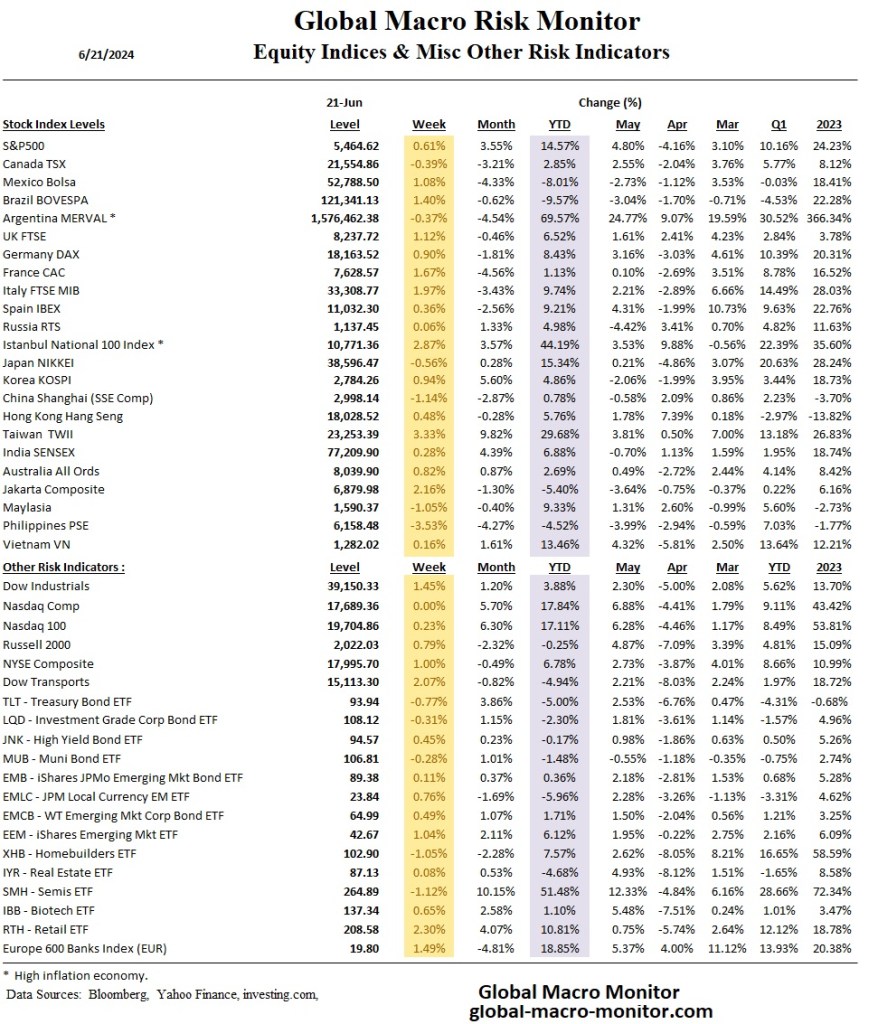

The global markets experienced mixed results for the week. Equity markets mostly rose, led by a rebound in European shares and Brazil, while bond yields exhibited slight increases. Currencies saw the dollar index strengthening slightly, with mixed movements among major currencies. Commodities showed varied performance, with notable gains in crude oil and platinum and losses in metals like nickel and zinc. Lumber was down 8.68 percent. Financial conditions continue to ease.

- Equities:

- The S&P 500 rose by 0.61% to 5,464.62.

- Brazil’s BOVESPA increased by 1.40% to 121,341.13.

- The Nasdaq Composite saw a minimal change, rising by 0.03% to 19,704.86.

- The French CAC was up 1.67%, and Italian shares rose almost 2.0%.

