Key Facts and Observations:

- Major U.S. indices declined significantly due to tariff uncertainties.

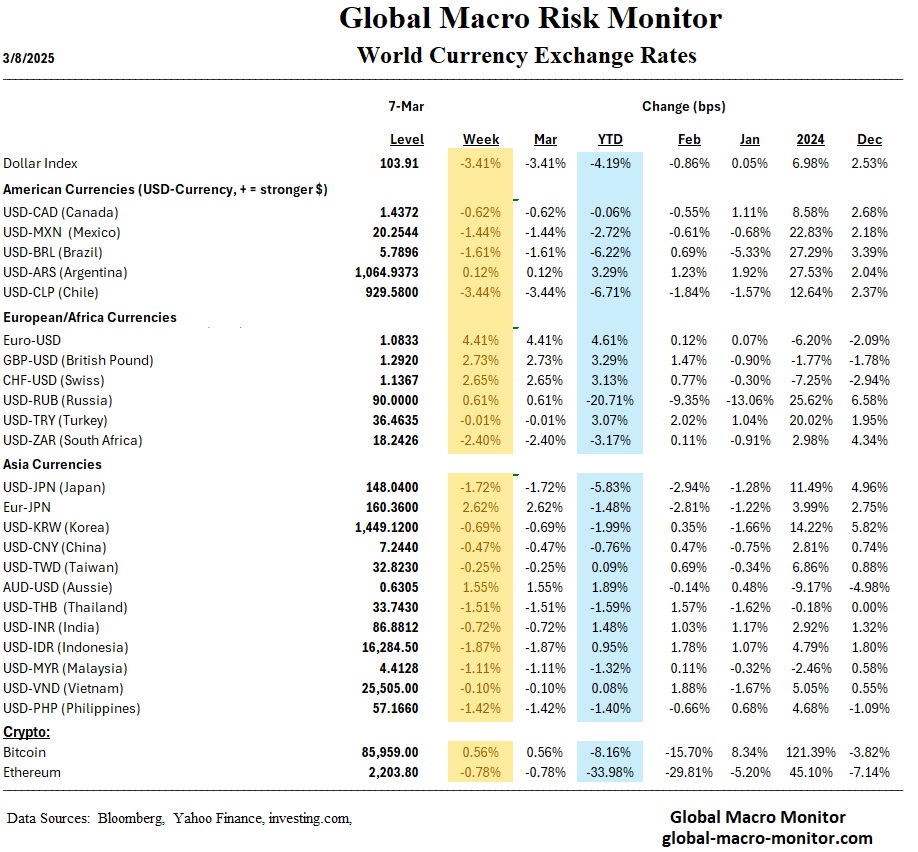

- The euro currency spiked after Germany announced a massive fiscal spending package.

- Germany’s new budgetary strategy caused historic bond yield increases.

- ECB lowered rates amid slowing inflation and substantial uncertainty.

- Japan’s bond yields reached the highest levels since 2008.

- China’s fiscal stimulus aims to combat deflationary pressures.

- Employment and manufacturing indicators in the U.S. signal economic moderation.

