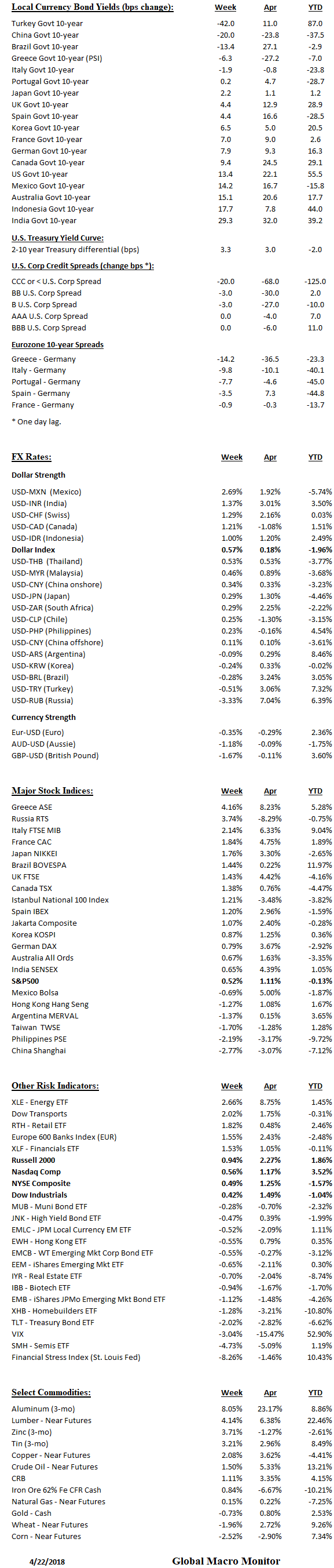

Bond Yields, Bond Yields, and More Bond Yields

The U.S. 10-year closed at its highest yield on a weekly basis since year-end 2013.

A weekly close above 3.03 percent signals big trouble ahead. The confluence of fundamentals – i.e., inflationary pressures — and technical issues, including ballooning budget deficits, the end of QE, and a foreign buyers strike are driving rates higher.

We doubt the pretty profit picture, which is expected and to some extent already should be discounted, is going to be able to offset the headwinds of higher interest rates.

Head & Shoulders Bottom

The following chart looks like a classic head and shoulders bottom in the 10-year yield on a weekly basis. A measured move would take the 10-year up to…ugh…3.92 to 4.73 percent depending on where you measure the shoulder. Either way, Gulp!

The economy would surely break before rates move that high but we could be moving into a period of inflation/stagflation if the trade war accelerates and takes hold.