Summary

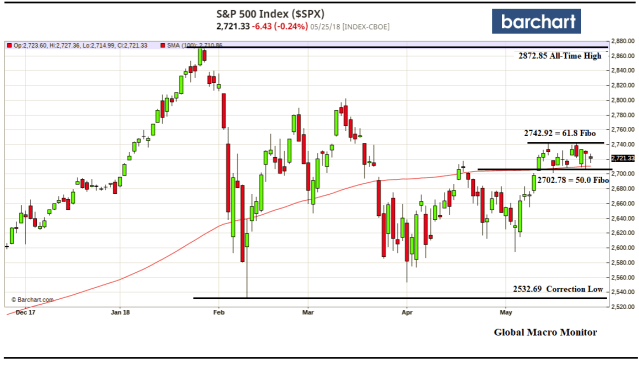

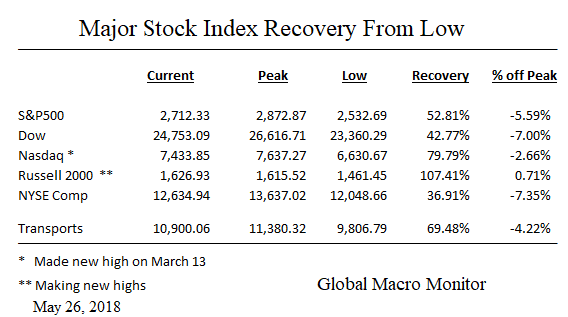

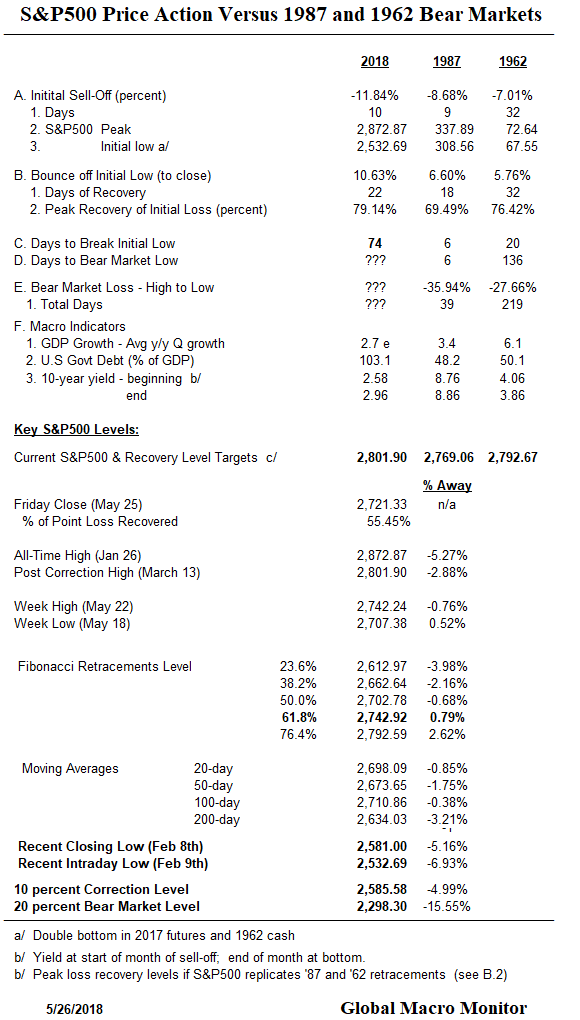

- The S&P500 is trapped in a 2-week trading range between 2707 to 2742. Of note, 2742.92 is the 61.8 Fibo in the correction, 2702.78 the 50 percent level Fibo. The 100-day moving average is also support at 2710.86. Watch these levels