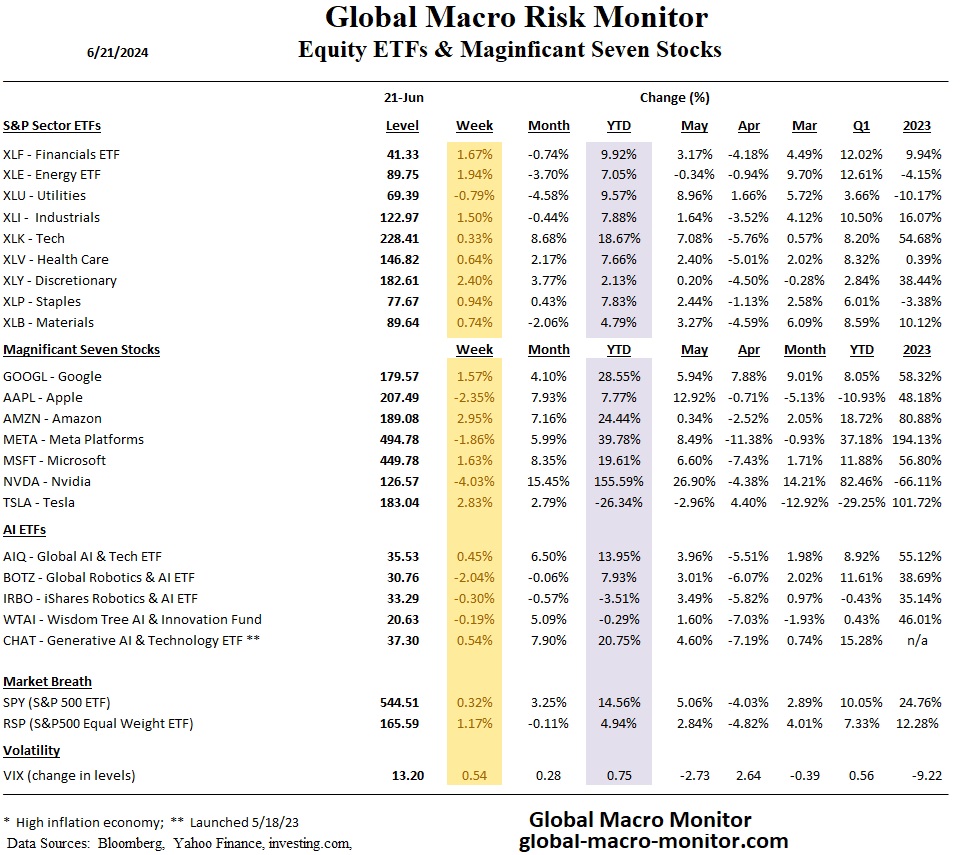

- S&P Sector ETFs:

- Financials (XLF) gained 1.67% to 41.33.

- Energy (XLE) was up 1.94% to 89.75.

- Technology (XLK) increased slightly by 0.33% to 228.41.

- Magnificent Seven Stocks:

- Google (GOOGL) rose by 1.57% to 179.57.

- Apple (AAPL) fell by 2.35% to 207.49.

- Nvidia (NVDA) took a hit, down 4.03% to 126.57.

- AI ETFs:

- AIQ increased by 0.45% to 35.53.

- BOTZ slightly fell by 2.04% to 30.76.

