-

In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.

-

Join 1,220 other subscribers

Contribute To GMM

Categories

- 3D Printing

- Agriculture

- AI

- Algos

- Apple

- Automation

- Banking

- BFTP

- Bitcoin

- Black Swan Watch

- Bonds

- Brazil

- Brexit

- BRICs

- Budget Deficit

- Capital Flows

- Cartoon of the Day

- Cashless Society

- Chart of the Day

- Charts

- China

- Clean Tech

- Climate Change

- Coach C

- Commodities

- Coronavirus

- COVID

- Credit

- Crude Oil

- Currency

- Cyprus

- Daily Risk Monitor

- Day In History

- Debt

- Demographics

- Disinflaton

- Dollar

- Earnings

- ECB

- Economics

- Economist

- Egypt

- Electric Vehicles

- Emerging Markets

- Employment

- Energy

- Environment

- Equities

- Equity

- Euro

- Eurozone Sovereign Spreads

- Exchange Rates

- Fed

- Finance and the Good Society

- FinTech

- Fiscal Cliff Monitor

- Fiscal Policy

- Food Prices

- France

- Futurist

- Game Theory

- General Interest

- Geopolitical

- Geopolitics

- German Bund

- Germany

- Global Macro Watch

- Global Reset

- Global Risk Monitor

- Global Stock Performance

- Global Trend Indicators

- Gold

- Greece

- Healthcare

- Heat Map

- Hedge Funds

- Housing

- Human Interest

- Immigration

- Impeachment

- India

- Inequality

- Inflation/Deflation

- Infographics

- Innovation

- Institutional Investors

- Interest Rate Monitor

- Interest Rates

- Interviews

- Italian Yields

- Italy

- Japan

- Jobs

- Lectures

- Macro Notes from Conference Calls

- Manufacturing

- Masters

- Mexico

- Monetary Policy

- Movies

- Muni Bonds

- Muni Market

- Natural Gas

- News

- Nonlinear Thinking

- North Korea

- Overbought Markets

- Picture of the Day

- PIIGS

- PMIs

- Policy

- Politics

- Population

- Populism

- Poverty

- President Trump

- Qunat Strategies

- Quote of the Day

- Quotes

- Rare Earth Elements

- Readership

- Reads

- Real Estate

- Relative Strength Index

- Robert Shiller

- RSIs

- S&P500

- Sector ETF Peformance

- Semiconductor prices

- Semiconductors

- Social Media

- Socialism

- Song for the Week

- Sovereign Debt

- Sovereign Risk

- Spain

- Sports

- State and Local Government

- Tail Risk

- Technical Analysis

- Technology

- The Big Reset

- The Weekend Read

- This Day In Financial History

- Trade War

- Trades

- Tweet of the Day

- Ugly Chart Contest

- Uncategorized

- US Releases

- Video

- Volatility

- Wages

- Week Ahead

- Week in Review

- Weekend Reads

- Weekly Eurozone Watch

- Whales

-

Recent Posts

Meta

Testing ChatGPT’s Stock Predicting Prowess

We are putting ChatGPT to the test here, and we shall know the results by market close tomorrow.

We prompted ChatGPT with the following:

What is the most pervasive pattern to predict a less than -1.0 % Daily Change.

ChatGPT came back with:

The most pervasive pattern before a daily change of less than -1% seems to involve negative changes in the days leading up to the significant drop. On average:

- The day before the drop, the daily change was approximately -0.11%.

- Two days before the drop, the daily change was approximately -0.05%.

- Three days before the drop, the daily change was approximately -0.05%.

We interpret this as three small down days before a 1 percent flop. Given last week’s close in the S&P (the data we used was the S&P500 daily change) of:

Wednesday: -0.19 percent

Thursday: -0.29 percent

Friday: -0.65 percent

the market is set up for a 1 percent down move according to the data and ChatGPT’s analytical capacity or pattern recognition.

No guarantees and beware of hallucinations.

Place your bets and stay tuned, folks.

Posted in Uncategorized

Leave a comment

Happy St. Patrick’s (Maweyn Succat) Day!

