The Italian 10-year government bond is 112 bps through the U.S. 10-year note yield, and the country doesn’t have an independent central bank! Moreover, the Germans are coming to town at the ECB very soon. How is that for pricing risk?

President Sergio Mattarella has given Italy’s divided political parties 24 hours to try to reach a deal on a new government before he appoints a caretaker cabinet. – Local Italy, May 9

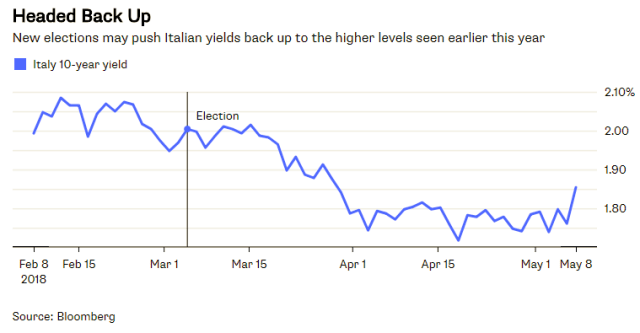

All of a sudden politics matters to Italian bonds. Disruption around an election process that was never smooth to begin with drove 10-year yields up 10 basis points on Tuesday to 1.85 percent, the highest level for six weeks – Bloomberg, May 8