Not that MF Monday! Traders like to muse over the “Day of the Week Effect”, particularly, “Mutual Fund Monday”, where convention posits that since the crisis, the S&P5oo performs better on Mondays than other days. The thesis is that mutual funds tend to step-up purchases of stocks on Mondays, driving the day’s higher return.

Not that MF Monday! Traders like to muse over the “Day of the Week Effect”, particularly, “Mutual Fund Monday”, where convention posits that since the crisis, the S&P5oo performs better on Mondays than other days. The thesis is that mutual funds tend to step-up purchases of stocks on Mondays, driving the day’s higher return.

We love to “torture the data until it confesses” as much as anyone else and have sliced and diced daily returns S&P 500, not only “just to entertain you, “ but to enhance your trading/investing acumen in order to impress others at the company Christmas party. Making money? Iffy.

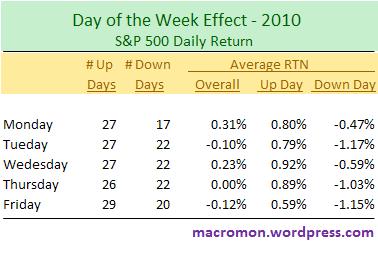

The average return on Mondays for the S&P5oo in 2010 is 0.31%, which is higher than other days of the week. The index has been up 61% of all Mondays in 2010, rising 27 and declining 17, which is the highest percentage day of the week. Generating only the third highest return on up days, trailing Wednesday and Thursday, Monday’s average loss on down days is significantly lower than others.

The average return on Mondays for the S&P5oo in 2010 is 0.31%, which is higher than other days of the week. The index has been up 61% of all Mondays in 2010, rising 27 and declining 17, which is the highest percentage day of the week. Generating only the third highest return on up days, trailing Wednesday and Thursday, Monday’s average loss on down days is significantly lower than others.

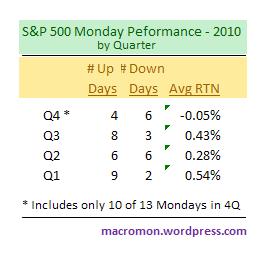

Slicing deeper, however, “ Mutual Fund Monday” appears to have lost its luster since the first quarter, when the S&P 500 traded up 9 of 11 Mondays . After an excellent Q3, the Monday fade continues into Q4, where the S&P500 is currently down 5 straight Mondays. On a positive note, after a similar 5-week losing streak in June, Monday generated a positive return for next 6 weeks.

Now, how’s that for making the data dance? Can and will the S&P snap its “MF Monday” losing streak end tomorrow after China’s hot inflation number? We’ll leave for the Monday morning quarterbacks. Stay tuned!

Yale Hirsch (Stock Trader’s Almanac) published his book Don’t Sell Stocks on Monday in 1986. He provides a technical trader’s trove of data regarding how the market behaves each hour of the day, day of the week, week of the month, and month of the year. Sometimes it works, sometimes it doesn’t, just like the digital clock that wakes me up in the morning.