Summary

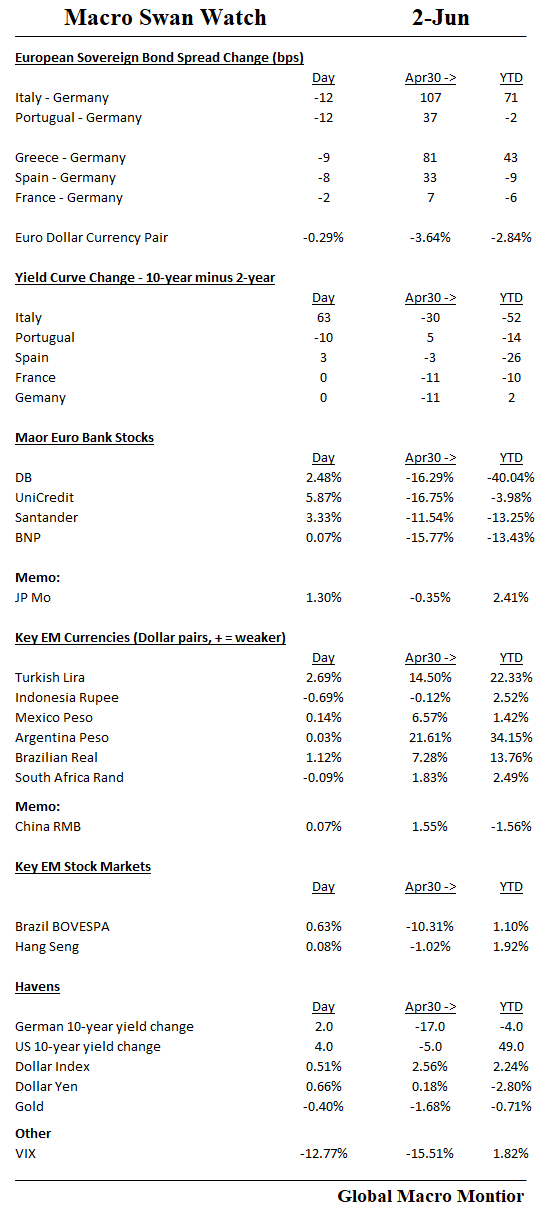

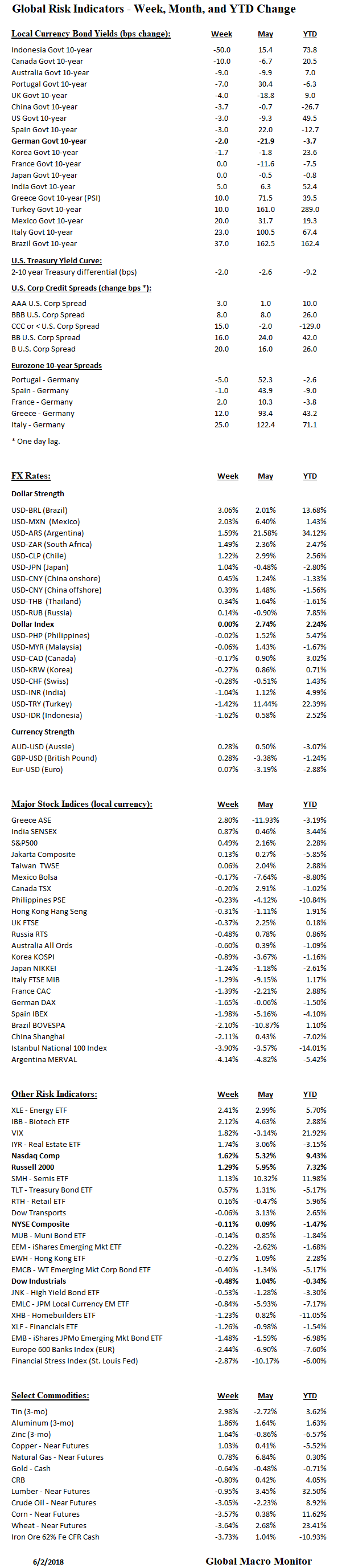

- The week began with a spike in volatility on Italian politics, then again on Thursday on trade war fears

