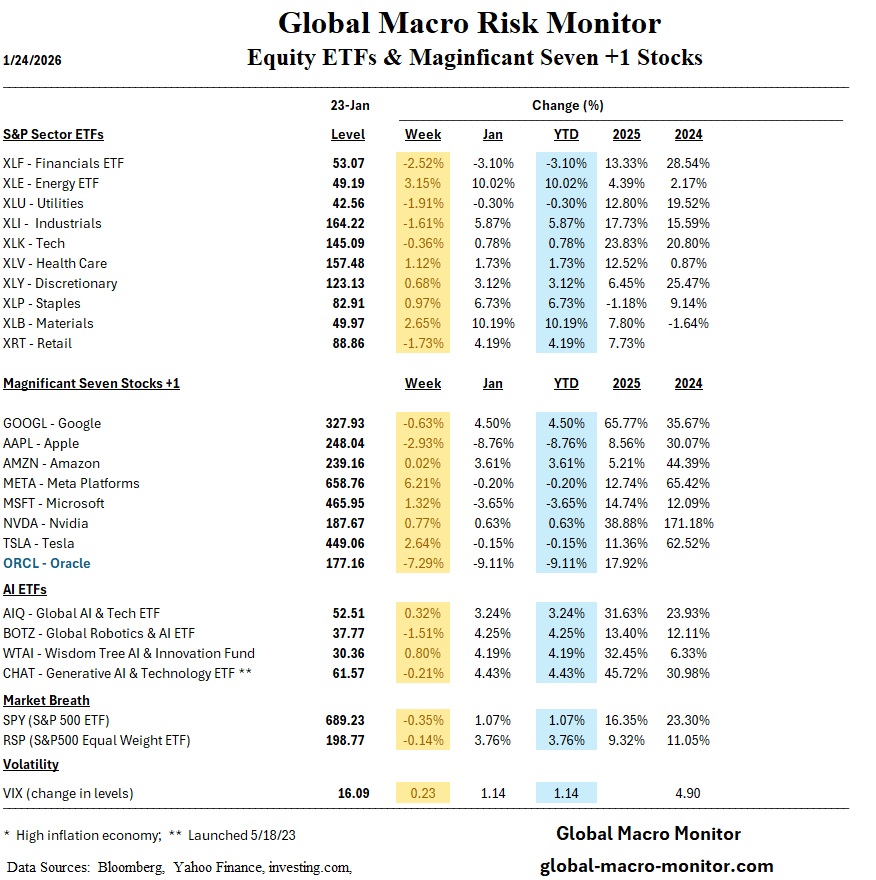

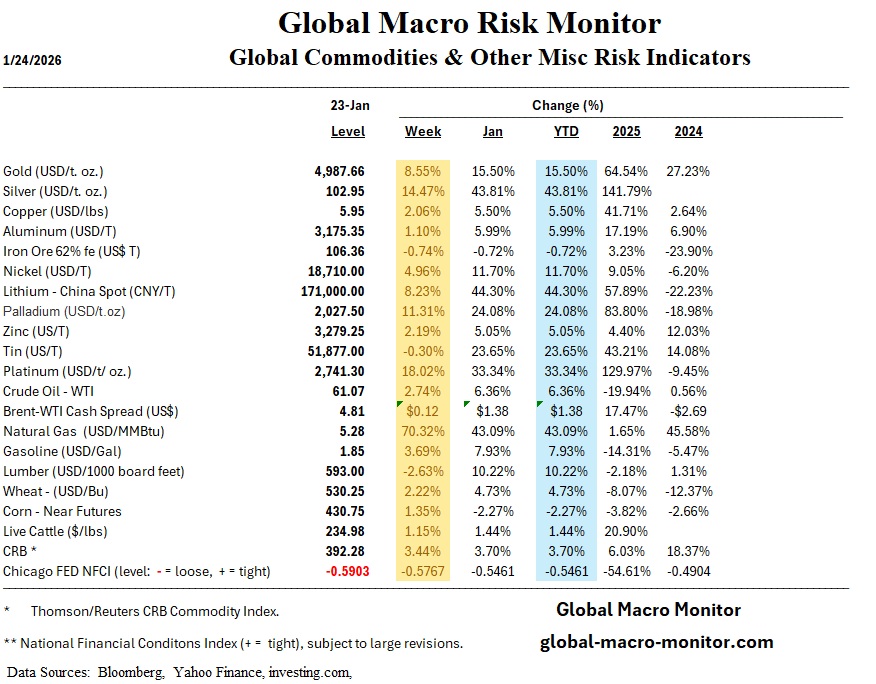

This week’s global financial landscape was characterized by intense volatility and a continued and significant rotation across asset classes. A prominent trend is the marked shift toward small-cap stocks, as investors move away from the high-valuation mega-cap technology sector that dominated the previous year. This rotation has been underscored by the notable underperformance of technology stocks in January, with investors largely shying away from the sector amid concerns over AI-related valuations and higher interest rates. Conversely, the commodities market witnessed an extraordinary surge. Silver prices have skyrocketed, rising by over 44% this month alone, while gold has also shown strong gains. Energy markets were equally explosive, with natural gas prices spiking more than 70% this week, driven primarily by a severe cold spell.

