QOTD = Quote of the Day

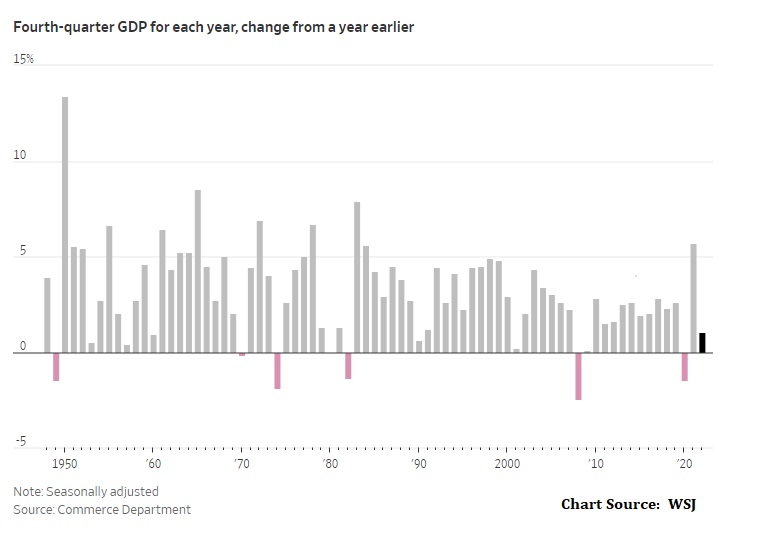

Oh, dear! I wonder if the FOMC is looking at the deflationary bust in virtual real estate? Will Jay Powell mention it in his presser today?

Do you think real estate in the metaverse is at risk due to climate change? After my last two homes where my family lived were incinerated in the Northern California wildfires, I may be moving to a nice virtual beach house in the metaverse soon, and very soon. Escape to the metaverse!

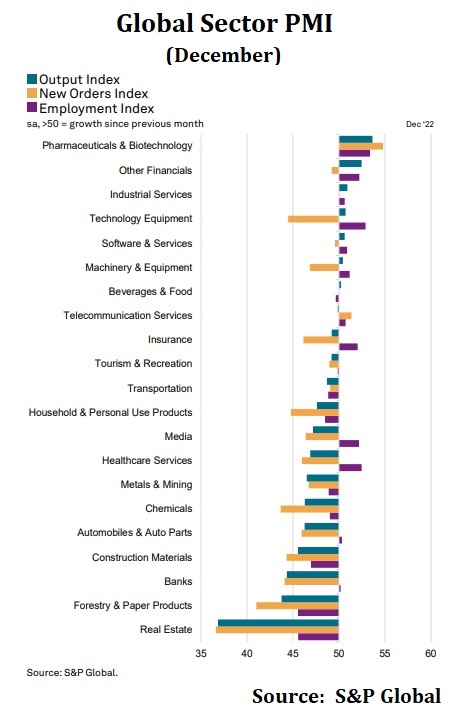

By some accounts, virtual real estate in the metaverse has dropped by about 80 percent in value from its high point, more than the decline in physical real estate during the same period. – Hamza Khan, McKinsey & Co