Blast From The Past (BFTP).

For my late grandmother from Cork.

Happy St. Patrick’s (Maweyn Succat) Day!

St. Patrick, Ireland, St. Patrick’s Day. Simple, right? The man wasn’t even Irish! He was actually born in Britain around the turn of the 4th century. At 16 years old, Irish raiders captured him in the midst of an attack on his family’s estate. The raiders then took him to Ireland and held him captive for six years. After escaping, he went back to England for religious training and was sent back to Ireland many years later as a missionary. St. Patrick was actually born Maewyn Succat, according to legend; he changed his name to Patricius, or Patrick, which derives from the Latin term for “father figure,” when he became a priest. – Time

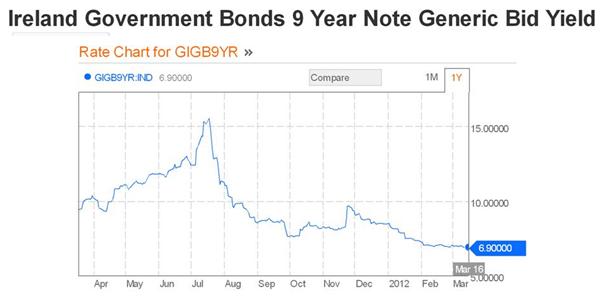

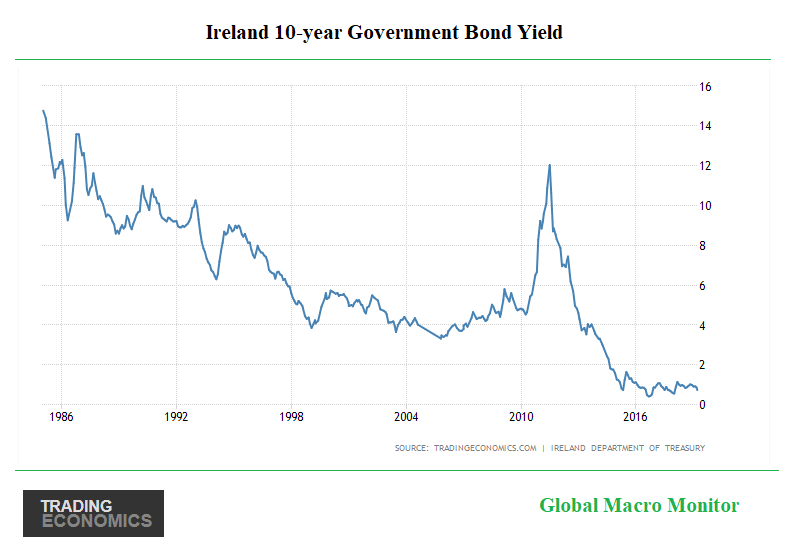

The Irish Comeback

Ireland has come a long way since this post, which was just after the European debt crisis. The government just placed €1.03 billion of 10-year bonds in mid-February at a stunning yield of 0.85 percent. The auction had a bid-to-cover of 2.24.

Yeah, got it, distorted due to ECB asset-buying program. But still well below the Euro periphery bond yields.

Though the Irish economy is slowing and there is much uncertainty around Brexit, still it’s been one helluva comeback, and the Irish are a resilient bunch, now positioning themselves with U.S. and Canadian companies as the “only English-speaking common-law country in the whole of the European Union.”

Me “finks [sic]” part of the success was thumbing their nose and ignoring the advice and dictates of the Eurocrats in Brussels.

Plus, Ireland still has Bono and U2, Andrea and the rest of the Corrs, and the many, if not all the great people of Ireland, we love so much, including my late grandmother and her side of the family. That is the upside of being an American. We are all mutts and can claim to be citizens of many cultures. Don’t think POUTS has got the memo quite yet.

