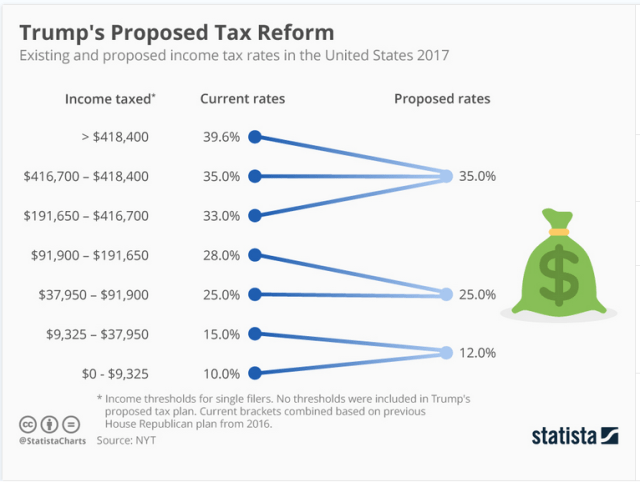

Individual income tax makes up around 49 percent of the Unites States tax revenue, the single biggest position, according to inside.gov. Trump wants to simplify the tax code by bringing the number of income tax rates from now seven down to three (35, 25, 12 percent). The plan didn’t name specific income thresholds, but the New York Times consulted plans by the House Republicans from 2016 to see how the new brackets could shape up.

Some observers have argued that Trump’s tax plan would one-sidedly profit the rich. Indeed, bringing down the tax ceiling from almost 40 to 35 percent would profit the biggest earners. In the lower middle income bracket ($37,950 to $91,900) there wouldn’t be any movement (25 percent). This contradicts Trump’s assertion that he would aim for tax cuts for the middle class. Finally, lowest income bracket taxes would hike 2 percentage points. – statista

Anybody wants to discuss ideas to free up money for workers and discuss unique tax cut ideas I’m down. This was unimpressive…period. 35,25,12…. that is nearly a tax increase for regular folks. Where was the 10% repatriation? Where was the lower capital gains and dividends? Where is immediate expensing? To top off it off they didn’t even go 15% which 20% is fine, but I expected for all their concessions they would be bold and go with 15%… Dude, screw the chamber of commerce and the Kock brothers get that 15% border adjustment to help pay for it…damn

Agreed, Shane. Some things never change.

Reblogged this on iktisat terk and commented:

Global Macro Monitor (bu arada bu siteyi yakından takip etmenizi öneririm), Trump hükümetinin vergi reformunun hangi gelir grubunu ne yönde etkileyeceğini çok iyi özetleyen bir şematik görsel paylaşmış. GMM’in notunu Türkçe’ye çevirerek paylaşıyorum…

“inside.gov’a göre, Bireysel gelir vergisi ABD’de vergi hasılatının yaklaşık yüzde 49’unu oluşturuyor (the single biggest position). Trump, halihazırda 7 olan gelir vergisi sayısını 3’e (%35, %25 ve %12) indirerek sadeleştirmek istiyor. Planda spesifik gelir düzeyi sınırları tanımlanmıyor, fakat New York Times, yeni vergi aralıklarının nasıl şekillenebileceğini görmek için planları Temsilciler Meclisi’ndeki Cumhuriyetçilere sormuş.

Bazı gözlemciler Trump’ın vergi planının tek taraflı olarak zenginleri kârlı çıkardığını öne sürdüler. Gerçekten de, vergi tavanını nyaklaşık %40’tan %35’e çekilmesi, en yüksek gelir düzeyindekilere kâr sağlayacak. Alt-orta gelir grubunda (37.950 dolar – 91.900 dolar arası) herhangi bir hareket yok (%25). Bu durum Trump’ın vergi indirimlerinin orta sınıfları hedeflediği savıyla çekişiyor. Son olarak, en düşük gelirlilerin vergileri ise 2 yüzdelik puan artıyor. – statista