Summary

- The S&P kissed its 200-day then reversed bringing most risk markets down with it. Now, analysts are “retrofitting” their fundamental view to downside price action. Nice skate save on Friday

- Go no further than local bond markets to confirm the risk-off end of week move. Developed yields in x/Mexico, the Euro periphery and EM out. Even the French sovereign spread out 7 bps. Surveillez cet endroit!

- U.S. credit stable on the week but weaker at the end of the week

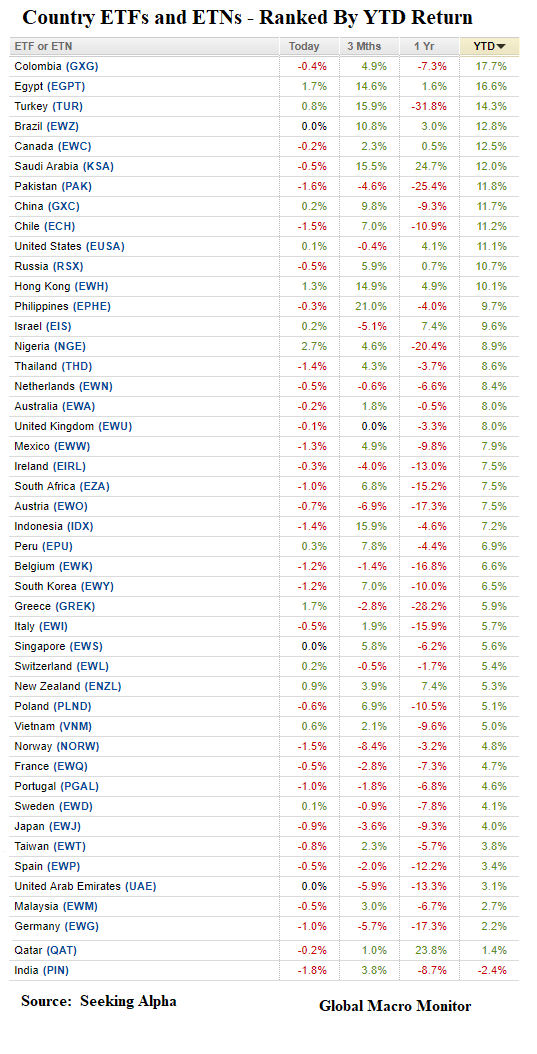

- Dollar stronger with major Latins giving back some YTD gains. The Dixie only 1.1 percent or a chip shot away from taking out its December 14th high at 97.71, which could put the kibosh on the EM rally

- Aussie stocks led the weak or week

- Iron ore jumped to its highest levels since 2014 on Vale concerns. We flagged Iron Ore early as an indicator and signal the old China economy is about to kick in

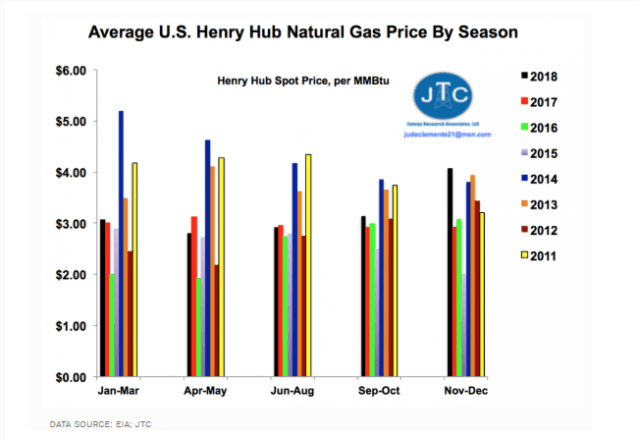

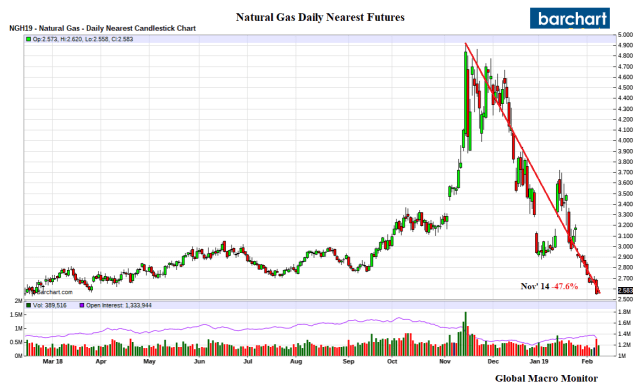

- Natural gas ugly and should be higher given seasonals.

