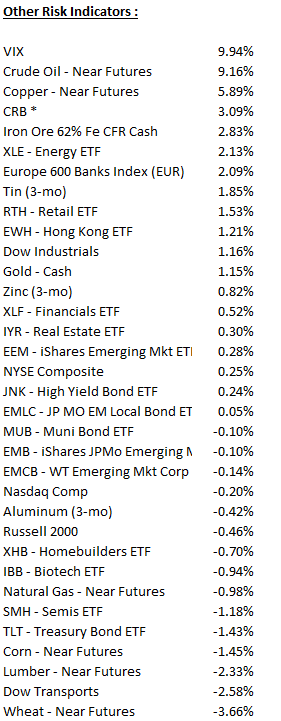

Global Stocks

Flat week for the S&P500 after making new all-time earlier in the week although the Dow continues to make record highs. Nasdaq also new record early in week then succumbed to profit taking on Thursday and Friday. India, one of our favorite EM’s continues to perform well. Greece weak, closing down over 3 percent after profit taking. Greece up almost 30 percent YTD.

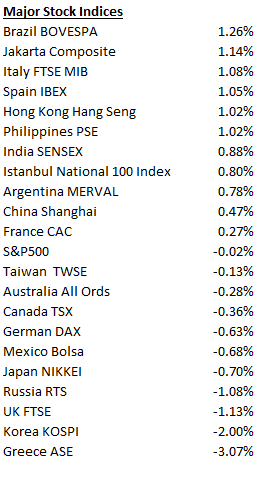

Fixed Income

Fairly quiet week for local currency bonds. Interest rates up slighly on week with biggest move in Canada – + 14.3 bps. U.S. yield curve steeper by 4 1/2 bps.

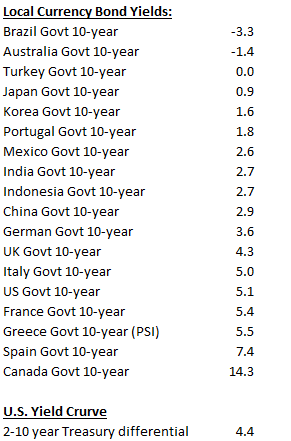

Currencies

Dollar index continues to slide toward the key 92 critical level, after what was percieved as a dovish FOMC statement. Pound, Aussie, Euro, and Canada pairs versus dollar all strong. China strengthening. Mexico gave a little back after its YTD rip.

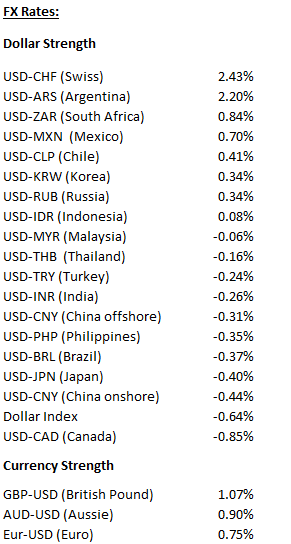

Other Risk Indicators

After trading with 8 handle for only its second time in history, the volatility index increased to close over 10 for the week. The Dow Transports sold off hard, down over 2 1/2 percent. Inflation commodities picked up strength with CRB up over 3 percent. Crude up almost 10 percent and Copper up 5 percent. Iron Ore looks like it has turned and was up almost 3 pecent.