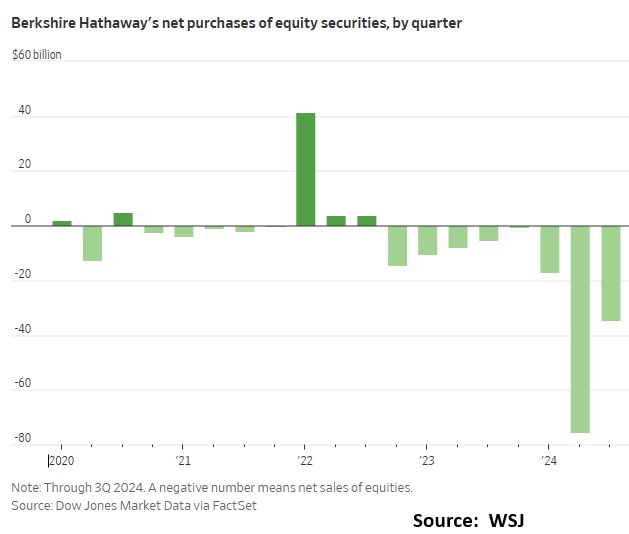

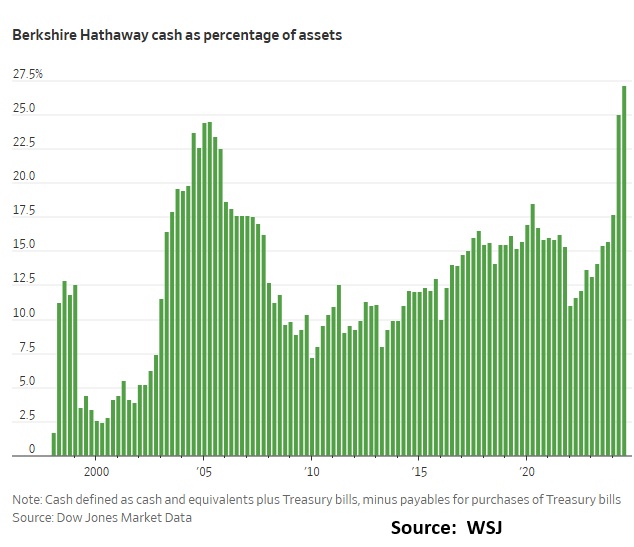

Warren Buffett’s recent moves in the stock market signal a strong defensive posture, one that suggests a serious market correction may be on the horizon. Over the past several years, Berkshire Hathaway has been a net seller of equities, shedding over $134 billion in stocks in 2024 alone, particularly trimming its holdings in Apple and Bank of America. Simultaneously, Buffett has amassed an unprecedented $334 billion cash pile, which the Global Macro Monitor estimates to be over 30 percent of BH’s total assets and his largest cash position ever.

“Nothing Looks Compelling”

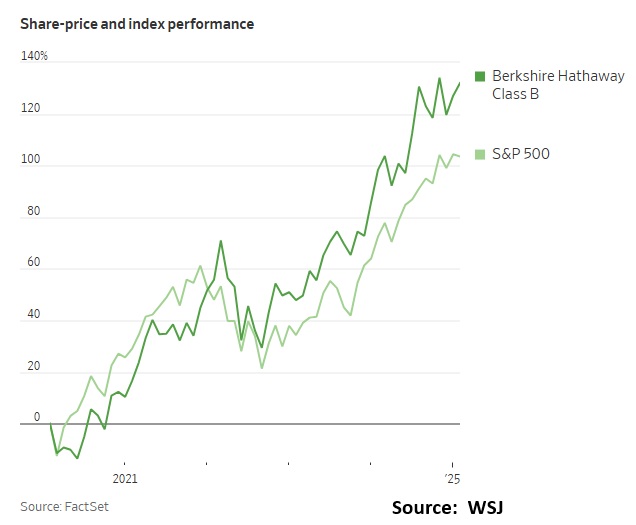

Buffett’s reluctance to deploy this cash, despite historically favoring equities, underscores his view that the market is dangerously overvalued. The S&P 500 has surged over 20% in consecutive years, yet Buffett has remained on the sidelines, signaling that valuations have exceeded reasonable levels. His repeated assertion that “nothing looks compelling” suggests that he sees few opportunities that justify the risk. Moreover, Berkshire has halted stock buybacks, another indication that Buffett believes prices are stretched.

Steve Cohen Bearish

The broader economic climate supports Buffett’s cautious stance. Steve Cohen, CEO of Point72, has turned bearish for the first time in years, citing rising inflationary pressures due to aggressive tariff policies, a restrictive immigration stance that could constrict the labor force, and federal spending cuts aimed at reducing the deficit. Cohen argues that these factors will slow economic growth from 2.5% to 1.5% in the second half of the year, increasing the likelihood of a market correction. Buffett’s strategy aligns with this outlook: in an environment of deteriorating fundamentals, cash provides a safe haven.

Newsletter to Investors

Buffett’s latest letter to shareholders further reveals his perspective. He openly acknowledges past mistakes in capital allocation and emphasizes the importance of adjusting to changing market conditions. He notes that while Berkshire still holds substantial equities, their marketable securities portfolio has declined from $354 billion to $272 billion, while non-quoted controlled equities have increased. Buffett reiterates that Berkshire will always favor ownership of quality businesses over cash but also warns that economic uncertainties and fiscal irresponsibility can erode paper money’s value.

Not A Market Call?

Notably, Buffett does not explicitly frame his cash hoarding as a market call, yet his actions suggest otherwise. While valuation alone is not a reliable timing mechanism, the alignment of stretched stock prices, macroeconomic risks, and Buffett’s defensive positioning strongly suggests that a significant market correction is imminent. Historically, Buffett has been an opportunistic buyer during downturns, and his current stance implies he is waiting for a major dislocation to deploy capital at more attractive valuations. Given Buffett’s unparalleled market acumen, investors should take heed—this could be a pivotal moment in market history.

I have been feeling this way for some time.

Trump scares the bejesus out of me. Business needs predictability, and all bets are off with whackadoodle in charge.