Here you have it, folks, a one stop chart.

The chart below shows the total outstandings of Treasury bonds and notes, the Fed ownership of the total maturities and percentage of outstandings in each year of maturity (note, the data in chart is from January, but the maturities coming due are updated for May 1)

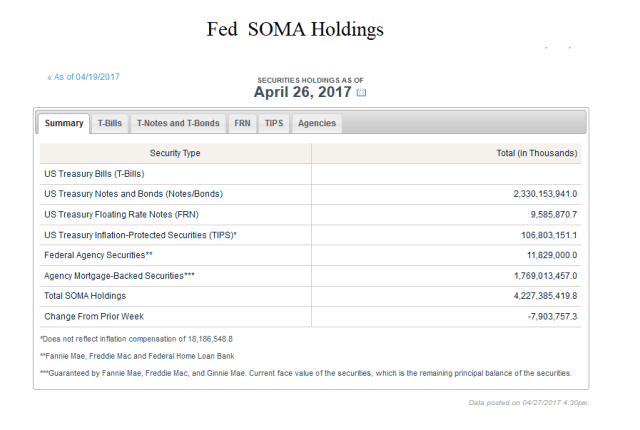

Almost 73 percent, $1.635 trillion, of the Fed’s holdings of Treasury securities comes due in the next 6 years. We expect an announcement of a smoothing of the balance sheet run-off. Unless credit begins to expand at a decent clip, such a large reduction in the monetary base over such a short time could be onerous for the economy, for example.

Also, note the limited maturities in the early 2030’s. This is the result of the budget surpluses and lack of issuance in the late Clinton years and President Bush’s decision to suspend the 30-year early on in his administrations, which contributed to the housing/credit bubble.

Stay tuned.