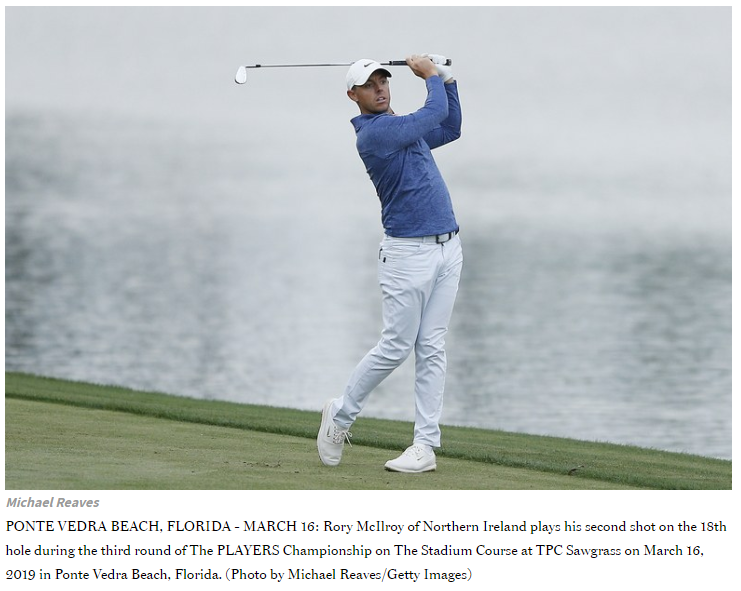

Rory

How great would be to see an Irishman win the PGA’s coveted Players Championship on St. Paddy’s Day? Rory tees it up in today’s final round one back.

Getting long Rory as I write. Pour me one in Dublin and Hollywood, CD in the wee hours tomorrow to celebrate! You heard it here first. Unleash the Leprechauns!

Source: Golf Digest

Happy St. Patrick’s (Maweyn Succat) Day!

In case you’re wondering, Maweyn Succat was St. Patrick’s real name and he wasn’t even Irish!. Click here for some great background and history of St. Patrick’s Day.

Go Paddy, Rory, Graeme, and Darren!

Happy St. Patrick’s Day! Not too many green beers, folks!

By the way, there has been one huge bond rally in Ireland over the past year.

Posted in Bonds, General Interest, Picture of the Day, PIIGS

Tagged bonds, Darren Clarke, Grame McDowell, History of St. Partrick, Ireland, Paddy Harrington, Rory Mciiroy

1 Comment

Chinese Economic Reform Is Off The Table

Elizabeth Economy is good. She is a distinguished figure in international affairs, specializing in Chinese policy. She holds a senior fellowship at the Hoover Institution, Stanford University, and has previously advised on China for the Department of Commerce. Economy’s expertise is rooted in her tenure at the Council on Foreign Relations and her extensive authorship, including books like “The World According to China” and “The Third Revolution.” Her work has garnered significant recognition, including a shortlist for the Lionel Gelber Prize. Economy has contributed to academic and policy discourse through numerous publications and has been an influential voice in media and government circles. Her educational background includes degrees from Swarthmore College, Stanford University, and the University of Michigan.