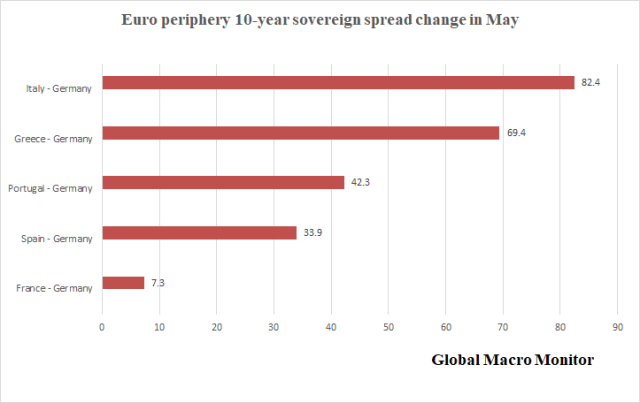

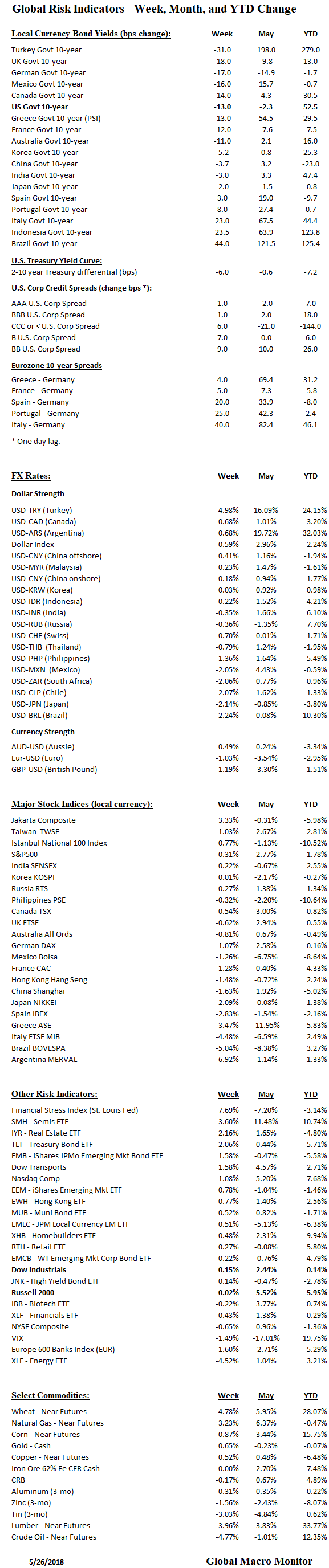

- Big blowout in Euro periphery spreads, led by political and policy uncertainty in Italy, and Friday’s political tape-bomb in Spain. Italy sovereign spread out 40 bps on the week

- Dollar index (60 percent euro weight) continues higher

- Turkish lira pounded another 5 percent on the week and 24 percent YTD. Erdogan asks Turks to convert their foreign currency holdings to lira.

- Other EM currencies stabilized, eking out small gains of around 2 percent

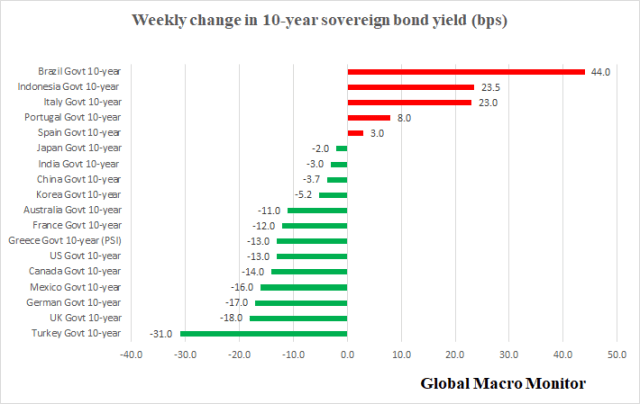

- Big move down in 10-year bond yields in the majors. Flight to quality as macro swans gather

- Bond yield spike in Brazil, Indonesia, and Italy

- Global stocks relatively weak with big selloffs in Argentina, Brazil, and Italy

- Saudi and Egypt country ETFs standout as only two with double-digit YTD return

- JFK-Trump S&P500 analog had a big divergence this week. Friday marked 389 trading days since the election, and the day of JFK’s S&P500 flash crash, taking the index down 6.7 percent on the day, and 11 percent over the five day period. We can force fit the analog by changing start dates but will not. Still on the shelf and will bring it out when it starts working again. Note the Trump S&P500 has always lagged the JFK market over the history of the analog.