The market view on Carol K. is starting to consolidate that she just may become is the GOAT of Comeback Kids. What a fighter! Do you believe in miracles? Go Neutrophils!

Summary

– The market narrative explaining the breakdown in the global supply chain is starting to come together

– Some of the rock star pundits are now touting the supply chain is being swamped by too much demand, which has been our narrative since summer

– The initial shock came with the 22 percent collapse in point-of-sale demand (we use U.S. retail sales as our global proxy), then an extraordinary 34 percent rebound over a six-month period

– The unprecedented volatility in retail sales “bullwhipped” the supply chain and caused mass confusion and panic among upstream suppliers

– As the pandemic forced consumers to shift their preferences from services (restaurants, Disneyland, etc) to durable goods (kettlebells, golf clubs, etc.), the supply chain for merchandise goods was initially overwhelmed by the new and unexpected demand

– The secondary shock came from the massive global stimulus, which drove consumption and retail sales much higher

– The combination of the shift in consumer preferences and massive increase in stimulus induced demand is primarily what broke the supply chain

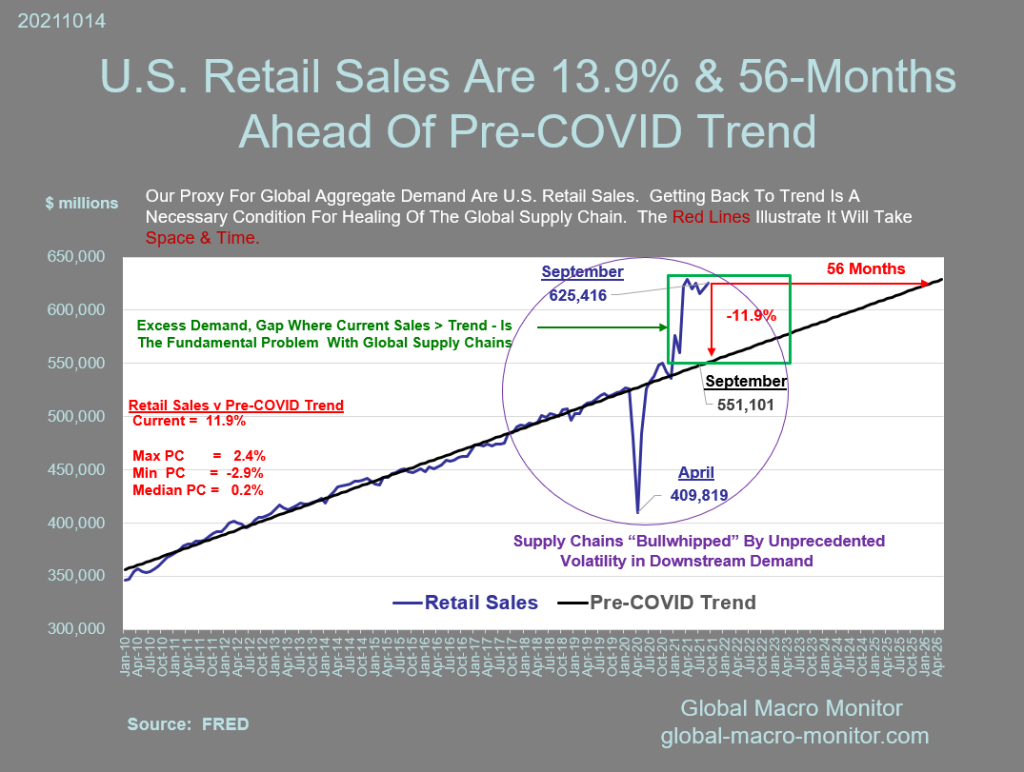

– We don’t see an end to supply chain woes until point-of-sale demand moves back to its pre-COVID trend, which, for our proxy, dictates that U.S. retail sales fall by almost 12 percent from current levels or stay flat for 56 months, which, we believe is much too painful for the policymakers and markets

– We are not sure how this all plays out but we certainly don’t think “everything is awesome”

– We believe historians will write about the Shortage Economy: “The great supply shock of the COVID pandemic was, at the end of the day, a demand shock”

:

:

Americans stepped up their spending in September, a sign of resilient demand and rising inflation as consumers head into the holiday shopping season.

Sales at retail stores, restaurants and online sellers rose a seasonally adjusted 0.7% in September from the previous month, the Commerce Department said Friday. The rise in sales reflects persistently strong demand and higher consumer prices.

Consumers, armed with stimulus payments and rising wages, have stepped up spending this year, shrugging off the Delta variant of Covid-19, the end of enhanced unemployment benefits and emerging supply constraints. The retail sales, which aren’t adjusted for inflation, rose 13.9% in September from a year earlier. Consumer inflation increased 5.4% in that time, according to the Labor Department. – WSJ

What Broke The Supply Chain?

The bulk of the problems in the global supply chain are caused by excess demand. Policymakers have injected too much stimulus into the global economy. By combining income support through transfer payments, the central banks have effectively monetized much of the large deficits and spending run-up.

Our view is derived from [the above chart], where we use U.S. retail sales as a proxy for global aggregate demand. The EU’s retail sales chart looks very similar.

[The chart] illustrates that spending unexpectedly came roaring back after an unprecedented drop when global economies were turned off in March 2020 and had a massive “Bullwhip Effect” on the global supply chain.

[September] retail sales – our proxy for global aggregate demand, which is not observable, by the way – are 13.9 percent above and running 56 months ahead of its pre-COVID trend. Retail sales are inflated by the policy measures and will need time (56-months of zero growth) and/or space (-11.9% down from current levels) to get back to trend. No doubt, it will be a combination of both time and space. A sharp, abrupt correction in retail sales could be painful and confuse the supply chain even further.

