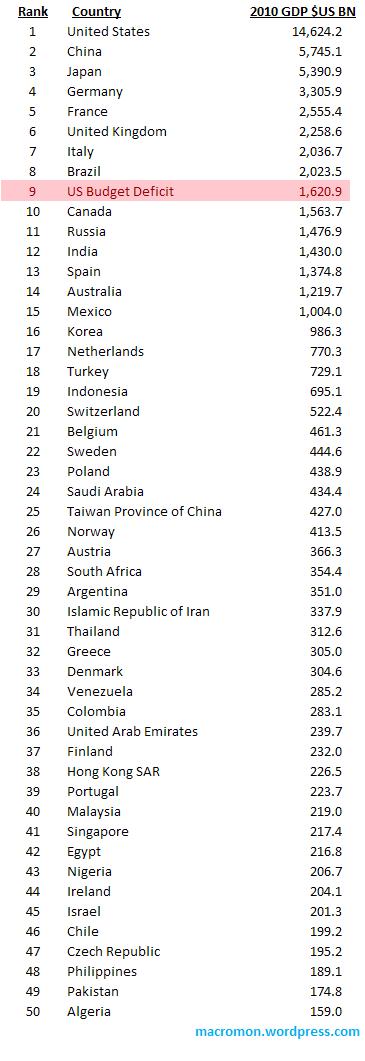

To get a sense of the magnitude of the U.S. government’s funding requirements, we’ve constructed the following table from the IMF’s World Economic Outlook (WEO) database. If measured as a separate economy, the US budget deficit would rank as the 9th largest economy in the world.

It’ll take a boatload of quantitative easing to keep interest rates from rising if a global portfolio reallocation takes place. This may be what the big spike in commodity prices is signaling. Stay tuned.

Pingback: Greenspan: High US Deficits Could Spark Bond Crisis | Global Macro Monitor