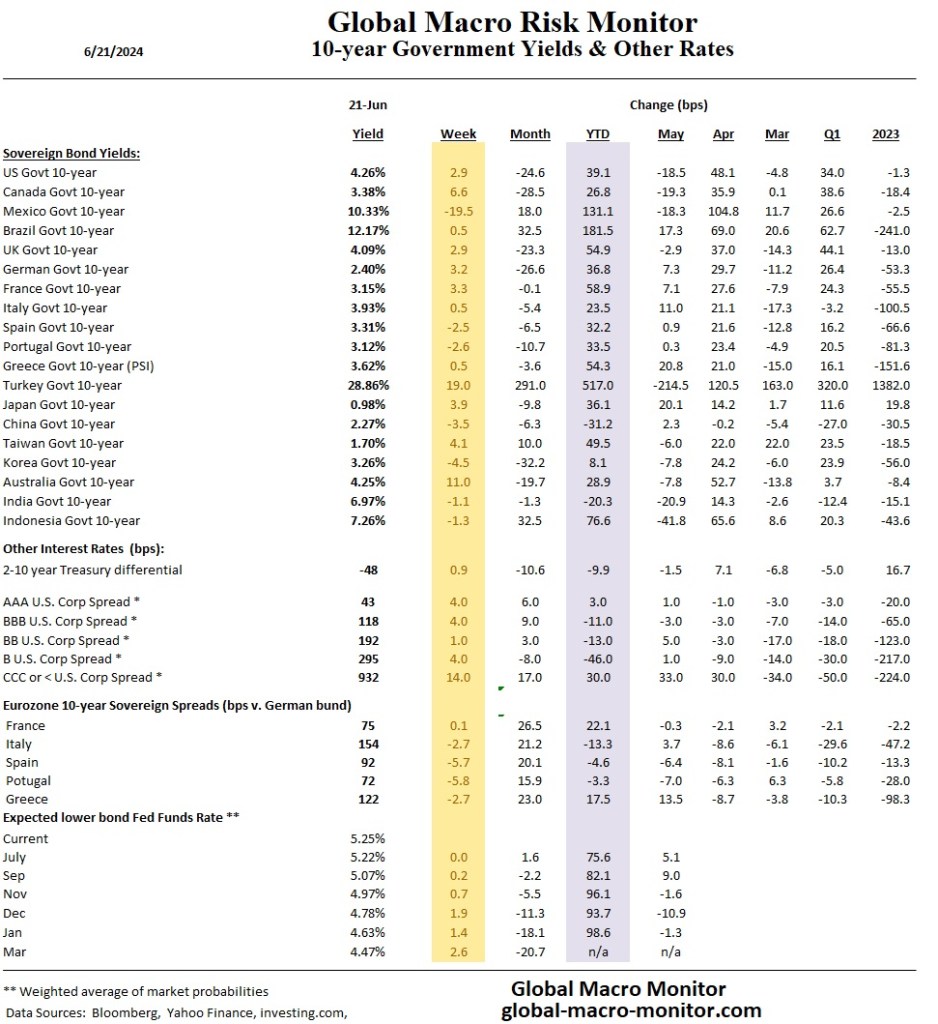

- Bond Yields:

- US 10-year yield rose by 2.9 basis points to 4.26%.

- Mexico 10-year yield fell by 19.5 basis points to 10.33%.

- Australia 10-year yield increased 11 basis points to 4.25%

- Japanese 10-year yield gained 3.9 basis points to 0.98%.

- Other Interest Rates:

- The 2-10 year Treasury differential slightly increased by 0.9 basis points to -48 basis points.

- AAA US Corporate Spread widened 4 bps to 43 basis points.

- Euro sovereign spreads were slightly tighter, led by Portugal coming in 5.8 bps.