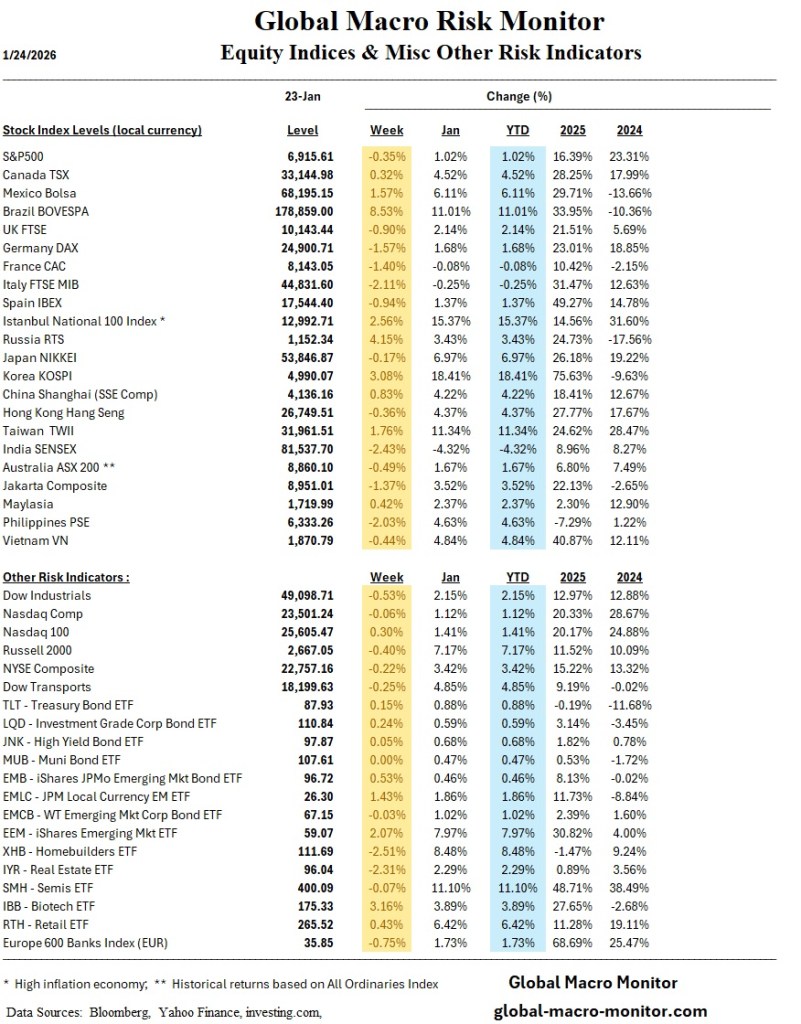

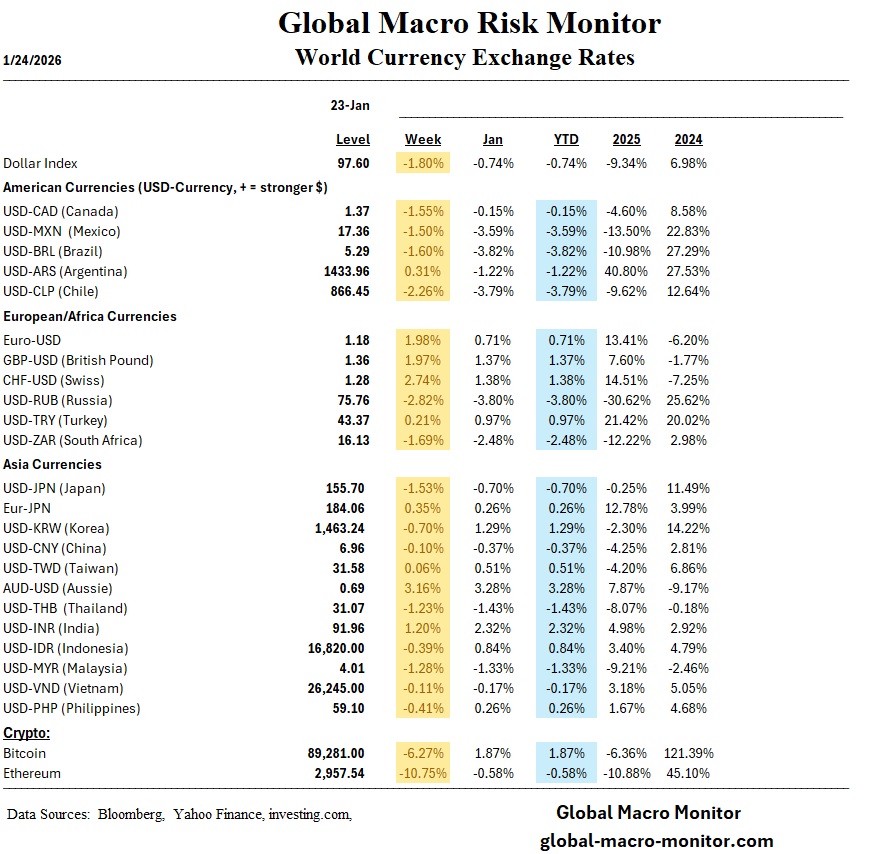

In international markets, Asian equities—particularly in Korea—continued their impressive trajectory, with Korean markets up 18% in January following a massive rally in 2025. This occurs against the backdrop of a sharply declining U.S. dollar, with the DXY index dropping 1.80% over the week. While U.S. GDP growth was revised higher to 4.4%, persistent inflation and geopolitical tensions, specifically regarding trade threats, continue to weigh on market sentiment.

Summary

- Risk Appetite and Credit Spreads: While credit spreads remain tight historically, the current week saw a shift in investor focus toward defensive commodities and rotational equity trades.

- Asset Performance Divergence: A clear divergence has emerged between surging precious metals and natural gas versus a “hammered” U.S. dollar and Bitcoin.

- Equity Rotation: Investors are increasingly moving away from mega-cap technology, testing support levels in indices like the Nasdaq 100 as they seek value in other sectors.

Regional Economic Insights

- United States: The economy remains resilient with a revised Q3 GDP of 4.4% and an Atlanta Fed Q4 Nowcast of 5.4%. However, consumer sentiment, while improving monthly, remains 20% lower year-over-year due to high prices.

- Europe: The Eurozone is facing renewed trade and geopolitical uncertainty, with the STOXX Europe 600 ending the week nearly 1% lower. Bulgaria notably adopted the euro currency on January 1st, despite internal political turmoil.

- Asia:

- Korea: Remains a standout performer, with gains reaching 18% for the month of January.