We believe only when demand returns to trend will the global supply chains begin to heal. Some will sooner than others, but it will take longer than most expect unless the global economy hits the skids big time or the central bankers panic. – GMM, Sep 14th

We will concede that part of the retail sales overshoot to the upside is a catch-up from the overshoot on the downside, which beefed up consumer savings.

Demand Shock And Bullwhip Effect

The initial shock to the supply chain was the collapse and abrupt snapback in consumer spending (point-of-sale demand), in the U.S. and elsewhere, which then “bullwhipped” the supply chain and caused mass confusion with upstream suppliers.

Research indicates a fluctuation in point-of-sale demand of +/- five percent will be interpreted by supply chain participants as a change in demand of up to +/- forty percent. Much like cracking a whip, a small flick of the wrist a shift in point of sale demand can cause a large motion at the end of the whip manufacturers response. – Wikipedia

Do the math, folks, as illustrated in our chart above downstream final or point-of-sale demand fell and an unexpected and unprecedented 22.3 percent from March through April, then, more surprisingly, rebounded 34.2 percent from May through October 2020.

As final demand whipsawed last year, the upstream supply chain was jolted into mass confusion and panic. Many suppliers began to hoard, double and triple order, and secure materials in the black market. Input prices skyrocketed, lead times spiked.

The bullwhip effect refers to a logistics supply chain inefficiency when there is either too much or too little inventory. Usually, this comes as a response to incorrectly reacting to or forecasting customer demand.

Small fluctuations at any point along the supply chain can have a major impact on the rest of the logistics chain.

…The bullwhip effect either creates excess or a lack of inventory. A surplus of inventory is expensive and wastes resources, while insufficient stock leads to unfulfilled orders and poor customer service (which can result in lost business in the short- and long-term).

There may also be secondary impacts of the bullwhip effect, like a breakdown of communication, loss of the partnership, or shipping delays. Overall, it sets off a chain reaction that impacts the processes of every logistics partner, which in turn means loss and expense is nearly inevitable. –

Excess Demand Causing Logistics Breakdown

Secondly, the amount of fiscal and monetary stimulus pumped into the global economy, illustrated in the chart below, is mindboggling. Thought the Fed is expected start tapering next month but tapering is not tightening (withdrawing the digital money). That’s a long way off, folks, and we suspect the Fed will have to surprise the markets.

The massive stimulus has spiked global consumption and driven up U.S. retail sales (our proxy for global demand) to an unprecedented 15.6 percent above trend in April 2021 (see above chart), a good proxy for equilibrium, where supply equals demand. Note supply curves are an abstract economic concept and not observable in the real world, though they can be estimated with rigorous econometric models.

The September retail sales were released on Friday and illustrate the goods market is still significantly out of equilibrium, where excess demand continues to pressure the supply chain, most notably through congested ports with container ships floating at sea in a traffic jam waiting to bring the goods into the country, some of which will be counted in the October and November retail sales data. The container ships are also full of intermediate goods. It’s all upstream bottlenecks from there.

Yes, there are real breaks in the supply chain as there always are.

For example, we believe the labor supply curve has shifted left in the “Great Resignation” and wrote about it in early August..

Moreover, the low vaxed countries of Southeast Asia, mainly the result of their complacency to secure vaccines due to success of stamping out the first wave of COVID, has forced governments to lock down factories, further adding to supply chain woes,

Infection Surges In Southeast Asia Threaten Global Supply Chains

Malaysia, Thailand and Vietnam, countries that previously avoided the worst of the pandemic, are now seeing rapid increases in infections. The region serves as a key manufacturing hub for intermediate goods as companies shift production away from China. Now the surging cases are threatening to disrupt global manufacturing. — NIKKEI Asia, June 1

Supply shocks are commonplace and do not break the global supply chain. The problems are macro and the big problem right now is in logistics and the transport of merchandise goods is being swamped by too much demand.

We will let you figure out the logical conclusion policymakers should be making here.

Others Seeing The Reality

We are starting to others draw the same conclusion and narrative that too much demand is the primary driving force behind the global supply chain woes. Jim Bianco, the rock-star pundit and perennial candidate for a Fed governorship, posted these threads on Friday and earlier today.

They so good we suspect he may be positioning himself as a “hawk” for the next FOMC seat. We believe he draws the right conclusion,

The only way this gets solved next month if we crush the economy so bad that all new sales stop. – Jim Bianco

If this is what it takes to fix the supply chain — crush retail sales — good luck, the policymakers don’t have the stomach, in our opinion.

PK

Even Paul Krugman is starting to waffle. On Friday, he wrote,

I’m basically for the former, on what has come to be known as Team Transitory, but I might be wrong — and the data are sufficiently ambiguous that both sides can claim that the evidence supports their take.

Yet policymakers can’t just shrug their shoulders; they have to, um, make policy. So what should they do in the face of uncertainty? The answer, I’d argue, is to make decisions that won’t do too much damage if their preferred take on inflation is wrong.

Not until the retail sales move back to trend our the suppliers believe the stimmy induced spike in demand is real and sustainable. PK, NY Times

And this on Thursday,

About those supply-chain issues: It’s important to realize that more goods are reaching Americans than ever before. The problem is that despite increased deliveries, the system isn’t managing to keep up with extraordinary demand. – PK, NY Times

The words of the Nobel laurate bears worth repeating.

“…the system isn’t managing to keep up with extraordinary demand.”

Extraordinary means too much, in our book.

The great supply shock of the COVID pandemic is, at the end of the day, a demand shock.

Pingback: What Are Bond Yields & Breakevens Telling Us? | Global Macro Monitor