Posted in Uncategorized

2 Comments

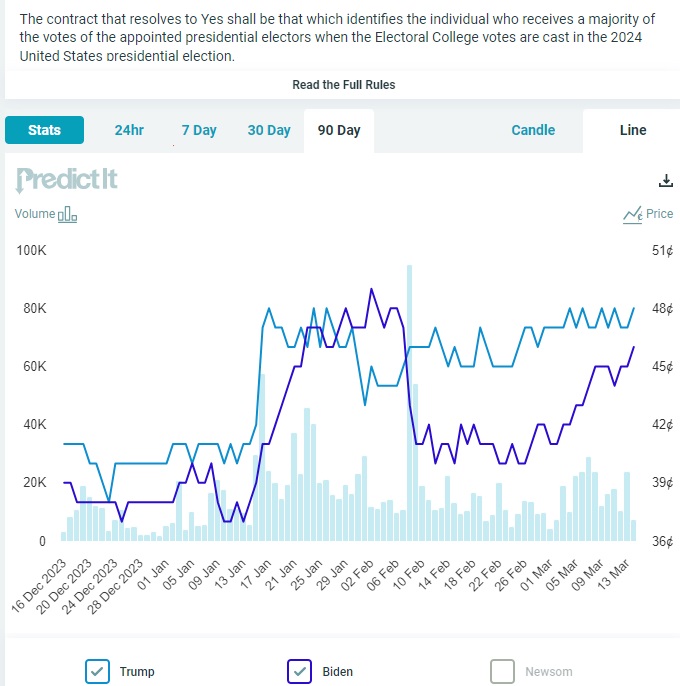

Biden Closing & Lincoln’s Counterfeit Convention Tix

President Biden’s probability of being re-elected, as measured by the betting markets at PredictIt, has closed a 6-point gap between him and the former president. As you can see from the chart, Biden’s predicted probability of being re-elected took a tumble after the special prosecutor’s report labeled POTUS as,

“as a sympathetic, well-meaning, elderly man with a poor memory“. – Special Counsel’s Office

The bettors are predicting a photo finish. Our brain agrees, but our heart feels that it will be much less close than the conventional wisdom.

It’s hard to fathom America may join the ranks of authoritarian countries, but there are many things happening today that leave us shaking our heads.

Lincoln & His Fake Convention Tickets

The monumental impact of the results of the upcoming election on the country and the world has often been compared to that of the election of 1860, which brought President Lincoln to the White House. And if you agree “politics ain’t beanbag,” imagine today the uproar if a candidate snagged their party’s nomination the way President Lincon did from William Seward, who later became his Secretary of State, part of the Team of Rivals.

Lincoln’s Nomination

The 1860 Republican National Convention, held in Chicago, is notable for Abraham Lincoln’s unexpected nomination as the Republican candidate for President, a feat achieved through shrewd political maneuvers, most notably the strategic use of counterfeit tickets by his delegation. Here’s a revised account emphasizing this aspect:

- Chicago’s selection as the convention location set the stage for a significant political showdown, with Senator William Seward of New York as the expected nominee.

- Lincoln, a lesser-known figure at the time, capitalized on his political acumen and local support to challenge the frontrunner.

- Central to Lincoln’s strategy was the ingenious production and distribution of counterfeit tickets by his team.

- These counterfeit tickets were used to flood the convention hall with Lincoln supporters, effectively marginalizing Seward’s delegates.

- Seward’s camp, led by Thurlow Weed, was initially confident but failed to anticipate Lincoln’s tactical planning and grassroots support.

- The convention dynamics were heavily influenced by Lincoln’s ability to control the audience composition, thanks to the counterfeit tickets.

- Despite Seward leading after the first ballot, Lincoln’s growing momentum was palpable, aided by his supporters’ overwhelming presence.

- The shift in delegate support on subsequent ballots, particularly from Pennsylvania, was a turning point, facilitated by the charged atmosphere favoring Lincoln.

- Lincoln’s nomination was secured after three ballots, marked by the strategic use of counterfeit tickets which played a crucial role in his victory.

This pivotal moment underscored Lincoln’s resourcefulness and political insight, setting him on the path to the presidency.

We leave you with the words of Chairman Mao,

Buckle up, folks.

Posted in Uncategorized

1 Comment

NVIDIA’s Stunning 400% Growth In Data Center Revenue

NVIDIA recently reported a monumental performance for the fourth quarter and the fiscal year 2024, marking significant strides in revenue growth across various sectors. The fourth quarter saw revenues soar to $22.1 billion, a staggering 265% increase from the previous year and a 22% rise sequentially. What gets lost in the big numbers is that Data Center revenue, the bulk of NVIDIA sales (80 plus percent), grew by a stunning 409 percent y/y; that’s the AI kicker. folks.

The fiscal year rounded off with $60.9 billion in revenue, climbing 126% year-over-year. A notable highlight is the Data Center sector, which set a new record in the fourth quarter with a 409% increase from the prior year, largely fueled by the high demand for the NVIDIA Hopper GPU computing platform and InfiniBand solutions. This growth trend continued across the fiscal year, with Data Center revenue up 217%.