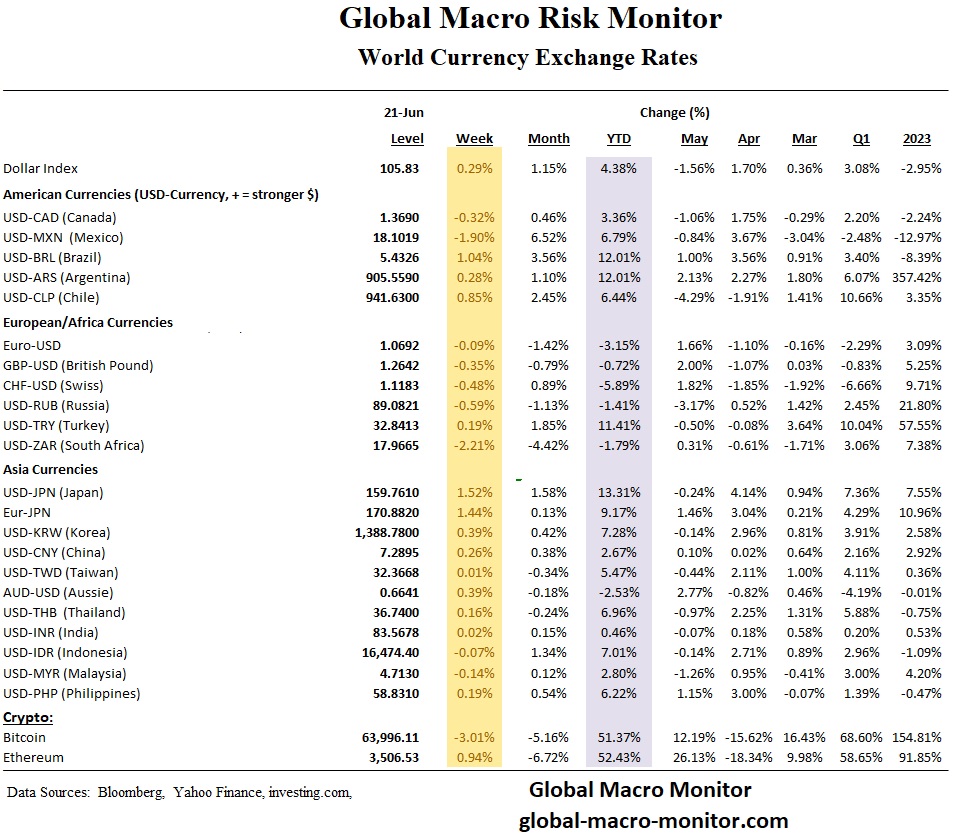

- Currencies:

- The Dollar Index increased by 0.29% to 105.83, up 4.38% for the year.

- USD/BRL (Brazil) saw a rise of 1.04% to 5.4326.

- USD/CAD (Canada) fell by 0.32% to 1.3690.

- USD/ZAR (South Africa) declined by 2.21% to 17.9665.

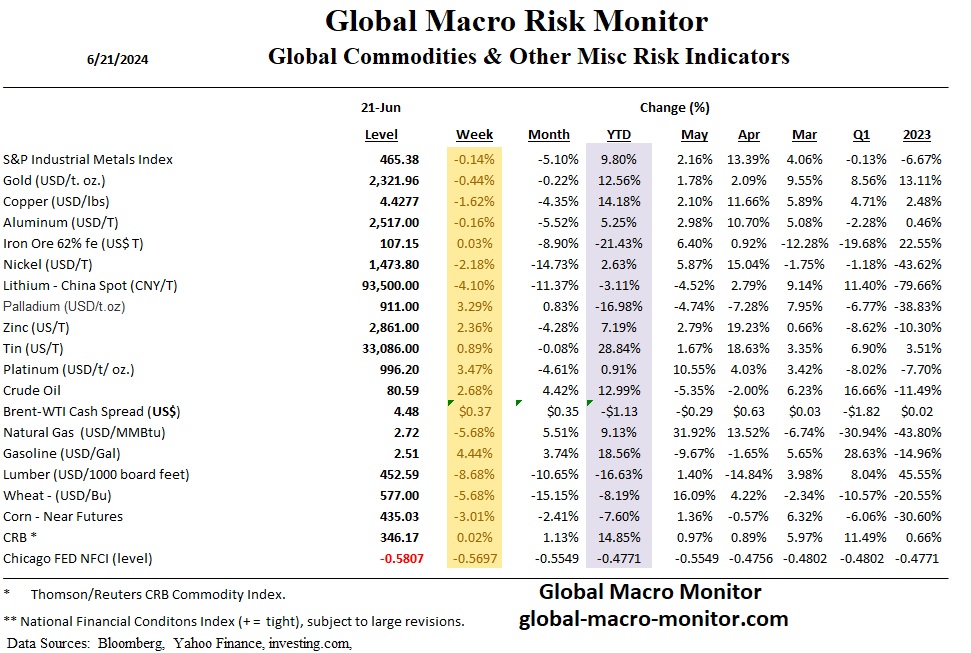

- Commodities:

- Crude oil prices rose by 2.68% to $80.59 per barrel.

- Nickel dropped by 2.18% to $1,473.80 per ton.

- Zinc saw a gain of 2.36% to $2,861.00 per ton.

- Gold fell slightly by 0.44% to $2,321.96 per ounce.

- Cryptocurrencies:

- Bitcoin fell by 3.01% to $63,996.11.

- Ethereum increased slightly by 0.94% to $3,506.53.

- Other:

- VIX remained stable at around 13.

- Equal-weighted S&P (RSP) outperformed the S&P500 (SPY) by 85 bps

- Financial conditions continue to ease Chicago Fed’s NFCI, falling to -0.5807