Bonds

- Big outperformance by local emerging markets and Euro periphery in first half.

- Last week was pivotal as some bonds gave back almost entire year due to ECB hawkishness.

- Watch this space. More big moves here will determine asset trading for summer and set up big correction in the fall, in our opinion.

.

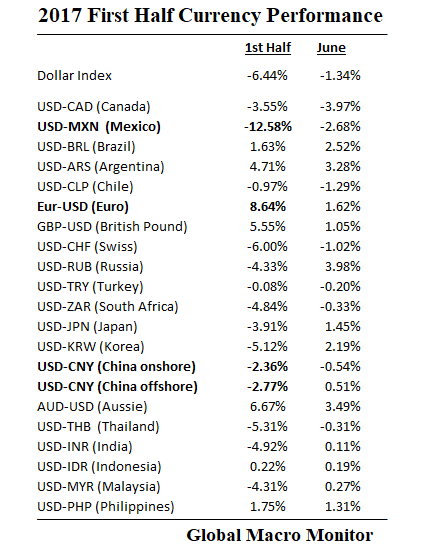

Currencies

- Surprise weakness in dollar, mainly due to stalling of Trump agenda.

- We expect a big dollar rally in second half as we move closer to tax reform. All bets off if Trump fails.

Stocks

- Big outperforrmance in emerging markets. We expect this to continue. Especially like India.

- If bond markets stablize in Europe, which we expect moves to become more muted, but still expect higher interest rates, Euro stocks should outperform U.S.

- Russia looking cheap as crude oil stablizes. Watch Trump/Putin meeting next week.

Selected Indicators

- High beta tech big outperformance. Expecting a rotation into laggards, such as financials and energy.

Commodities

- Crude oil collapse soured commodity index. Natural gas gave back some of last year’s 50 percent gain.

- Lumber has been a leading indicator of economy over past history although some of move can be attributed to duties imposed on Canadian lumber.

- Copper had strong bookends. Up over 10 percent in January, weak during intervenng months and finished strong with over 4 percent gain in June.

- Looks like Iron Ore has bottomed.

- Gold going to be a tough trade in a rising rate and QT world unless all hell breaks lose.

Conclusions

- We expect markets to grind around with a bit more volatility as central banks move away from QE and toward quantitative tightening (QT).

- Preparing for a choppy summer with lots of sector and stock rotation with a slight bias to upside in risk markets.

- Expecting algos and trading ‘bots to continue to play their games, setting bull and bear traps, shaking the trees, and, you know, your basic market manipulaton. Bastards!

- Looking for full blown correction in the fall.

- WE KNOW NOTHING ABOUT WHAT THE FUTURE HOLDS. JUST OUR CALCULATED GUESS.

Pingback: 07/05/17 – Wednesday’s Interest-ing Reads | Compound Interest-ing!

Pingback: Weekend Reading: Oil & Retail Send A Warning | RIA

Pingback: Weekend Reading: Oil & Retail Send A Warning – Earths Final Countdown

Pingback: Weekend Reading: Oil & Retail Send A Warning | Wall Street Karma

Pingback: Weekend Reading: Oil & Retail Send A Warning | ProTradingResearch

Pingback: Weekend Reading: Oil & Retail Send A Warning | Zero Hedge

Pingback: Weekend Reading: Oil & Retail Send A Warning | GEOECONOMIST

Pingback: Weekend Reading: Oil & Retail Send A Warning - BuzzFAQs

Pingback: Elliott Wave Analytics » Blog Archive Weekend Reading: Oil & Retail Send A Warning