Summary

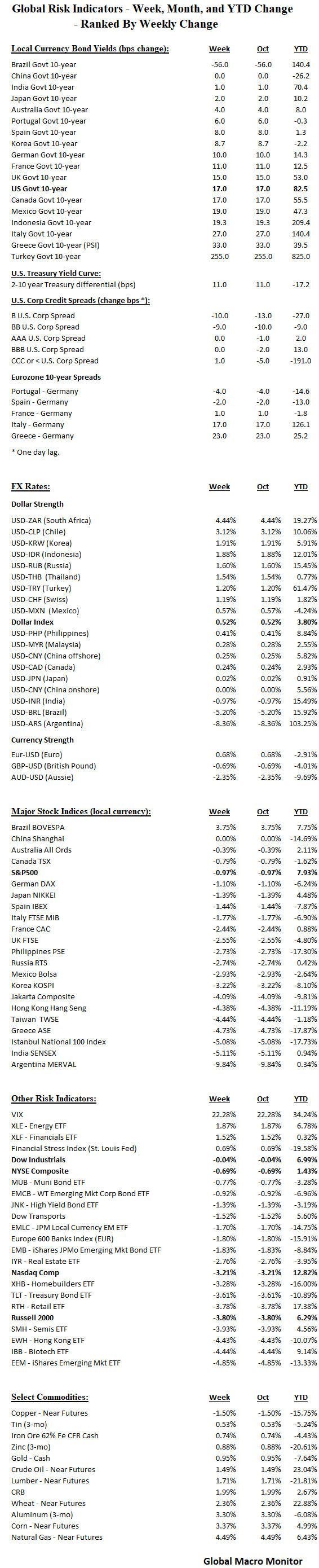

- Ugly week for Global Bonds. Run to our Sept 23rd post, The Gathering Storm in the Treasury Market 2.0, as to why we thought yields were about to spike. Boy, did they

- Stocks followed bonds lower causing pain the interest rate parity funds

- Credit hanging in there. Need weakness here to validate a stock market top. Watch this space

- EM FX hammered x/ Argentina, which is experiencing an oversold bounce and afterglow of an updated IMF deal

- Commodities showing some life, led by nattie and the grains

Commentary: All eyes on long-term interest rates this week. If the bond sell-off accelerates, expect a big risk-off move this week. Rising rates are not good for the now heavily indebted AE sovereign sector. Potential doom loops ahead: rising interest rates = interest payments = rising deficits = rising interest rates = rising interest payments = rising deficits = rising interest rates. The U.S. bond market seems oversold and should, at least, generate and dead cat bound here. If not, GULP!

10-year Treasury Note Yields

Source: Jesse Colombo @TheBubbleBubble