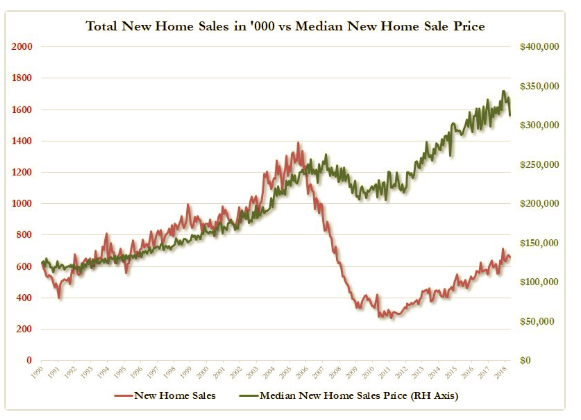

David Stockman tweeted the following Zero Hedge chart this morning.

Clearly, a shift in the supply curve for new homes to the left.

OK – and some buying at irrational prices fueled by artificially low-interest rates and excess money. The irrational panic buying will take care of itself as interest rates rise and the Fed reduces its balance sheet making money tighter.

This is not the highly leveraged housing market of 2006-07, where even our range boy at the local golf club owned mortgaged three homes, quit his job, and bought an Escalade financed by a home equity loan (true story). This market is driven primarily by restricted supply and will be more difficult to pop. The price adjustment will also take place over a much longer period.

The New Supply-Side Economics Is Not Good

We have written how private equity has taken a yuuuge supply of existing homes off the market through their mega 2012-14 bankruptcy purchases, and now rent out the homes to the same people they foreclosed on. Existing housing is a perfect substitute for new homes.

Rising Costs

The rising costs of building, primarily labor shortages in the construction sector, and restrictive zoning laws are constraining building and the supply of new homes.

The lack of enough skilled workers and a narrow talent pipeline has added extra hurdles, time, and costs to many current projects, according to builders, hindering the current boom time in the industry.

“The number one issue is the cost and availability of labor,” says Randy Strauss, owner of Strauss Construction in Amherst, Ohio, roughly 40 miles east of Cleveland.

The issue is a nationwide one. Contractors in areas such as Houston, which were battered by Hurricane Harvey last year, have struggled to staff up, and the National Association of Home Builders recently found that 82 percent of its members believe the cost and availability of labor are their biggest issues. In 2011, only 13 percent named labor costs as their biggest worry. — Curbed

The immigration crackdown has played a significant role in the labor shortage in the construction sector.

One study from the National Bureau of Economic Research found that over 1.1 million undocumented immigrants, many of them skilled in essential trades such as framing, work in the construction industry. – CITYLAB

Lumber Prices

The parabolic rise in lumber prices isn’t helping either. Lumber prices are down over 12 percent from last week’s high, however, with several days of limit down in the futures markets. Look no further than the long-term lumber price chart to understand what tariffs do to prices and input costs, which ultimately hurt the majority.

Last April, the Trump administration placed a 20.83 percent tariff on Canadian lumber, to the benefit of politically valuable voters in Maine. Within the construction industry, these imports commonly turn into framing lumber, which is used to build single-family homes and small multifamily buildings.

– CITILAB

Bad timing by the administration unless you belong to the small minority of those who make their living in the framing lumber business.

Policy Relief Needed

Shortages are breaking out and are now ubiquitous throughout the economy.

The housing market is one of the hardest hit sectors. Shortages of new and existing homes; shortages of buildable land, shortages of skilled construction workers. Inflation is running rampant in the sector. Yet it hardly registers in the inflation indices because of the way the government measures housing costs.

The new supply-side of housing (shifting the curve left) is not working for most Americans. Taking existing homes off the market for rentals or the restriction of new supply through rising input costs, labor shortages, and zoning restrictions are severely reducing affordability and turning the country into a Landlord Nation.

Since most of the problems are policy-induced, they can be fixed by better and a more comprehensive housing policy. That is getting back to the old supply-side economics of the Reagan era where the supply curve shifts to the right, illustrated in the simple graph below. Lower prices with more supply of homes (P 2, Q 2).

Higher prices and lower supply may work for some, but it is certainly not good economics and only adds to an already toxic political environment.

It is time for disruption in housing.

Pingback: Contra Corner » Thanks, Washington! You’ve Made A Shambles of The Housing Market

Appreciate your keen analysis of the change in the supply curve for new houses in the U.S..

Thanks, King. You’re the best.

Good analysis, but I don’t agree that all policy solutions are the proper solution. An illegal immigrant labor pool is an artificial fix to a problem with labor (artificial in that it’s, well, it’s illegal and should be illegal). Home-builders–and I’m one of them (a start-up)–need to get creative with their solutions. For example, the manufactured home (just a stick-built house on a factory assembly line) is an excellent solution to labor supply shortages. Smaller homes is a reasonable solution to a lumber shortage/higher lumber prices (although getting rid of tariffs on Canada, a good trade partner, would be smart, too).

Thanks for comments, Kevin. I agree with you but open to guest worker status for sectors facing labor shortages. Since the Feds own over 50 percent of the land in the West (85 percent in Nevada), maybe they should loosen some up for new housing. Sure, much is not buildable but a start.

http://bigthink.com/strange-maps/291-federal-lands-in-the-us

I love how business people, at least acknowledging the corrupt central-control policies that created this, if not railing against them, then turn around and say “Golly Gee. We need centrally approved neo-slave labor to help us out.”

Same ol’.

Let the market brutalize *all* parties until the party’s over.

Your visit to the “Great Whore, Rome” is over. It cannot be suckled any more.

And then we shall be free.

Pingback: “Landlord Country” & The New Offer-Aspect Of Housing – Viralmount

Pingback: “Landlord Nation” & The New Supply-Side Of Housing – iftttwall

Pingback: “Landlord Nation” & The New Supply-Side Of Housing | Real Patriot News

Pingback: “Landlord Nation” & The New Supply-Side Of Housing – TradingCheatSheet

Pingback: “Landlord Nation” & The New Supply-Side Of Housing – open mind news

Pingback: "Landlord Nation" & The New Supply-Side Of Housing | Daily Forex Circle

Pingback: “Landlord Nation” & The New Supply-Side Of Housing – Wall Street Karma

Pingback: "Landlord Nation" & The New Supply-Side Of Housing | Newzsentinel

Pingback: "Landlord Nation" & The New Supply-Side Of Housing | StockTalk Journal

Pingback: “Landlord Nation” & The New Supply-Side Of Housing | Wall Street Vibes

Pingback: “Landlord Nation” & The New Supply-Side Of Housing – ProTradingResearch

Pingback: “Landlord Nation” & The New Supply-Side Of Housing

Pingback: Thursday links: really cheap beta | AlltopCash.com

Pingback: Landmark Links May 29th – Relaxed

Pingback: Housing Supply Curve – The Big Shift Left | Global Macro Monitor

Pingback: The New Supply-Side Of Housing & Landlord Nation 2.0 | Global Macro Monitor