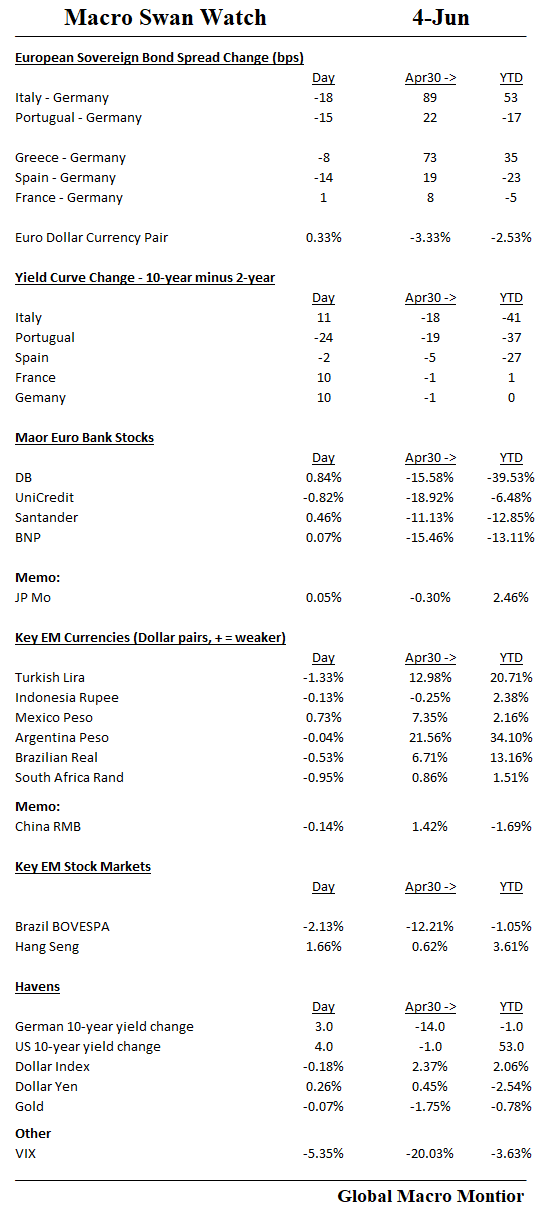

The recovery in the European periphery continues.

Sell-offs when markets are in bullish mode now seem to act as an centripetal force to move financial assets back to their central point of bullish with great velocity. Similar to a gravity assist, the sell-offs bring in buyers which accelerate and propel markets to higher levels but often overshooting their fair value.

Euro Banks

The recovery is lagging in Europeans banks, which are woefully undercapitalized. We ran sum numbers over the weekend and, ironically, found the Italian banks are better capitalized than many French and German banks.

EM currencies were stronger today x/ Mexican Peso, which may now be a “trade war” proxy.

Havens sold off.

Financial markets want to be bullish.