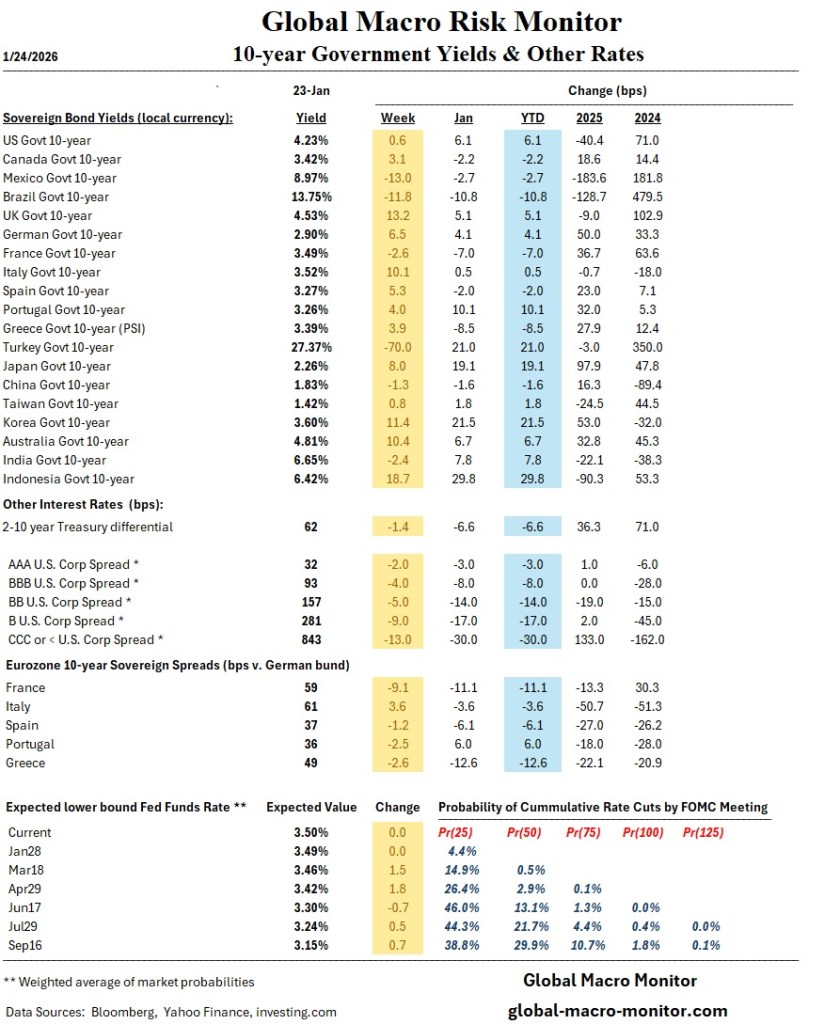

- Japan: Markets are roiled by political uncertainty and proposals for temporary food tax cuts, leading to a spike in 10-year JGB yields to 2.26%, the highest since 1997.

- China: Growth remains uneven, with the fourth quarter of 2025 seeing the slowest pace (4.5%) since the pandemic reopening.

- Latin America: Brazil showed significant strength with markets up 8%, even as Colombia faces potential rate hikes due to a 23% minimum wage increase.

Inflation: CPI-PPI Divergence

- PCE and Inflation Targets: The November core PCE price index rose 0.2% monthly and 2.8% annually, remaining consistently above the Fed’s 2% target.

- Expectations: While one-year inflation expectations eased to 4.0%, long-run expectations ticked up to 3.3%, indicating that price pressures remain a long-term concern for the FOMC.

Valuations and the “Low Fuel Tank” Risk

- Technology Sector Pressure: Software stocks are under particular pressure due to AI concerns and a broader rotation away from the mega-cap tech cohort.

- Market Volatility: The CBOE Volatility Index (VIX) has fluctuated, and with major tech earnings (MSFT, AAPL, META, TSLA) and a Fed meeting scheduled for next week, the risk of a sharp repricing remains high.

- Yield Curve Shifts: The U.S. Treasury yield curve ticked up slightly, with the 10-year yield hovering around 4.25%, reflecting shifting expectations for 2026 rate cuts.

Precious Metals: Gold & Silver

- Recent Trends: Gold surged 8% this week, while silver has seen an extraordinary 15% weekly gain, bringing its total January increase to over 44%.

- Market Drivers: A “hammered” U.S. dollar, with the DXY index dropping 1.80%, has acted as a significant tailwind for dollar-denominated metals.

- Forecast: Continued dollar weakness and lingering geopolitical scars from recent trade threats could sustain the “safe haven” bid for precious metals.

- Supply/Demand Impact: While demand is rising as a hedge against inflation and dollar depreciation, the rapid monthly ascent in silver suggests potential for high volatility or a technical cooling period if the dollar stabilizes.