The surge in demand was primarily driven by large cloud providers, accounting for over half of the Data Center revenue, catering to both internal workloads and external customers. NVIDIA’s AI infrastructure saw broad adoption across various industry verticals, including automotive, financial services, and healthcare. Despite a significant decline in sales to China due to U.S. licensing requirements, Data Center compute and Networking revenue showed robust growth. Thanks to the GeForce RTX 40 SUPER Series GPUs, the Gaming segment also reported growth. Professional visualization and automotive sectors witnessed mixed results, with the latter seeing a slight dip year-over-year and an increase in self-driving platforms.

Base Effects

There will be a dampening base effect, slowing revenue growth. Growing Data Center revenues 4x on the Q4FY23 low base of $3.6 billion will be extremely difficult to repeat on a Q4FY24 base revenue of $18.4 billion.

Gross Margins = 77%

Looking ahead to the first quarter of Fiscal 2025, NVIDIA anticipates the following financial outlook:

- The company forecasts revenue to reach approximately $24.0 billion, subject to a plus or minus 2% variance.

- Gross margins, on both a GAAP and non-GAAP basis, are projected to stand at 76.3% and 77.0%, respectively, with a potential fluctuation of plus or minus 50 basis points.

Key Facts:

- Q4 revenue hit $22.1 billion, up 265% year-over-year.

- Fiscal year revenue reached $60.9 billion, a 126% increase from the previous year.

- Data Center revenue in Q4 soared by 409% year-over-year.

- Fiscal year Data Center revenue grew by 217%.

- Over half of Q4 Data Center revenue came from large cloud providers.

- Data Center sales to China dropped significantly in Q4.

- Data Center compute revenue surged by 488% year-over-year in Q4.

- Networking revenue increased by 217% year-over-year in Q4.

- Gaming revenue grew by 56% year-over-year, with fiscal year revenue up 15%.

- Automotive revenue saw a 4% decrease year-over-year in Q4 but a 21% increase for the fiscal year.

Posted in Uncategorized

1 Comment

Where The Wild Prices Are…Inflation Update

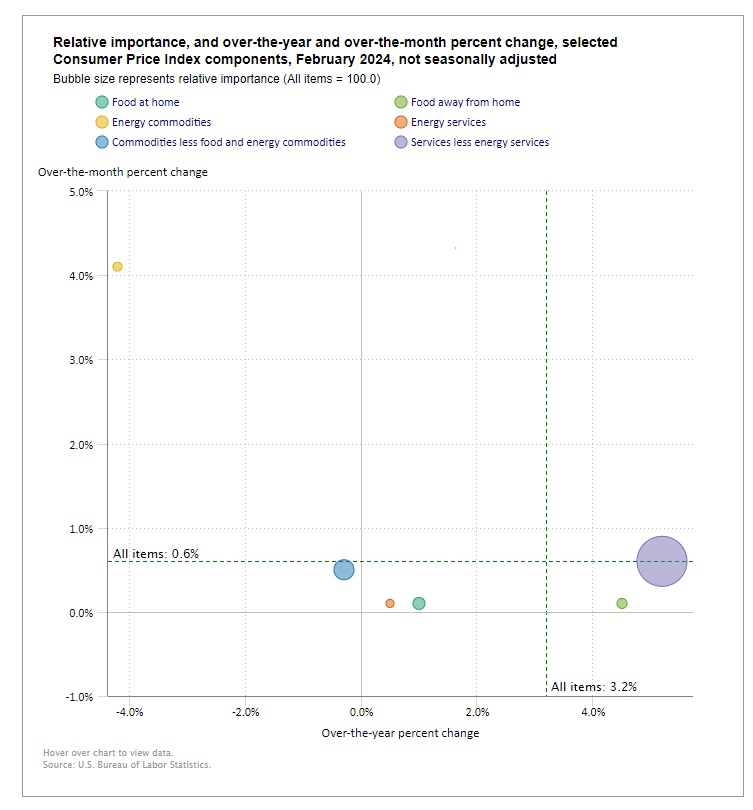

The Consumer Price Index for All Urban Consumers (CPI-U) edged upward by 0.4 percent, a notch above January’s rise, based on the CPI survey conducted by the U.S. Bureau of Labor Statistics. This measure, a barometer of the urban dweller’s cost of living, mirrored the broader passage of time with a 3.2 percent ascent over the past year, unadjusted for the season’s whims.