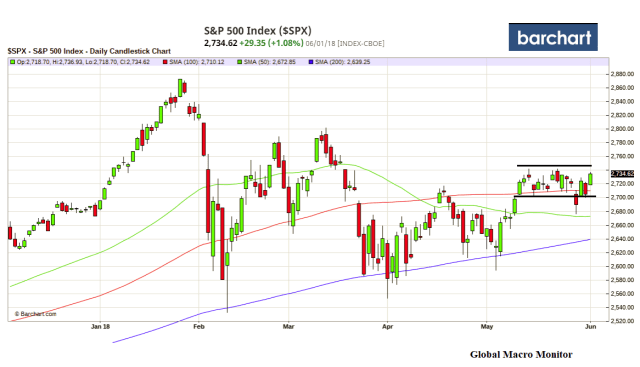

- Stocks remain resilient, firming up Friday with the solid employment numbers

- S&P500 continues to trade in a 40-point range, stuck between the 31.8 Fibo on the upside and the 100-day on the downside

- Italian and the euro periphery bonds rebounded sharply after Monday selloff

- Brazil and Mexico 10-year yields up 37 and 20 bps, respectively

- Corporate credit a bit weaker

- Latin currencies weaker

- Dollar index (60% Euro) flat

- Turkish lira recovered slightly

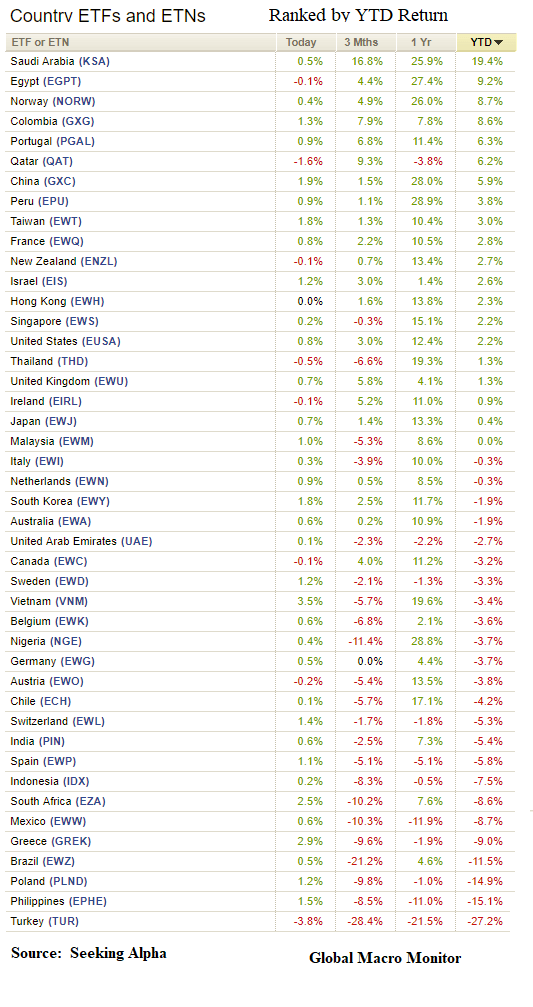

- Global equities flat to weakfish

- NASDAQ and U.S. small caps continue to outperform

- Banks weaker and may be worried of spillover from Europe and decline in Deutsche Bank shares

- Crude oil weaker

Upshot: The U.S. stock market wants to trade higher but being buffeted by tighter U.S. monetary policy and the gathering macroo swans. Strategy – Rental longs only with strong predisposition to sell and short at higher prices. Could get a nice run to 2800 if the S&P500 breaks above 2743. Patiently waiting for the break.