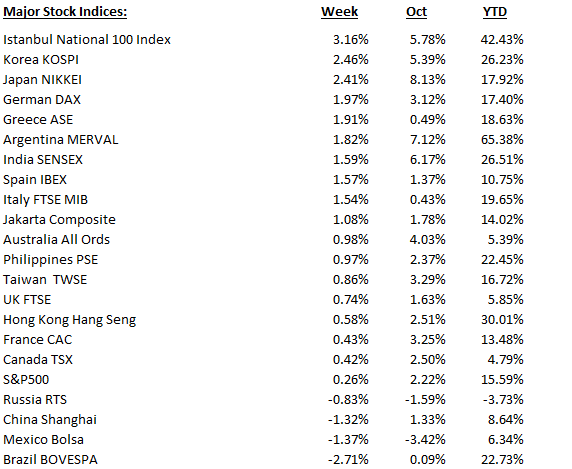

Global Stock Indices

Turkey up Monday through Thursday but gave some back on bad inflation print Friday morning, which took the country’s 10-year rate up and currency down, bigly. Turkey is one of the largest emerging markts. Watch this country.

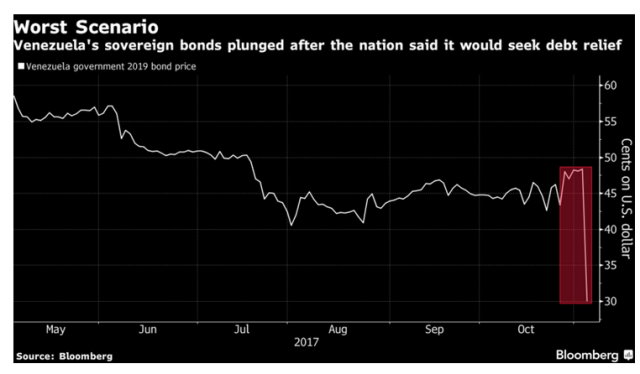

Neverthless, most equity markets enjoying what they percieve as the Goldilocks global economy with synchronized economic expansion and low inflation. Latins hit on currencies and probably Venuzuela’s announcement of a global debt moratorium on Thursday night, though somewhat ambigous, probably caused some risk aversion in the region.

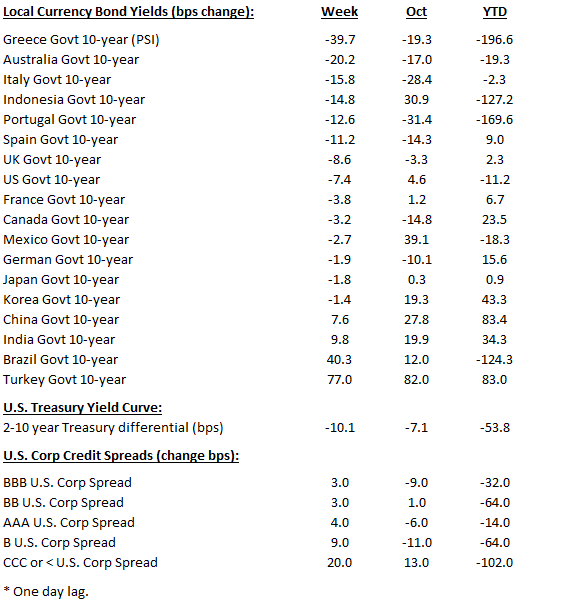

Global 10-year Bond Yields

Euro periphery coming in as markets continue to digest Mario Draghi’s dovish taper from October 26th. Turkey yields up big on bad inflation print. Brazil one of the high yielders also up big on the week. Watch these bonds.

