Very. It’s been the dike that has kept the Bear Sea at bay.

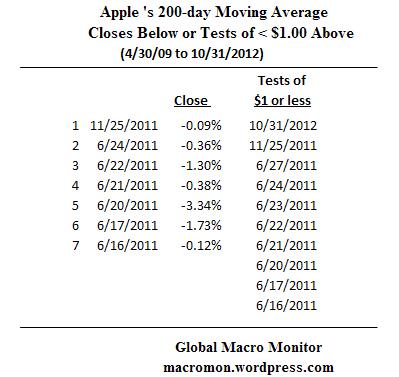

Apple’s stock managed an impressive bounce off the its 200-day moving average yesterday. It was the first time the stock has come within $1.00 of the 200-day since November 2011 and only the third time in the past three years. *

In fact, AAPL has only moved below its 200-day moving average twice sense the crash lows, closing only seven times under the 200-day since it crossed over in early April 2009. Of those, six took place in the June 2011 streak.

The stock continues to trade poorly and can’t seem to hold a bid. We sense the size and over ownership of Apple limits new buyers and traders are looking for a new catalyst to jump back in. We’re watching the 200-day like a hawk. Keep it on your radar.

Stay tuned.

* Only including one observation from the streak of closes below the 200-day in June 2011.

(click here if chart is not observable)

Pingback: Bears Breach Apple’s 200-day | The Big Picture

I am not sure where you’re getting your information, but great topic.

I needs to spend some time learning much more or understanding

more. Thanks for excellent info I was looking for this information for my

mission.

Hi! I know this is sort of off-topic however I needed to ask.

Does managing a well-established blog like yours take

a lot of work? I am brand new to writing a blog however I do write in my diary on a daily basis.

I’d like to start a blog so I can easily share my experience and views online.

Please let me know if you have any kind of recommendations or

tips for new aspiring blog owners. Thankyou!