Summary

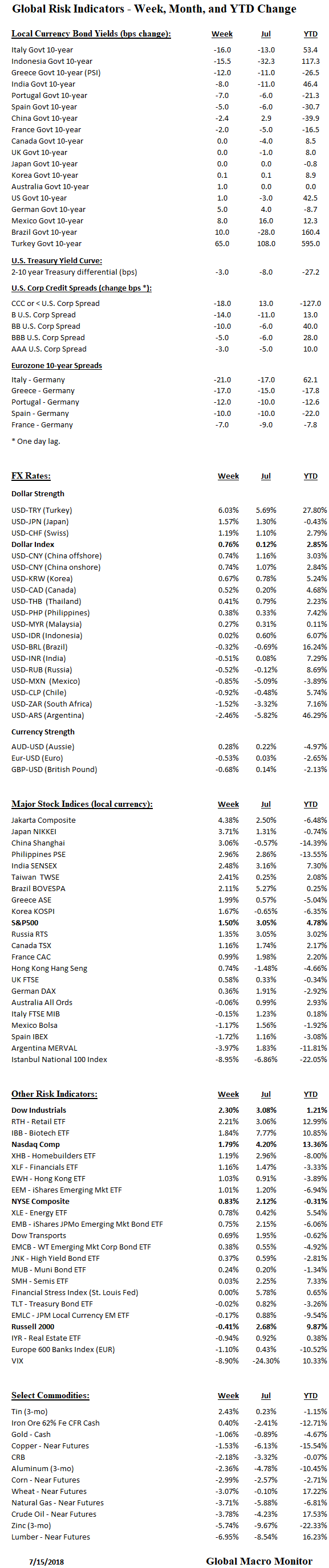

- Italy and euro periphery continue to stabilize

- Turkey 10-year rates still blowing out, up almost 600 bps YTD

- U.S. corporate credit spreads tighter on the week

- Argentina IMF program starting to take hold as currency 6 percent stronger in July

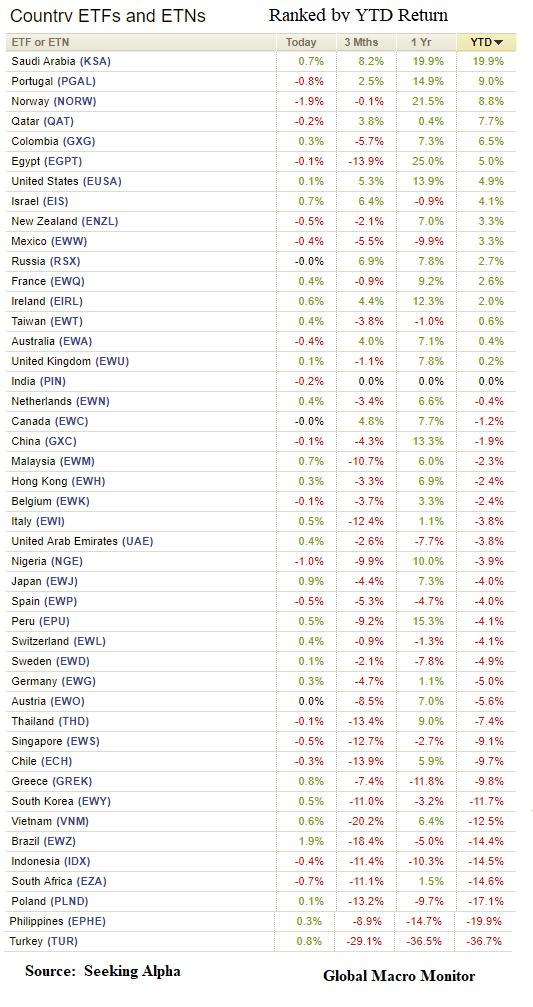

- Most global stock indices having a decent month

- VIX back down to a 12 handle

- Commodities weak. Keep copper on the radar

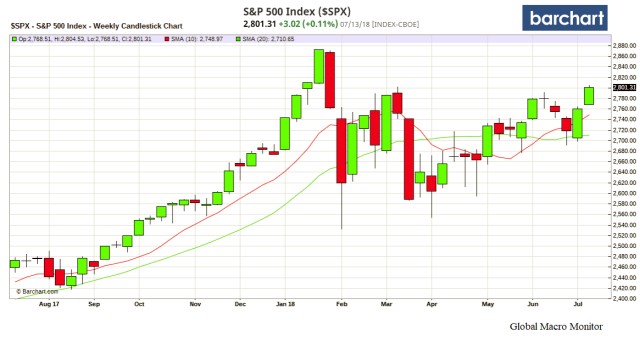

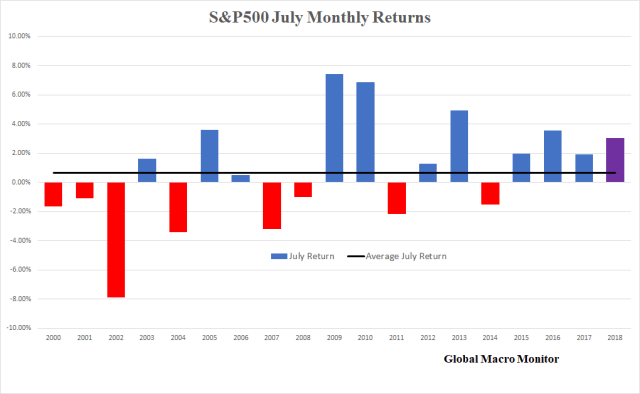

Commentary: The S&P closed the week at its highest level since January correction. There have not been three consecutive green weekly candlesticks since January highs, however. It feels the S&P is ready to break above the critical 2802 level as earnings season kicks into high gear. Already up over 3 percent in July, so history suggests not much juice left in the battery.

Inflation probably running hotter than expected. Watch to see if Chairman Powell throws some shade on the market.

The market also thinks the “trade war” is nothing more than virtual reality. Tell that to the farmers.