Nice bounce.

The S&P500 is up 7.88 percent off the low and has recovered 58.65 percent of its loss. It looks like the pivot is the .618 Fibonacci retracement level, which it traded through but could not hold as the market sold off into Friday’s close.

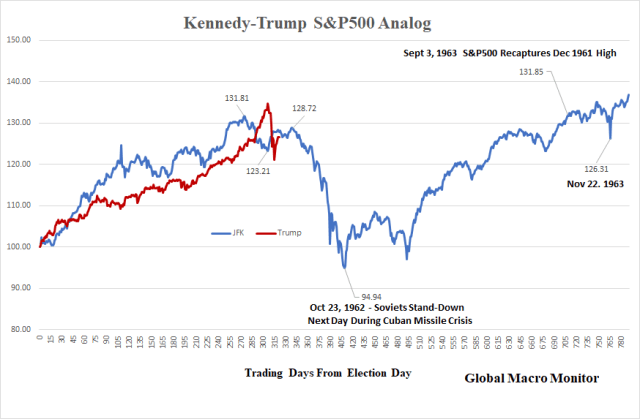

We are still following the Kennedy-Trump analog and won’t trash it until the S&P500 closes firmly above the 2,800 level.

Interest rates seem to have stabilized and came back nicely in Germany, which provided some cover for equities to bounce. Credit spreads are wider in February.

The dollar continued on its weak path with the index making a new low on Friday before bouncing. Tread carefully if rates start moving higher and dollar lower.

Financial stress in the system is increasing, but note, the data is lagged by a week.

Copper and Zinc up big this week. Natural gas is, and will always be, the widow maker.

.