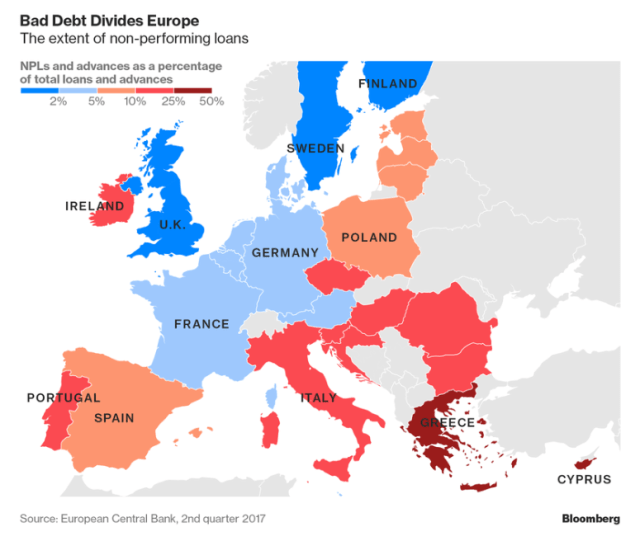

Looks like the new “Iron Curtain” in Europe is the non-performing loans (NPLs) in each country’s banking system. Greece and Italy stand out.

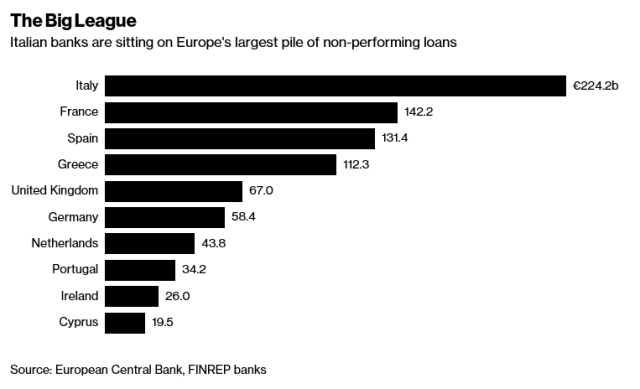

For European banks, it’s a headache that just won’t go away: the 944 billion euros ($1.17 trillion) of non-performing loans that’s weighing down their balance sheets.

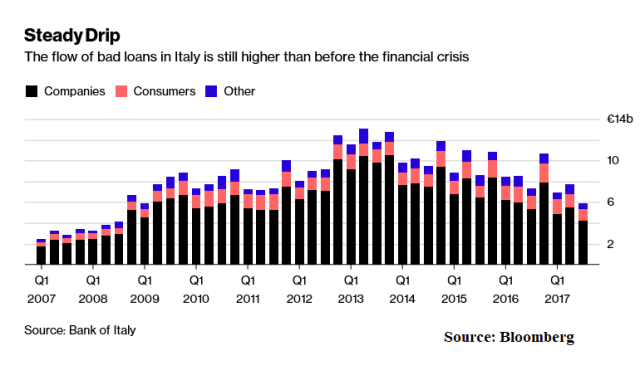

Economists say the pile of past-due and delinquent debt makes it harder for banks to lend more money, hurting their earnings. European authorities are prodding lenders to sell or wind down non-performing credit, but they’re split on how to tackle the issue, and some investors are disappointed by the pace of progress. – Bloomberg

And with rates in all time lows, non performing will soar if rates keep climbing back to normal.

Exactly, Leonardo. Maybe the motivation for Dalio’s big European short. Thanks for comments.