Dig deeper, folks.

Our good friend, David Jones, sent the following IBD piece over this evening.

If you been following GMM over the past week, you know we are knee-deep in the Federal Reserve’s distribution of wealth data (see our last post here).

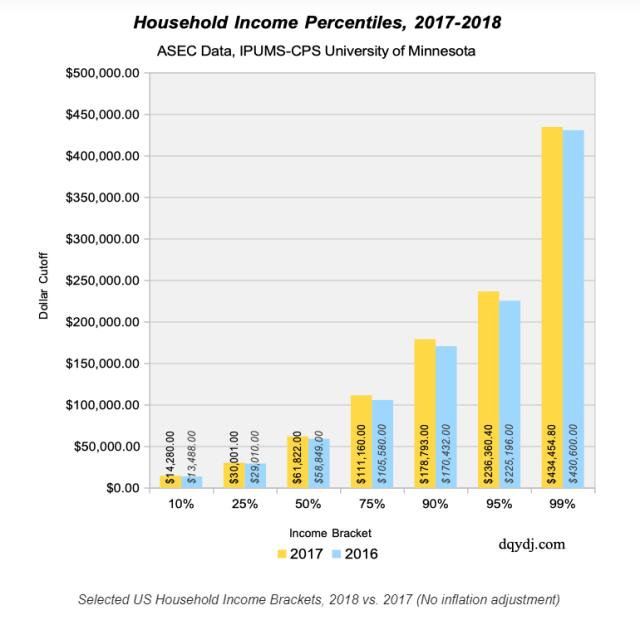

As the distribution of income, and especially wealth, become so top-heavy and skewed toward the top few percent, the macroeconomic data are becoming more difficult to interpret to ascertain the true wealth and economic health of the nation. Diminishing and making the aggregate data increasingly meaningless for many.

Instead of looking at the aggregated macro data, it would be much more informative to breakdown all the data by household income percentiles to see where the economic gains and pains are accruing.

The data are just not available on a broad scale, however, and one should fully understand how to interpret the statistics, especially when it comes to averages. That is to be skeptical and try and keep them in context by fully realizing we are now in a two-speed economy: 1) the economy for the very well-off, and 2) the economy for the majority of the rest of the participants.

The data are just not available on a broad scale, however, and one should fully understand how to interpret the statistics, especially when it comes to averages. That is to be skeptical and try and keep them in context by fully realizing we are now in a two-speed economy: 1) the economy for the very well-off, and 2) the economy for the majority of the rest of the participants.

We put together a little parable to help our readers.

The Central Tendency Problem Of A Seattle Dive Bar

Three young lawyers, having just passed the Washington State Uniform Bar Exam, are celebrating in a popular dive bar in Seattle. It’s relatively early and they are the only patrons in Get Shorty’s.

Joe, the bartender, is a student at the University of Washinton studying statistics. The young new lawyers begin lamenting about the massive student debt they have taken on over their seven years of university and law school. Carol, a Harvard Law grad, owes $300k; Greg, a Yale law grad from Australia, is $250k in debt, and Constantin, a UCLA and University of Chicago graduate, owes $150k.

Joe, kind of shocked, asks the three if they own any financial or real assets, to which they answer, “nada, zip, zero, it’s all human capital. Tell me it ain’t so, Joe!”

Joe decides to calculate the average and median net worth of the group of young barristers for a school project. Surely, both, a very negative number. He then decides to keep a running total of the mean and median net worth or wealth of his customers as his shift progresses.

Suddenly, the door swings open and in walks Bill Gates, who sits at the bar and orders a Cherry Cola. Joe’s project starts to get interesting.

Twenty minutes later, Jeff Bezos walks in to have a pop with his billionaire buddy. Joe is elated.

The average net worth of the Get Shorty patrons at that time has now swung from -$233k to $43.7 billion just in a little over 30 minutes. Joe, the bartender, is stunned by the data.

He then calculates the median net worth, which has moved from just -$250K for only the three young lawyers to just -$150K, including Gates’ $105 billion and Bezos’ $113.4 billion of wealth. Joe is now a bit more skeptical of the average net worth/wealth data but perplexed by the divergence of the mean and the median data.

Joe finally understands and internalizes that statistics always need context, can lie, be used to mislead, and be misinterpreted.

Nevertheless, Carol, Greg, and Constantin toast Bill and Jeff for making them multi-billionaires on average for a brief and shining moment.

Upshot?

Know thy stats.

Be somewhat skeptical, especially when looking at the current macroeconomic data.

Joe’s analysis should have at least taken into account the variance of the data, including the standard deviation, and the lower moments of central tendency, such as the skew and kurtosis, i.e., the measures of the data distribution’s shape and its tails.

Real Life Macro Economy Example:

2019 Q1: Average U.S. Household Wealth = $803.3K

Median U.S. Household Wealth = $112.5 K

America’s Two-Speed Economy Moving In Different Directions

We are going to hold off on presenting some very explosive data and charts that show the polar opposite direction that America’s two economies are moving, including, mainly, the relative decimation of the wealth of the lower middle class and bottom 50 percent until later next week.

Percy Bysshe Shelley’s aphorism, “The rich get richer and the poor get poorer,“ is ringing more true as America approaches the 2020 presidential election and we believe will have an outsize impact on the results, as it did in the 2016 election.

Stay tuned, folks.

Pingback: America’s Perilous Path Of Wealth Distribution | Global Macro Monitor

Pingback: Will Billionaires Embrace Wealth Tax As “Investment In Social Stability”? – SYFX+

Pingback: Will Billionaires Embrace Wealth Tax As “Investment In Social Stability”? | Raw Conservative Opinions

China’s statistical issues go beyond mere government meddling. The country’s economy is vast and quickly changing. Officials still struggle to catch up with years of growth and to modernize data-gathering practices.

Pingback: Stock Market Returns And Presidents – Beware Of Averaging | Global Macro Monitor

Pingback: Average Hourly Earnings Up 4.7 Percent In One Month? | Global Macro Monitor