Interesting charts from the CME group’s August 1st earnings release.

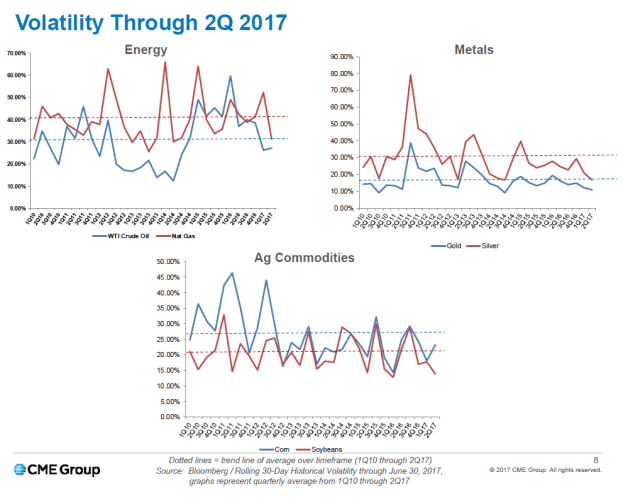

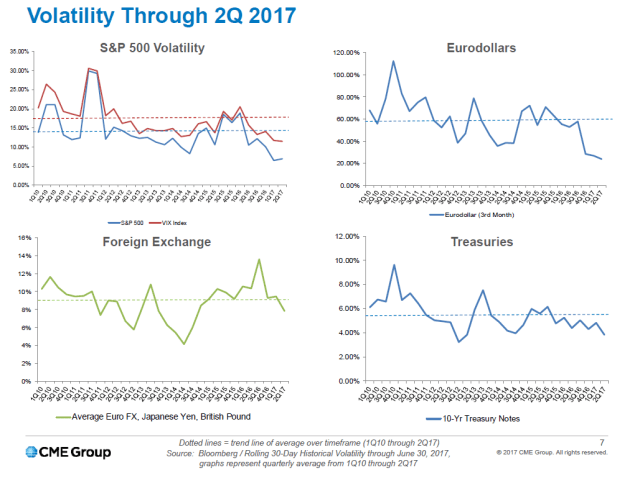

It’s not just the VIX that has been tanking over the past few years, but the volatility in almost all financial instruments and commodities has declined this decade and are now below their medium-term historical averages. Maybe with the exception of the vol spike in foreign exchange in the second half of 2016 and the July 2014 to Feb. 2016 crude oil crash. Even natural gas, the original widow maker, is at the low in of its range.

You can blame quantitative easing (QE), that great flood of central bank money pumped into the financial global system over the past decade, which has doused price and economic volatility, coupled with the emotionless algo programmed trading ‘bots void of confirmation bias (CB) — or , maybe, full of CB, with their machine learned trend following and correlation algos — and all the trading/investment vices of the human investor and trader.

Minsky Moment? Build it, and it will come?

Or, has the volatility of asset prices “…reached what looks like a permanently high low plateau“?

You decide.

.

.