Stock Indices

Argentina stocks up big after the ruling coalition did better than expected in primary legislative elections last Sunday. Emerging markets generally better bid than DMs. Europe traded better as it looks the mighty Euro is taking a rest though profit taking set in latter in the week. Japan down with U.S. on stronger non weaker yen.

Global Bond Yields

Fairly quiet week. Spain wider on terror attacks. Nothng in U.S. yield curve. Yields too low given moves in metals (see below).

Currencies

Philippine peso, the worst performing in Asia this year, continues to weaken over worries about the current account deficit, the first one since 2002, swinging from an $800 m surplus to an estimated $200 m deficit this year, less than 1 percent of GDP, however. EM currencies up on strong commodities and politics. Dollar index bouncing off 92 level, as we expected, the bottom of a medium-term range.

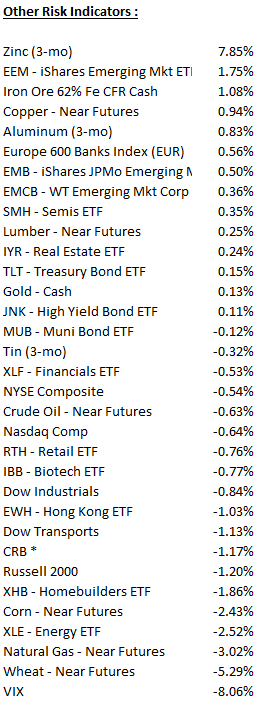

Other Risk Indicators

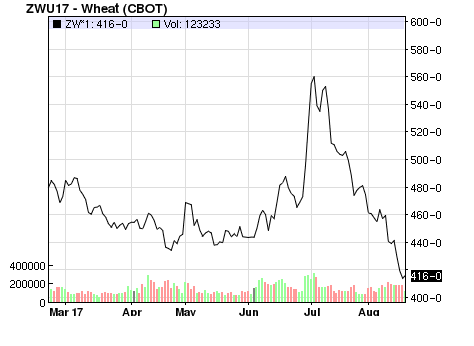

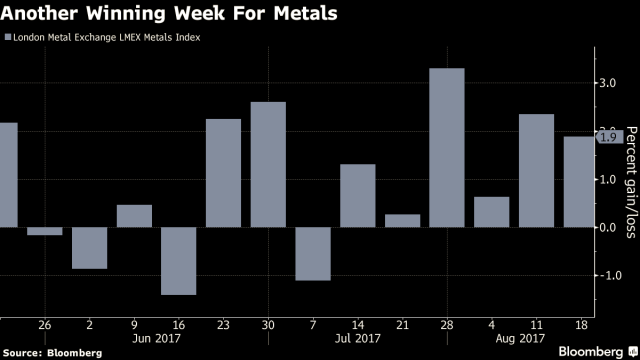

Zinc thorough the $3,000 for the first time in a decade as stockpiles have slumped to lowest level since 2008. Iron ore continues to recover, as we expected, as China recovers. EM shares up on commodities, mainly firmer metals. Grains are dismal, very ugly charts for wheat and corn.

Crude almost back to even after more than 4 percent rally on Friday after tough four days of trading. Almost seems safe haven bid came in for crude when stocks started tanking on Thursday morning. Hit a low of $46.46 on Thursday morning and went straight up as U.S. stocks went straight down. Crude is a widow maker. Those damn ‘bots!

.

.

.