At the end of September, we posted our analysis of the structural changes taking place in the Treasury market, The Gathering Storm In The Treasury Market 2.0, which was very well received and still getting thousands of hits per week.

Crowding Out

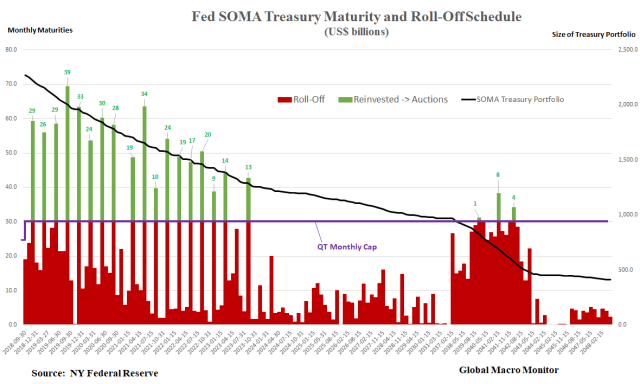

Our analysis focused on “crowding out”, mainly, the changing supply and demand dynamics in the Treasury market. We flagged the sharp increase in new Treasury supply this year and the coming years, and the declining demand, mainly, what was once “free money” from: 1) foreign central banks; 2) U.S. government trust funds, such as Social Security which is now in deficit; and 3) The Fed, which is now a net seller of Treasury securities as quantitative tightening is full steam of head, forcing the Treasury to issue an additional maximum of $30 billion into the market to refinance the FED’s maturing Treasury portfolio.

We concluded the extra supply and declining demand is putting almost unprecedented stress and pressure on the world’s financial markets. That is the marginal supply of liquidity/savings/capital, however, you label it, available for all global asset purchases is not unlimited unless complimented by quantitative easing, and is being sucked into the U.S. Treasury market.

Interest Rates

We also noted in the piece that the only possible case for Treasury yields to remain at current levels or to move lower was for haven flows to increase. Selling in other asset markets, such as stocks and emerging markets, with the money moving into Treasuries.

Even still, we expect real yields to move higher.

Moreover, as markets increasingly fret over the growing fiscal deficit and how it will be funded, we suspect the political conflict in the U.S. is going to get very loud and ugly over the next few years.

Place your bets on how to lower the deficit to relieve market pressures. Cutting entitlements or raising taxes? Or both?

Jim Grant

Finally, Jim Grant nailed it last week, confirming, at least to us, our analysis. Keep it on your radar, folks.

…the expected burden of Treasury security supply in the market this year..we are talking about the biggest dollar amount of securities for sale as a percentage of GDP since World War II, 1945. – Jim Grant, @2.35 minute mark

Click here for interview

Big changes coming to the Global Macro Monitor. See here for details.

Pingback: Mr. Market’s Biggest Headwind – TCNN: The Constitutional News Network

Pingback: Mr. Market’s Biggest Headwind | peoples trust toronto

Pingback: Mr. Market’s Greatest Headwind – Viralmount

Pingback: Mr. Market’s Biggest Headwind – iftttwall

Pingback: Mr. Market's Biggest Headwind - Novus Vero

Pingback: Mr. Market’s Biggest Headwind | Real Patriot News

Pingback: Mr. Market's Biggest Headwind - open mind news

Pingback: Mr. Market’s Biggest Headwind – The Deplorable Patriots

Pingback: Mr. Market’s Biggest Headwind – TradingCheatSheet

Pingback: Mr. Market's Biggest Headwind | Newzsentinel

Pingback: Mr. Market's Biggest Headwind | StockTalk Journal

Pingback: Mr. Market's Biggest Headwind | ValuBit

Pingback: Mr. Market’s Biggest Headwind – Wall Street Karma

Pingback: Mr. Market's Biggest Headwind - InternetticA

Pingback: Is this the Beginning of the Bear Market? - TradingGods.net

Pingback: Weekend Reading: Why This Isn’t “THE” Bear Market…Yet – iftttwall

Pingback: Weekend Reading: Why This Isn’t “THE” Bear Market…Yet | peoples trust toronto

Pingback: Weekend Reading: Why This Isn’t “THE” Bear Market…Yet | Real Patriot News

Pingback: Weekend Reading: Why This Isn't "THE" Bear Market...Yet — WITSNEWS

Pingback: Weekend Reading: Why This Isn’t “THE” Bear Market…Yet | Raw Conservative Opinions