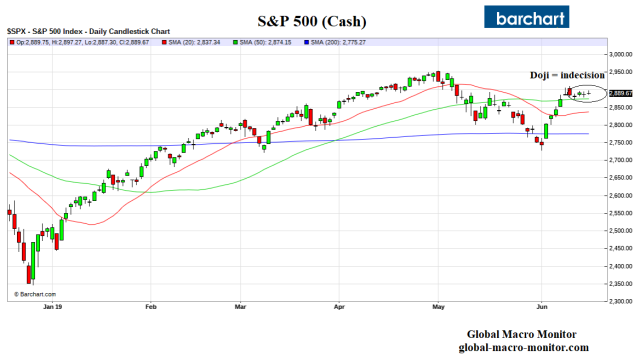

Snoozefest until the FOMC on Wednesday. Lots of Doji candles reflecting traders don’t wanna do jack all. Volume running at about 90 percent of the 10-day moving average.

Market expecting no rate cut, though a 20 percent probability is not exactly zero. It feels to us the market could be set up for some disappointment. Expectations of three rate cuts by year-end seem excessive with 3.6 percent unemployment and 2 percent off all-time stock market highs.

The market needs a reality check here with respect to expected rate cuts and will be very sensitive to and looking for clues in the FOMC statement.

Key Levels

The S&P is having trouble at the key Fibo, 2900.95. If that goes, the recent high of 2910.61 then off to new highs at 2954 plus.

On the downside, 2874 is a big number, the 50-day moving average, and last week’s intraday low. Going fishing tomorrow.