Industrial policy is all the rage these daze.

There will be retribution. Bank it.

If he were thrown into the sea with a huge rock tied to his neck, he would be far better off than facing the punishment in store for those who harm these little children’s souls. I am warning you! – Gospel of Luke

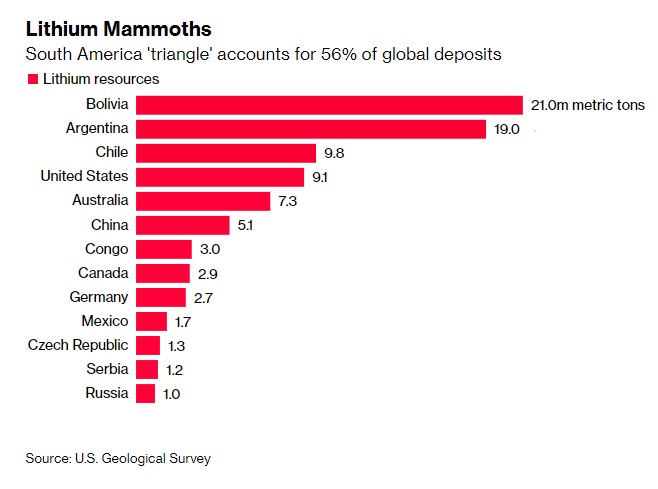

The so-called lithium triangle Argentina, Chile, and Bolivia account for more than half of global lithium resources, and both Brazil and Argentina have auto-making experience. That could be the basis of a regional electro-mobility platform, she said. – Bloomberg

There’s a big push among many resource-producing nations to move down the supply chain, taking advantage of the near- and reshoring craze. Rather than merely supplying the raw materials upstream in the supply chain, for example, the resource producers are looking to move into higher-value-added activities, such as manufacturing batteries, and eventually, the EVs that pack those lithium batteries.

Bloomberg reports that the Chinese carmaker Chery Inc. is looking at building a $400 million EV and battery plant in Argentina to secure Andean lithium supplies, which reflects a global trend by resource-rich nations to move away from just being just merely suppliers of the commodities, the inputs into higher valued added downstream products.

On average, EV lithium-ion battery packs contain about 9kg of lithium, one thousand times more than most consumer electronics.

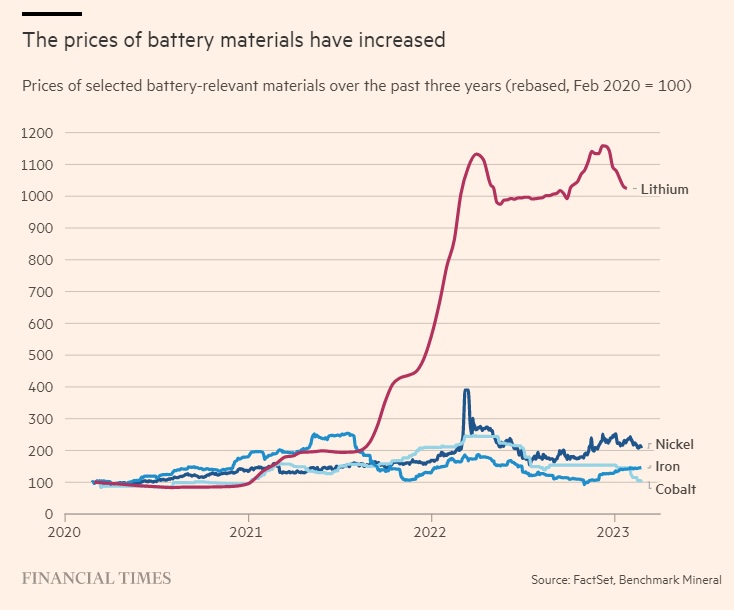

Lithium miners have been unable to scale supply to the rapidly growing demand as the electric vehicle market evolves. Adding new capacity online can take 3–5 years or more. The supply deficit has resulted in a huge spike in the price of lithium (see chart).

Annual lithium demand is expected to reach roughly 3.0 million metric tons of lithium carbonate by 2030, of which EVs could account for over 80 percent of the total demand.

