You heard it here first, folks, in our July 16th post, Market Liquidity Conditions Still Loose As A Goose.

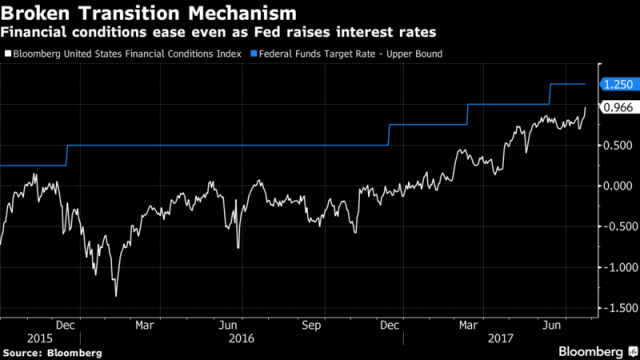

Here is Bloomberg on the easy money,

Easier financial conditions affect the Fed in three ways. First, officials will associate them with faster economic growth. But they don’t want so much growth that the unemployment rate falls too far below the natural rate. At the current pace of job growth, that seems likely.

Second, some members will associate easier financial conditions with financial instability. The dynamics of the last two cycles leave them wary of recreating the same conditions a third time. They will worry that halting the current path of monetary policy only sets the stage for more froth in financial markets down the road — markets that Yellen has already called “somewhat rich.”

Third, a falling dollar is contributing to easier financial conditions. The Fed will see that as another reason to expect their inflation forecasts to become reality after the impact of the recent “special factors” restraining consumer prices fade. – Bloomberg

.

(COTD = Chart of the Day)