“Frothy the Snowman, was a jolly, happy soul…. Thumpety, thump, thump, thumpety thump, thump, look at Frothy go!”

Momentum is a very powerful thang, especially when powered by a theme of synchronized global expansion and “blockbuster” retail money flows into stocks. No worries about extreme valuations in MoMo markets, however.

Note to self: Will not chase, will not short until market tells us to.

Of course, global asset markets are in a huge bubble. Let the trend play out and let markets break before getting shorty.

Could go until beginning of summer – maybe – but trying to pick exact tops and time corrections are a mug’s game. Why our preference is for trend based models.

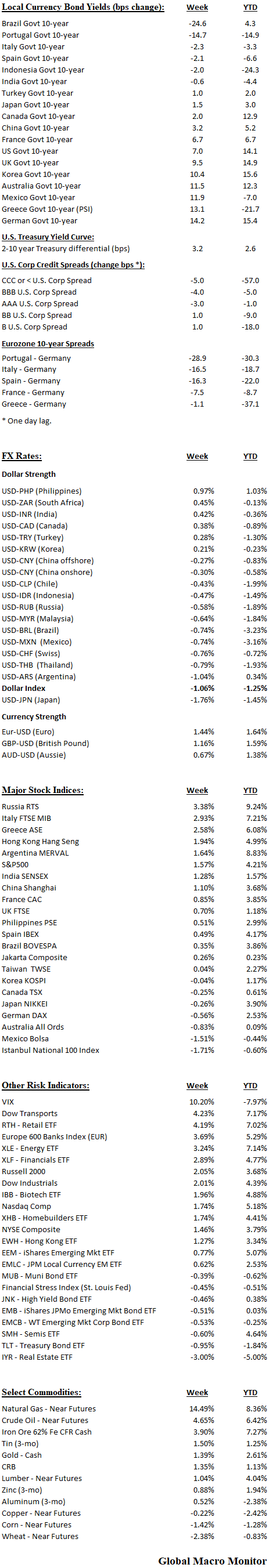

Fixed-income

– Euro periphery tightening on spec ECB to issue EURO bond to extract from QE;

– Yield seekers going all-in in Brazil;

– German 10-year approaches key resistance at 60-ish bps as ‘zone economy rips;

Currency

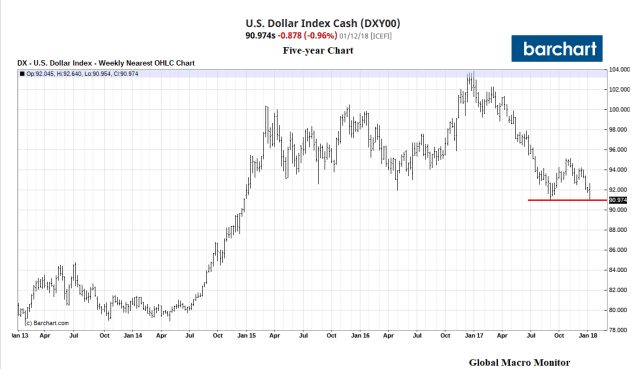

– Dollar seems to have caught Trump flu. Usually gets sneezy squeezy down here;

– Dollar/yen weak on speculation BoJ to start tapering;

.

– Euro breaks resistance at 1.20. Economic rip and hope of a Merkel government.

Stocks

– EM stocks continue to rock;

— Russia in catch-up mode;

– Mexico hit on reports U.S. wants to dump NAFTA;

— Nigeria, baby! Though POTUS may not, markets love the “shithole” countries.

.

Other Risk Indicators

– VIX up even as new records are ubiquitous;

– Trannies rocking the free world;

– Euro banks on verge of breaking out.

Commodities

– Crude breaking to new highs;

– The widow maker (Nattie) up yuge on record inventory draw;

– Grains continue to trade like wet dogs that don’t hunt.

.