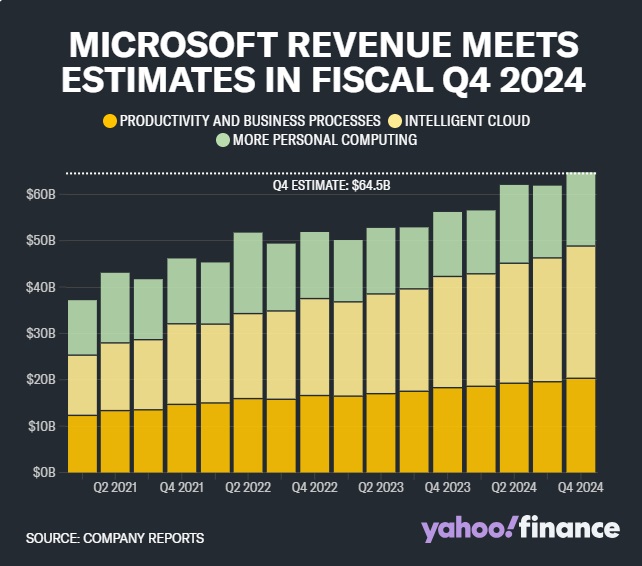

Microsoft (MSFT) reported its fiscal fourth-quarter earnings, surpassing Wall Street’s expectations on EPS and revenue but falling short of cloud revenue forecasts, notably in its Intelligent Cloud segment. Despite this, overall revenue increased by 15% yearly, with Intelligent Cloud revenue growing by 19%. The company highlighted that AI services contributed significantly to Azure and other cloud revenues, which grew by 29%. Following the announcement, Microsoft’s stock dropped over 7% in after-hours trading. The earnings report also impacted other AI-focused companies like Meta, whose shares declined by over 3%.

Key Facts:

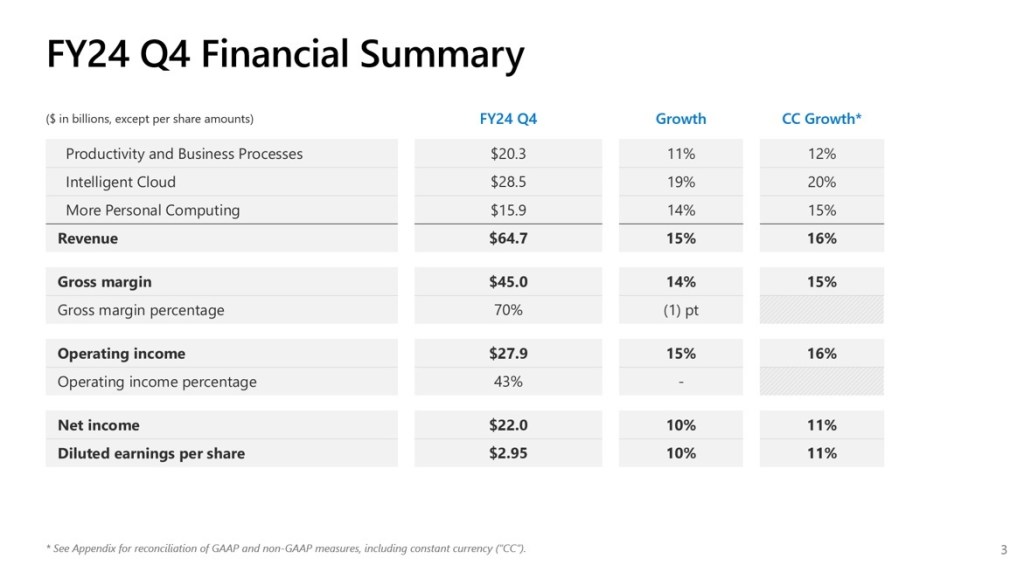

- Microsoft reported an EPS of $2.95 on revenue of $64.7 billion, beating expectations of $2.94 EPS and $64.5 billion in revenue.

- Cloud revenue totaled $36.8 billion, meeting expectations, but Intelligent Cloud revenue of $28.5 billion missed forecasts of $28.7 billion.

- Microsoft’s overall revenue rose by 21% yearly, with Intelligent Cloud revenue increasing by 19%.

- AI services contributed 8 percentage points to Azure and other cloud services revenue, which grew by 29%.

- Microsoft’s earnings report caused its stock to drop more than 7% after-hours trading, impacting other AI-heavy companies like Meta, which fell over 3%.

Expectations across the board were likely higher than “posted”. The stock price move this year has been extraordinary for a company of its size , reflecting expectations for numbers that would truly be mind boggling

True ‘dat!

Seems analysts are getting a little picky.