The fabric of February’s data was woven with familiar and fresh threads. Shelter, steadfast in its significance, rose alongside gasoline, their combined forces accounting for over sixty percent of the month’s increase. Energy surged by 2.3 percent, igniting all its components in a shared glow, while food remained constant, a still point in the turning world. Beyond the sustenance and warmth of food and energy, other realms too felt the touch of change: shelter, airline fares, and apparel among them, each contributing their verse to the month’s narrative. Yet, not all moved upward; some, like personal care and household furnishings, receded slightly, a reminder of the constant ebb and flow. Through it all, the landscape of costs painted a picture of growth over the past year, with the all-items index rising by 3.2 percent and its counterpart excluding food and energy, marking a 3.8 percent climb, a testament to the underlying price stickiness.

- February’s CPI-U increased by 0.4 percent, slightly higher than January’s 0.3 percent rise.

- The 12-month period ending in February saw the all items index rise by 3.2 percent.

- Shelter and gasoline significantly contributed to February’s CPI increase.

- The energy index experienced a notable rise of 2.3 percent in February.

- The all-items index, excluding food and energy, grew by 3.8 percent over the last 12 months.

Posted in Uncategorized

1 Comment

What’s Up With The Gold Price?

Gold is breaking out to new all-time highs. The market’s conventional wisdom is that it is mainly driven by the expectation the Fed will cut rates in June. The dollar index (dominated by the euro) is still up over 1 percent for the year.

“We still believe the same underlying premise remains, which is the combination of the expectation that the Fed is still going to cut rates later this year and dollar weakness,” said David Meger, director of metals trading at High Ridge Futures. – Reuters

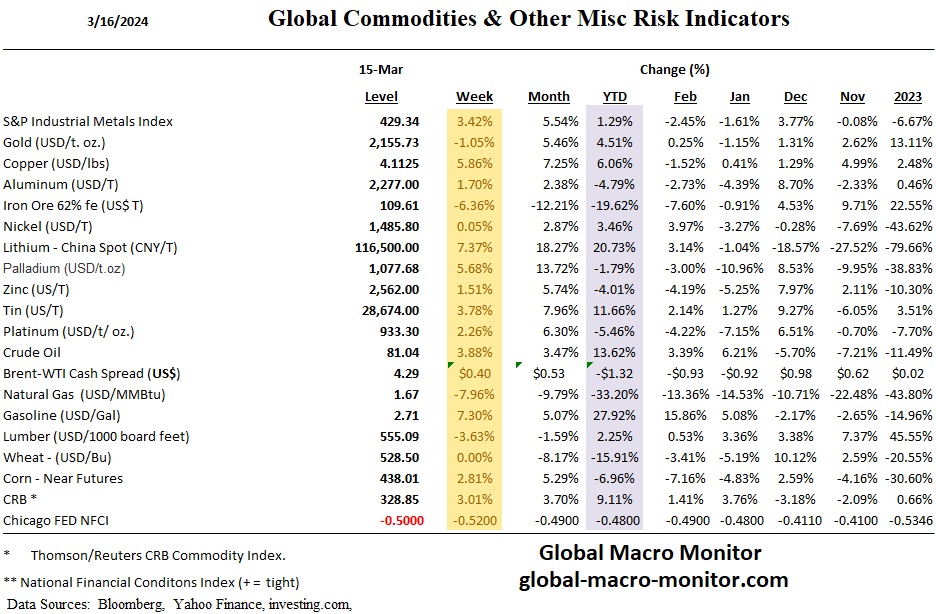

This makes zero sense to us as the market has priced out two rate cuts for the June meeting since the beginning of the year (see our Yields table). Moreover, according to the Chicago Fed’s National Financial Conditions Index, liquidity conditions tightened last week (see our Global Commodities table)

Nobody knows for sure, but our best guess is it’s a safe haven play with expected domestic and geopolitical instability to increase as the year progresses. Stay frosty, folks.

Posted in Uncategorized

2 Comments