GaveKal reminds us why assets typically have value.

- They can be rare—gold bars, diamonds, houses on Victoria Peak, bottles of 1982 Pétrus, Van Gogh paintings, or

- They can generate cash flows over time

We have been writing for years how the supply-side (relative shortages) has been increasingly driving financial asset values.

Also, run, don’t walk to our donut shop analogy,

The Local Donut Shop And Financial Asset Inflation

…The Fed, the Brinks Truck, has created a demand and supply shock for chocolate donuts or financial assets. A positive demand shock by handing out cash and injecting more liquidity through its purchases. A negative supply shock by removing chocolate donuts or financial assets from the donut shop and those of the customers in line.

All good until the price of maple donuts begins to rise, especially if some are imported from Canada with a now weaker currency, as the mandate of Brinks company is to maintain a stable price and production of maple donuts. — GMM, July 1st

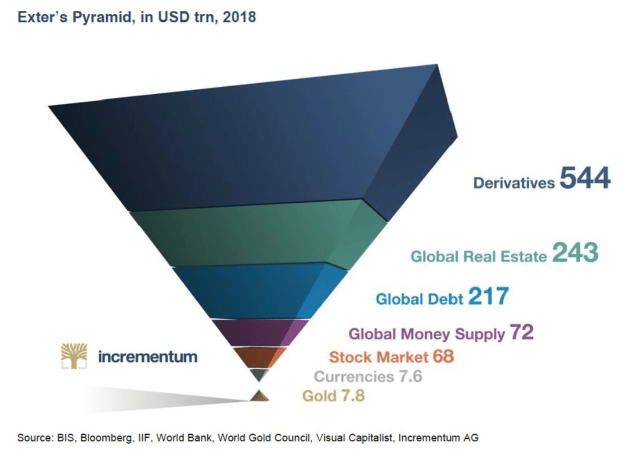

Check out the following chart. Is it any wonder why gold, now backed by an almost bulletproof story and negative real interest rates, is on a one-way rocket ship ride?

Hat Tip: @TheVolawatcher

Pingback: This Week’s Best Investing Articles, Research, Podcasts 7/31/2020 - Stock Screener - The Acquirer's Multiple®

Pingback: Common Sense Or Just Not Woke? | Global Macro Monitor