What a first week to start the year. Frothy the Snowman refuses to melt!

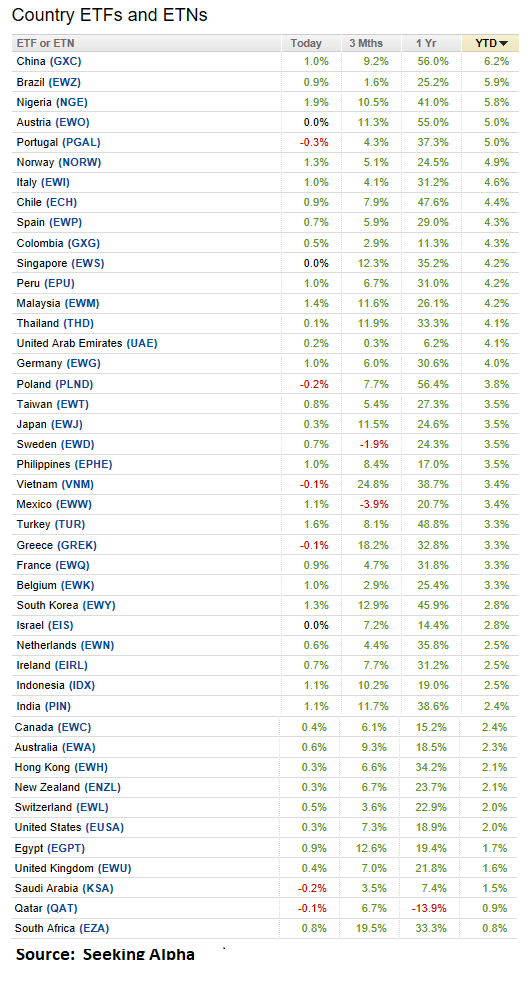

Emerging markets still all the rage.

No supply, my friends. Global markets have gone parabolic.

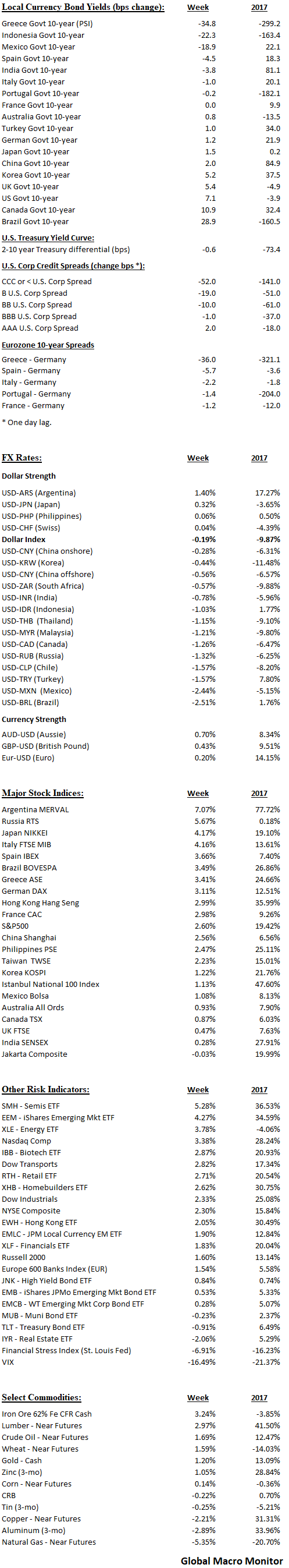

Fixed-income

– Greece bond yields hit 12-year low as the post-bailout era beckons;

– Indonesia continues to attract yield seekers;

– Mexico 10-year yields 20 bps lower. Talk of 10-year dollar bond at 160 bps.

– The dash for trash continues with CCC in over 50 bps on the week. B in 20 bps ;

– DM bond yields slightly higher. Fears of overheating starting to creep into markets.

Currency

– Dollar index relatively flat;

– EM currencies strong as capital flows continue to fly into the sector.

Stocks

– EM stocks continue to melt-up;

– Japan making 26 year highs on growth surprise. Nikkei still 40 below 1989 high.

.

Other Risk Indicators

– U.S. tech still rocking the free world;

– U.S. semiconductor ETF up another 5 percent after stellar 2017. Pass the A.I. chips, bro;

— VIX collapses again. Approaching new all-time lows.

Commodities

– Iron ore higher probably due to upward revisions to China growth;

– Gold continues to rally as Bitcoin wobbles;

– Nattie gave back some of last week’s 10 percent gain even as America freezes.