Energy: Natural Gas

- Recent Trends: Natural gas prices spiked 70% this week, the most significant gain among major commodities.

- Key Factors: Extreme price action was primarily driven by a cold spell, which significantly tightened the short-term supply-demand balance.

- Forecast: Investors should monitor the EIA Natural Gas Inventories report on Thursday (Jan. 29) for confirmation of inventory drawdowns.

- Supply/Demand Impact: Current demand is heavily weather-dependent; any signs of moderating temperatures could lead to a swift retracement of this week’s 70% gain.

Energy: Crude Oil

- Market Outlook: While not matching the volatility of natural gas, crude oil remains sensitive to broader macroeconomic sentiment and the declining dollar.

- Significant Events: The EIA Crude Oil Inventories report is scheduled for Wednesday (Jan. 28). Additionally, Friday’s earnings reports from energy giants Chevron (CVX) and Exxon Mobil (XOM) will provide critical insights into production levels and capital expenditure trends for 2026.

- Supply/Demand Impact: Resilient U.S. economic growth (revised to 4.4% in Q3) supports the demand side, but investors remain cautious about potential shifts in global trade policy.

Industrial Commodities & Agriculture

- Trends: Durable goods orders (forecasted to rise 5.4%) and upcoming data on manufacturing and factory orders will serve as proxies for industrial commodity demand.

- Factors to Watch: The “AI and space race” between the U.S. and China, along with a global supply chain reset, is expected to sustain demand for industrial inputs and high-tech manufacturing materials throughout 2026.

- Supply/Demand Impact: Protectionist surges worldwide and the risk of new tariffs (though currently tempered) create uncertainty for international trade flows and commodity supply chains

Week Ahead

The upcoming week is expected to be marked by “Higher Volatility” as investors navigate a dense schedule of high-impact earnings from the technology sector and a pivotal Federal Reserve meeting.

Major Economic Indicators

- Durable Goods Orders (Mon, Jan. 26): Forecasted to rise 5.4% in November, driven by a rebound in Boeing orders and a broadening of investment across various industries.

- Consumer Confidence (Tue, Jan. 27): This report will provide further insight into whether the recent improvement in sentiment can be sustained despite ongoing pressures on purchasing power.

- EIA Crude Oil and Natural Gas Inventories (Wed & Thu, Jan. 28-29): Following massive weekly spikes in natural gas prices, these inventory reports will be critical for gauging whether supply constraints persist.

- Trade Balance (Thu, Jan. 29): Analysts forecast a modest narrowing of the trade deficit to $23 billion, though data remains limited due to previous government disruptions.

- Producer Price Index (Fri, Jan. 30): This wholesale inflation gauge will be closely watched for signs of “sticky” input costs that could impact future consumer prices.

Key Earnings Releases

- Mega-Cap Technology (Tue–Thu): Microsoft (MSFT), Meta Platforms (META), Tesla (TSLA) , and Apple (AAPL) all report this week. These results are expected to be the “primary driver of investor sentiment”.

- Semiconductor & Software (Wed–Thu): ASML, ServiceNow, SanDisk, and Western Digital will offer a “better sense of the state of tech,” particularly regarding AI demand and memory chip market health.

- Industrial & Transportation (Tue–Thu): Boeing (BA), General Motors (GM), Union Pacific (UNP), and UPS will provide a pulse check on manufacturing, labor, and logistics.

- Energy & Finance (Fri): Chevron (CVX), Exxon Mobil (XOM), and American Express (AXP) will round out the week, highlighting trends in consumer spending and energy sector profitability.

Global Events & Factors

- Federal Reserve Monetary Policy Meeting: While no interest rate change is expected , the meeting is “in focus” as markets weigh the timing of potential cuts later in 2026.

- International Central Bank Decisions:

- Bank of Canada (Wed, Jan. 28): Focusing on economic fallout from trade strains with the U.S..

- South African Reserve Bank (SARB): Analysts expect a 25-basis-point rate cut.

- Central Bank of Colombia (Fri, Jan. 30): Expected to hike rates by 25 basis points following a massive 23% minimum wage increase.

- Geopolitical Resilience: Market confidence remains sensitive to trade policy headlines, particularly following recent volatility surrounding Greenland and global tariff threats.