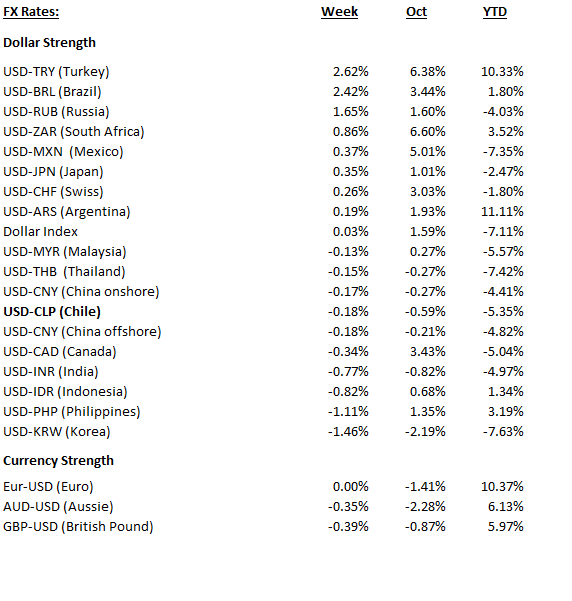

Global Currencies

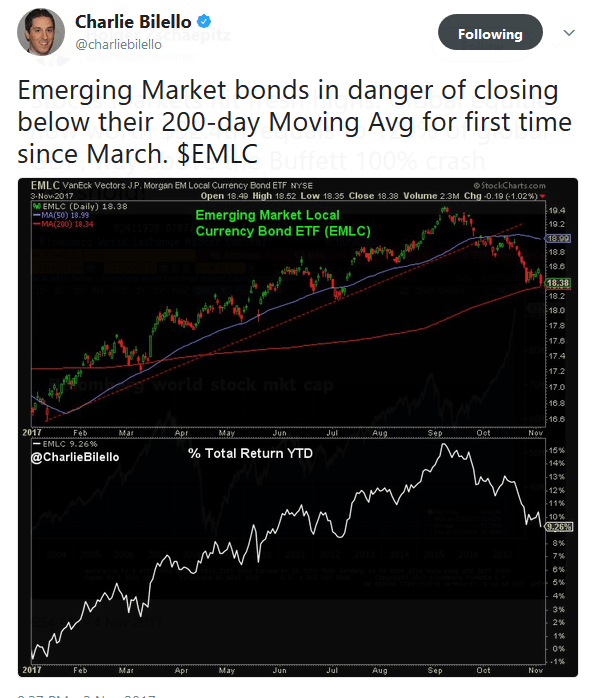

Turkish lira down big against dollar on the week on bad inflation print Friday morning. Most EM currencies hit on Friday with combo of Turkey sell off and Venezuela default. We had thought lira was a short-term buy after the sell-off in October. EM currencies totally unlinked from EM credit. (see chart below)

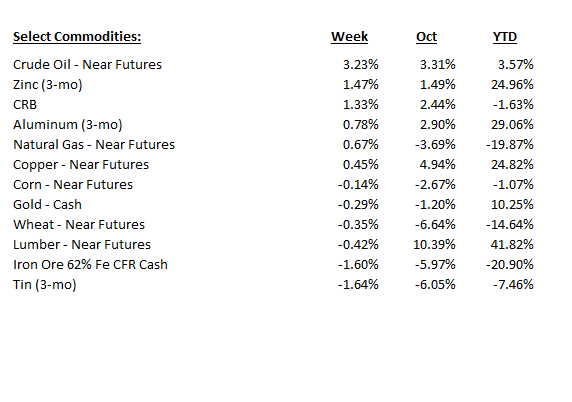

Select Commodities

Crude continues rally and got some legs after rig count decline on Friday morning. The political purge in Saudi over the weekend may provide some further support and upside. Lumber gave a little back after the big upside in October.

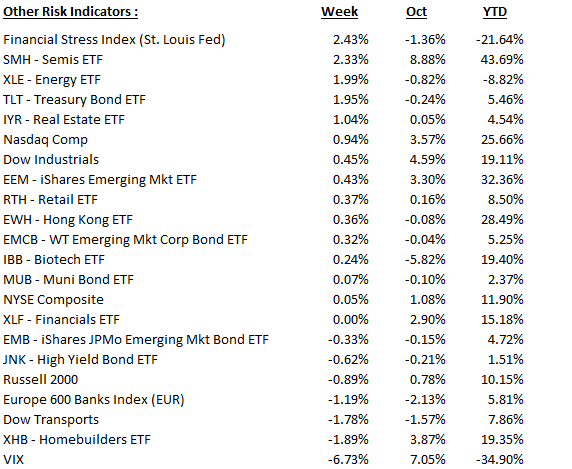

Other Risk Indicators

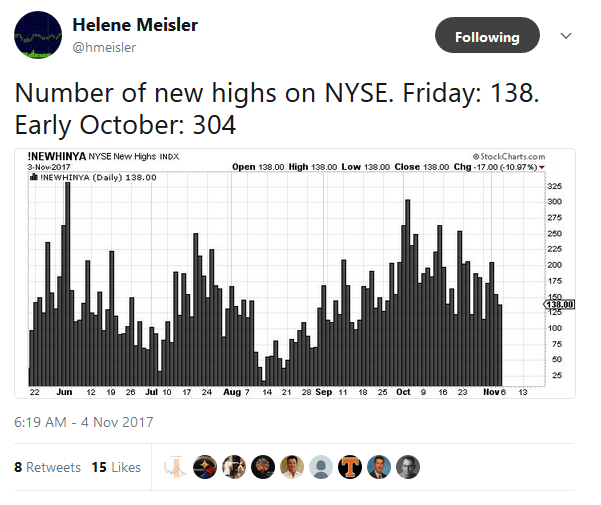

Semis still in beast mode and seem overbought to us. U.S. stock market advance becoming more narrow and showing signs of exhausation. Note NYSE composite index lagging and high-yield selling off. VIX closed at record low on Friday.

On The Radar

We are quite surprised at EM currency continues to sell and makes us begin to reaccess our view that the most global markets will remain bid or move sideways until risk-free and policy rates begin to move 100-200 bps higher. The weakness in EM and credit seems to be idiosyncratic to those particular markets and may be signaling something bigger on the horizon, or maybe not. Keep these markets are your radar.

We have been looking for a correction this fall and expected one on the back of European bond market taper tantrum in October. Never materialized.

This week will be big for emerging markets and high-yield as they have started to wobble. Watch this space.

Key Charts