Commentary: On February 3rd we posted,

Thus we expect the market to trade through the .618 Fibo at 2713 and kiss or temporarily pierce the 200-day moving average at 2740, getting the bulls Super Bowl lathered up, before reversing and setting on a new trajectory to test the December low. – GMM, Feb 3rd

Check.

We believe the index is on its way but certainly not in a straight line. Some are betting on a 1990’s melt-up as Fed will have to ease. That’s possible if the Fed begins easing with the S&P at 1000. Never have seen such nonsense, however.

The initial conditions in the 1990s couldn’t be more different than they are today. The mid-’90s was the beginning of globalization, cheap labor from China, India, and Eastern Europe. Peak America.

Now the reverse is true. The post-War order, i.e., globalization, is fading fast, and one, and the major reason we are cautious here, even as a long-term investor, and will steer clear of stocks until they get much cheaper. We are confident they will.

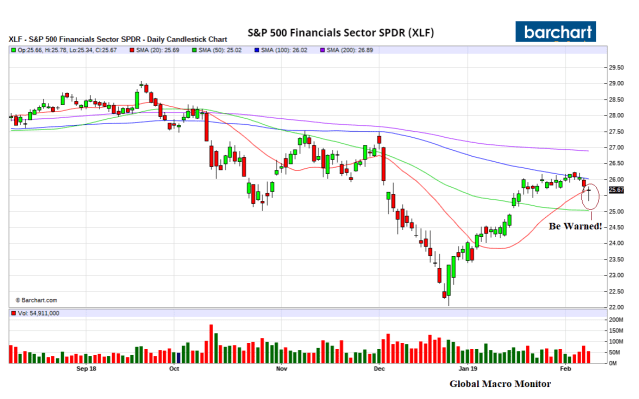

We don’t like the XLF (financials ETF) chart. Ugly Doji daily candle to end the week (see chart below) clinging to its 20-day. Watch this schpace (go lower)!

Natural gas is freakishly low here at this time of year. Yes, shale supply HELL. We think it deserves a stab down at these levels, however, but on a tight leash (which is a danger in itself as Nattie can easily, and often does, move 10% in one day). Be warned we have lost a ton of money in the “widow maker.”

China back online this week, Mnuchin and Lighthizer to China for negotiations, mo earnings, CPI, and government funding deadline on Friday.

Senate Appropriations Chairman Richard Shelby (R-Ala.) acknowledged on Sunday that negotiations had stalled, and he put the odds of getting a deal at 50-50. – Politico, Feb 10th

It will get done. They are not that foolish.

Happy hunting this week, folks.

Ugly Doji On Friday Clinging To 20-day. Going Lower

Nattie Down 48 Percent Since Novie In Midst of Polar Vortex

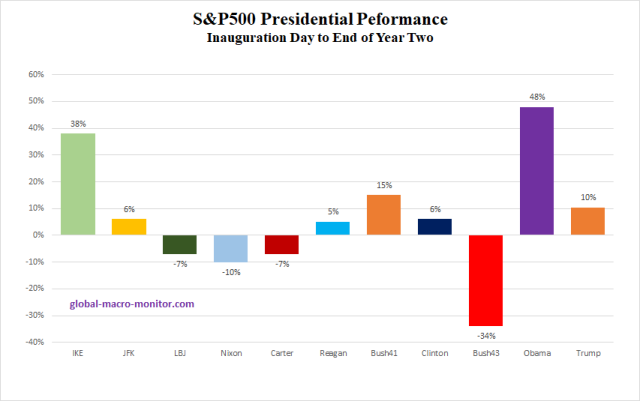

Reality Clashes With Presidential Spin

EM Should Start To Give Some/More Back With Stronger $

Returns For Week, February, and Year-to-Date

Pingback: S&P500 Key Levels | Global Macro Monitor

Pingback: Week In Review – March 1 | Global Macro Monitor