Markets: U.S. and Global

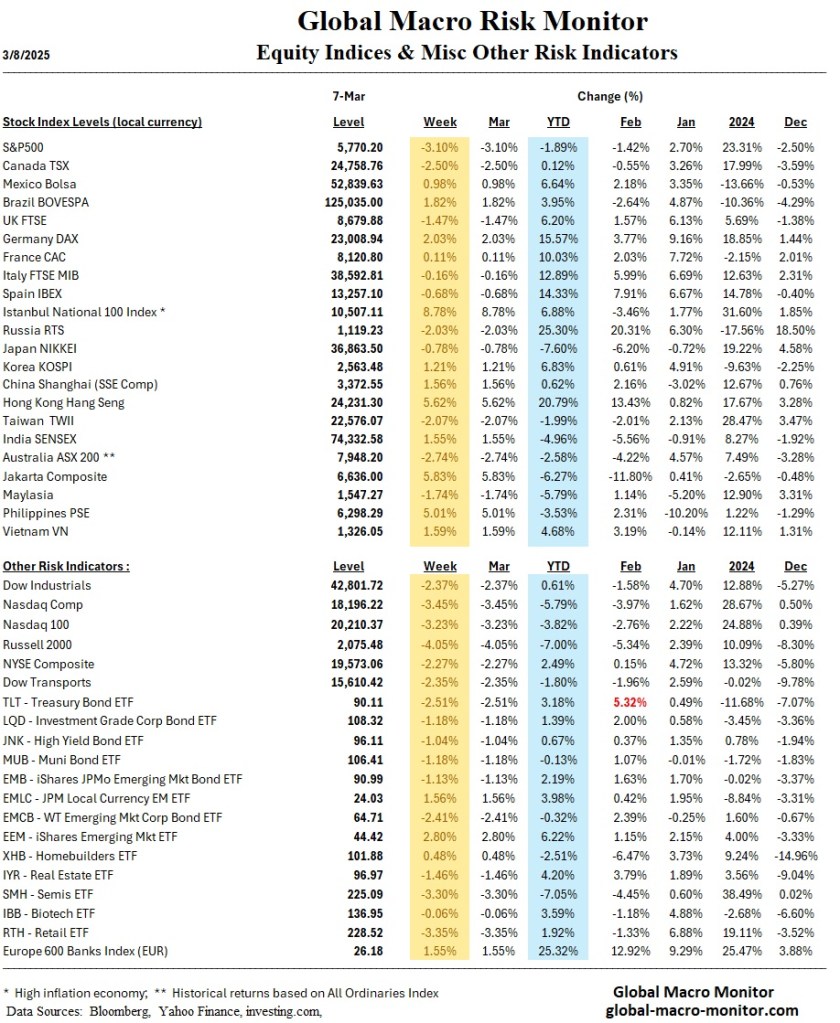

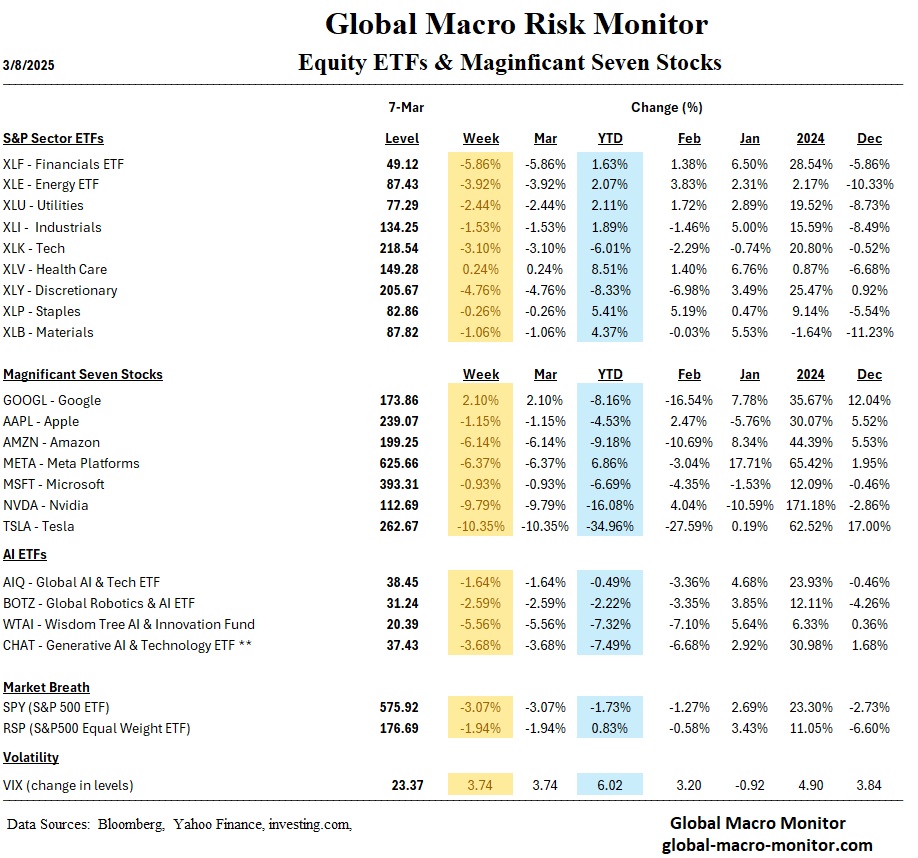

U.S. markets experienced considerable volatility this past week as Trump’s shifting tariff policies caused uncertainty among investors. The announcement of 25% tariffs on Canadian and Mexican imports and an additional 10% on Chinese goods led major indices, including the S&P 500 and Nasdaq Composite, to suffer their sharpest declines since September. The S&P 500, after penetrating key support, managed to rally into the Friday close.

Global markets echoed this instability, with European stocks ending a 10-week winning streak and Japanese markets showing mixed results amidst yen appreciation and rising bond yields. Chinese markets, conversely, rallied modestly after signals of further fiscal stimulus.

Economics: Domestic and International

Domestically, the inconsistency of tariff decisions has started to influence U.S. economic performance negatively, evidenced by sluggish manufacturing growth and increased concerns reported in the Federal Reserve’s Beige Book. Internationally, Trump’s policies prompted significant reactions: Europe’s strategic fiscal expansion, notably Germany’s EUR 500 billion infrastructure and defense spending, marked a historic policy shift resulting in dramatic rises in bond yields and Euro valuation. Japan is facing rate hikes due to inflationary pressures partly linked to trade uncertainties, and China faces ongoing growth headwinds despite new stimulus measures, highlighting broad global economic implications.

The Week Ahead

Attention will shift towards upcoming economic indicators, particularly the U.S. employment report, following signs of moderating job growth and rising unemployment. Germany’s fiscal announcement, causing a spike in European bond yields, will remain a focal point, alongside the appreciation of the Euro. Investors will closely monitor these developments as they navigate the ongoing financial market volatility stemming from Trump’s unpredictable trade stance.