The U.S. Geological Survey (USGS), estimates Mother Earth holds 88 million tonnes of lithium, of which one-quarter is economically viable to mine, known as “reserves.” Total reserves of lithium should increase as technology improves. The USGS estimated only 13 million tonnes just a decade ago.

A rough approximation by Popular Mechanics estimates that 22 million tonnes of lithium could produce 2.8 billion EVs

We smell big supply deficits of lithium for many years to come but innovation, as always, offers us hope.

Watch this space.

Geez, some of these firms got bailed out during the financial crisis, then turned around and bought up massive amounts of homes in bankruptcy, and now squeezing tenants for higher rents.

No justice, no peace.

Don’t look at the average buyers, look at the marginal buyers, who are setting prices.

QOTD – Quote of the Day

h/t: Dr. W., the best!

Weekly Summary

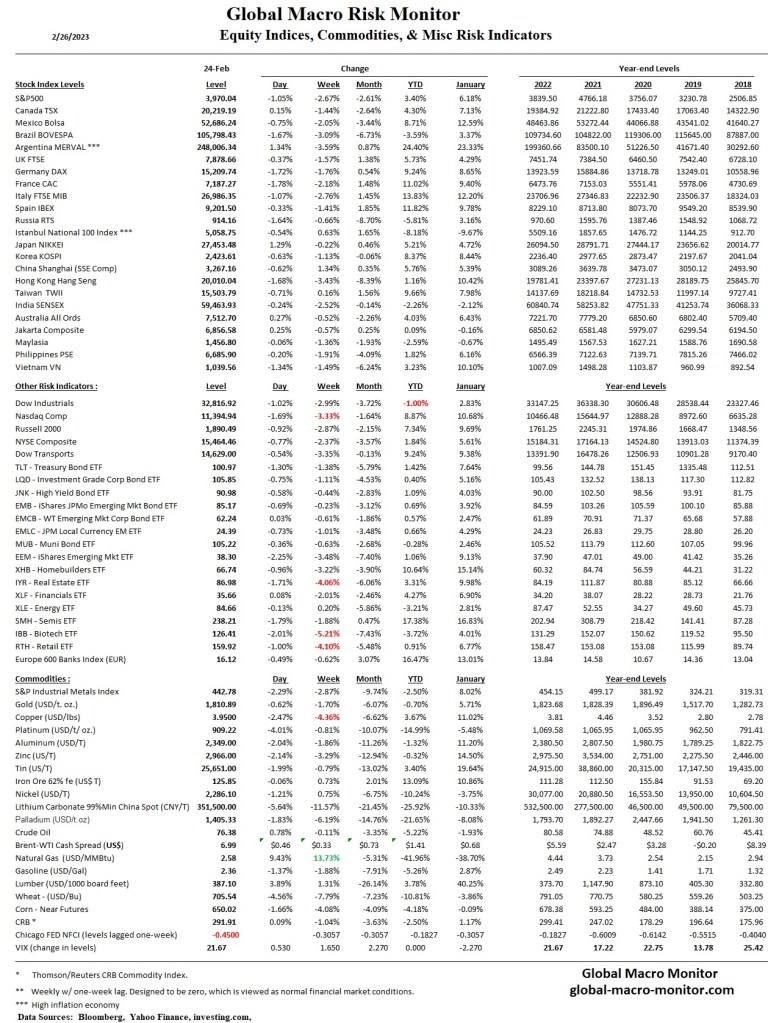

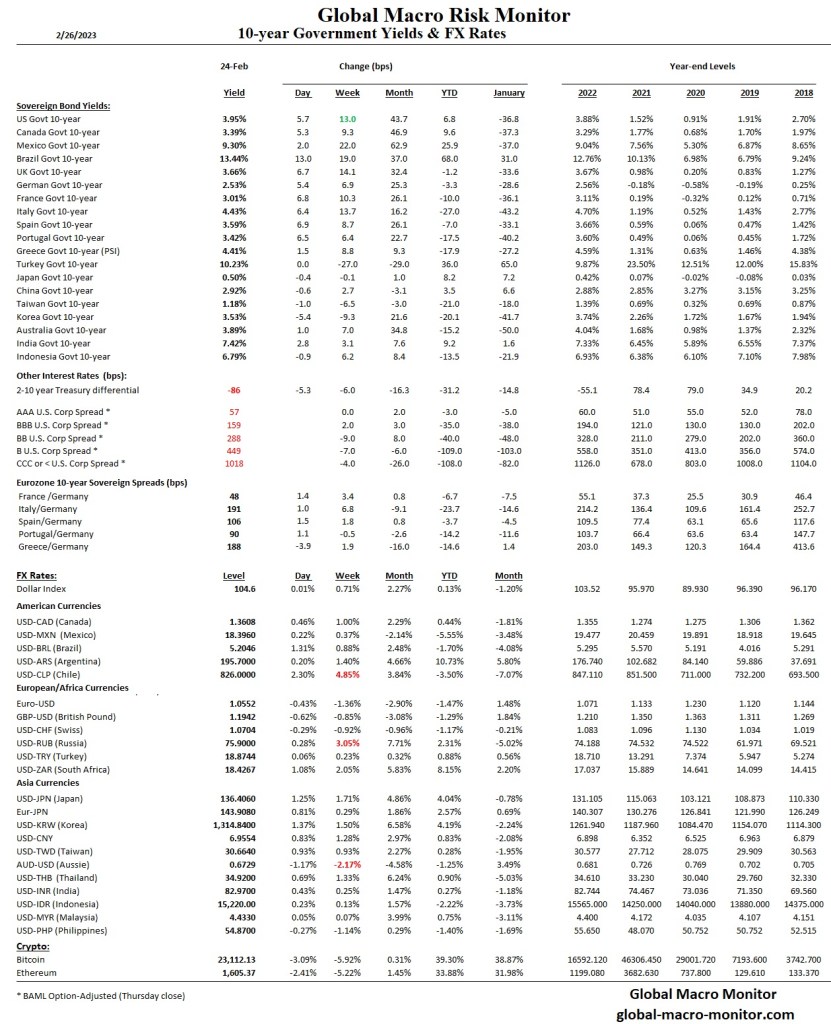

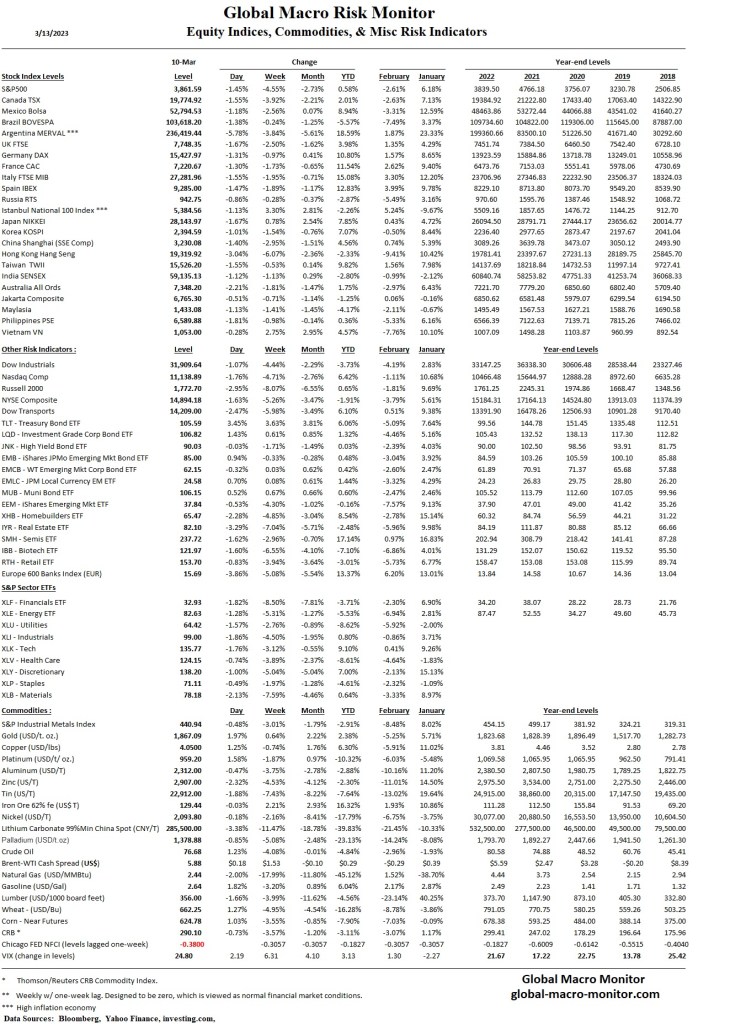

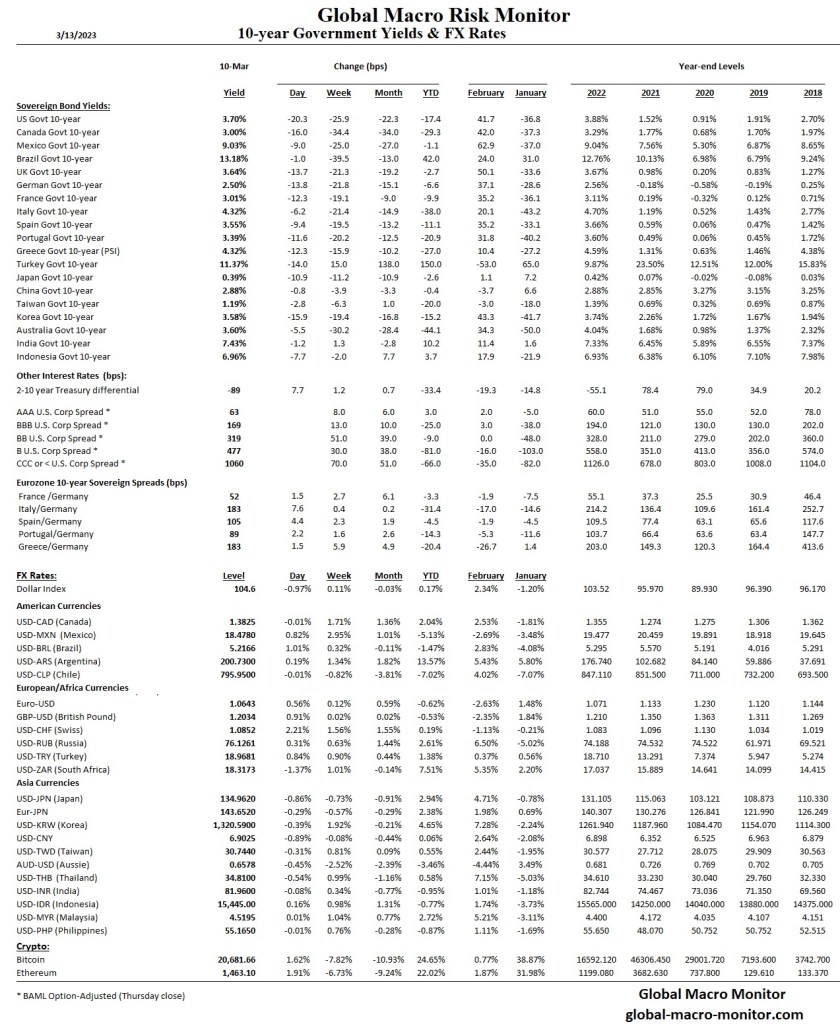

Global markets correlated as theory would predict: interest rates higher, the dollar stronger, and stocks and commodities lower.

Ten-year yields were up across the globe as the U.S. Treasury note yield approaches 4 percent on sticky inflation data. Consequently, world stocks fell across the board, with the S&P 500 down 2.7 percent on the week and the Dow now down 1 percent, YTD. Biotech, real estate, and retail were hammered.

The dollar index strengthened about 1 percent with big moves lower in the Chilean Peso (copper related) and the Russian Ruble.

Copper fell below $4.00 though natural gas put in an impressive rebound but the vapor is still down yuuge on the year.

We are baffled that the markets are baffled that disinflation may have bottomed. We see the issue as the myopic memory of the massive stock of central bank injections into the global economy coupled with too much focus on the price rather than the quantity of money, which is still at flood stage levels.