Whenever we see markets tanking as they have been for the past few days with the Dow down almost 1,000 points (3.7 percent) since Friday’s close, we think counterparty risk may be spooking traders and investors. We suspect, and we could be wrong, there is a growing concern over Deutsche Bank’s (DB) stock making new all-time lows.

We see a lot of hits on our blog today on our past posts about Deutsche Bank.

Biggest Globally Systemically-Important Bank (GSIB)

Deutsche Bank, which has been labeled by the IMF as the biggest contributor to global systemic risk, hit a new all-time low in Frankfurt this morning, closing at around €8.17, down over 91 percent from its pre-GFC high and almost 50 percent year-to-date. The latest hit comes from its involvement with Danske Bank, who is wrapped up in a money laundering scandal in Estonia.

Whenever a GSIB stock is making a new low, it’s time to sit up, stand up and listen.

No Lehman

Deutsche is no Lehman Brothers. The Germans will never let its flagship fail and neither would world policymakers.

The bank is not dependent on wholesale funding from the markets and finances itself mainly through a large deposit base. The DB chart below illustrates its 77 percent deposit-to-loan ratio.

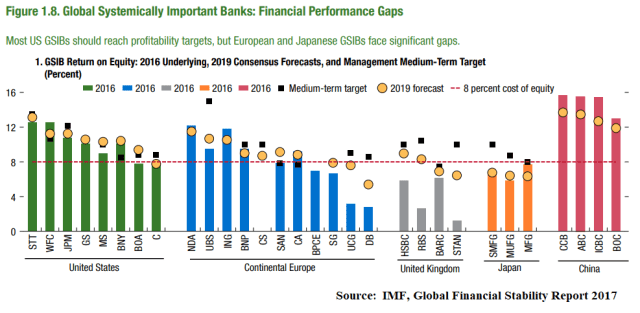

Also see the IMF chart on the bank’s horrendous return-on-equity, which many believe is the reason why the stock is tanking and not over balance sheet concerns.

Nevertheless, DB has, the last time we looked, the world’s largest derivatives book, and as the stock goes lower the risk of spooking its counterparties moves higher. The German government and EU regulators must be cognizant of these risks, not dilly-dally, and show firm resolve to the markets

The lower the stock goes the higher the probability the German government will be called upon for a capital injection. Deutsche Bank will not be allowed to fail as the world as we know it will end.

German Sovereign CDS

DB’s credit default swaps have risen from 120.7 bps in September to 155.7 bps, but have not yet taken out the May 188 bps high, however.

Deutsche Bank is relatively big. It’s total assets are equivalent to about 47 percent of German GDP, which compares to JP Morgan, the largest U.S. bank, and though larger than DB is asset size, is only around 12 percent of GDP. The large bank to GDP size throughout Europe is a reflection the continent is way overbanked.

Buying German sovereign 5-year credit default swaps at 13 basis points seems like a good, cheap, positive asymmetric bet on DB event risk to us. If the Merkel government is called upon to bail out DB, the sovereign’s CDS rates move higher, in our opinion. The cost of being wrong is a few basis points of carry over the next few months.

No peep from the talking heads today about DB, folks, so this definitely has the potential to hit the market by surprise. Keep it on your radar.

Update: WSJ just out with a good piece on DB, How Deutsche Bank is Dealing With its Big Weakness.

Pingback: Deutsche Bank, Yet again? – Viralmount

Pingback: Deutsche Bank, Again? | COLBY NEWS

Pingback: Deutsche Bank, Again? – iftttwall

Pingback: Deutsche Bank, Again? - open mind news

Pingback: Deutsche Bank, Again? | Newzsentinel

Pingback: Deutsche Bank, Again? - Novus Vero

Pingback: Deutsche Bank, Again? | Zero Hedge - Financial News & Business News

Pingback: Deutsche Bank, Again? – TradingCheatSheet

Pingback: Deutsche Bank, Again? | StockTalk Journal

Pingback: Deutsche Bank, Again? | ValuBit

Pingback: Deutsche Bank, Again? | Real Patriot News

Pingback: Deutsche Bank, Again? – TCNN: The Constitutional News Network

Pingback: Deutsche Bank, Again? – Wall Street Karma

Pingback: Nothing New Under The Sun 2016

Pingback: Deutsche Bank, Again? | Zero Hedge - Get the latest financial news. Free real time quotes, 25 Trading Tools, Technical analysis, and much more.

Pingback: Deutsche Bank, Again? - InternetticA

Pingback: Deutsche Bank, Again? – Conspiracy News

Don’t you mean buying German sovereign 5-year credit default swaps ?

Right, Felipe. Thanks for pointing that out. Typo, I must of been thinking credit spreads or something when writing.

Pingback: Deutsche Bank, Again, by Global Macro Monitor | STRAIGHT LINE LOGIC

Pingback: Deutsche Gang Bank. Część 3. – Ostateczne rozwiązanie – Business Outsider