Markets are having a very difficult time multi-tasking during this crisis.

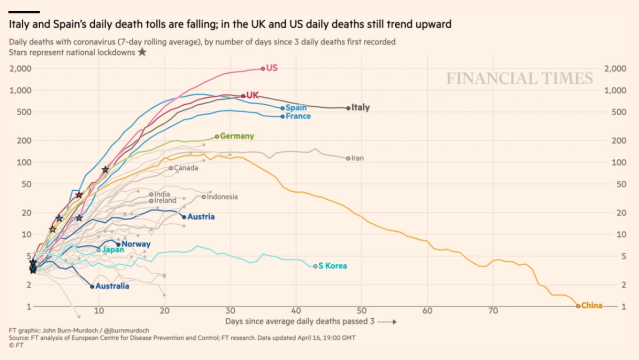

Getting all lathered up about seeing through the first-order existential threat of survival and death — we are very grateful the curves are starting to turn — and not pricing the risks of the second, third, fourth….seventh-order effects is a dangerous proposition.

EU Existential Crisis – Fourth Order Effect

The EU has on the verge of entering another existential crisis, worse than 2011 in political terms, though they do have the ECB backing but with less firepower.

Remember that one? The Euro was almost finished and the financial instability unleashed could have been 100x Lehman.

Emmanuel Macron has warned of the collapse of the EU as a “political project” unless it supports stricken economies such as Italy and helps them recover from the coronavirus pandemic. – FT

EM Crisis – Fifth Order Effect

The emerging market (EM) crisis alone, probably about number five down the line, would have shaved 20-25 percent off the DM risk markets in a normal world.

Steven Mnuchin has defended the Trump administration’s opposition to a bid to provide IMF liquidity to emerging markets that are facing capital outflows, saying it would mostly benefit wealthier nations that do not need the support.

…But the White House is resisting a proposal to increase the allocation of a general “special drawing right” to countries, which has been backed by a number of EU and African leaders as key to the global pandemic economic response. – FT

All that matters is where the Fed’s bid an pass the reefer.

This bear market feels like it is going to play out like none other. We are very comfortable with cash and gold. That’s it. We sleep well.

Pingback: The Extremely Overvalued & Top Heavy U.S. Stock Market | Global Macro Monitor

Pingback: The Extremely-Overvalued & Top-Heavy US Stock Market | ValuBit

Pingback: The Extremely-Overvalued & Top-Heavy US Stock Market – SYFX+

Pingback: The Extremely-Overvalued & Top-Heavy US Stock Market – MDC News Today

Pingback: The Extremely-Overvalued & Top-Heavy US Stock Market | Real Patriot News