Humans love patterns. Sometimes that’s helpful, but other times… Not so much. Apophenia is the common tendency to detect patterns that do not exist. Also known as “patternicity”, apophenia occurs when we try to make predictions, or seek answers, based on unrelated events. – nesslabs.com

“I come from a land down underWhere beer does flow and men chunderCan’t you hear, can’t you hear the thunder?You better run, you better take cover, yeah” – Men At Work

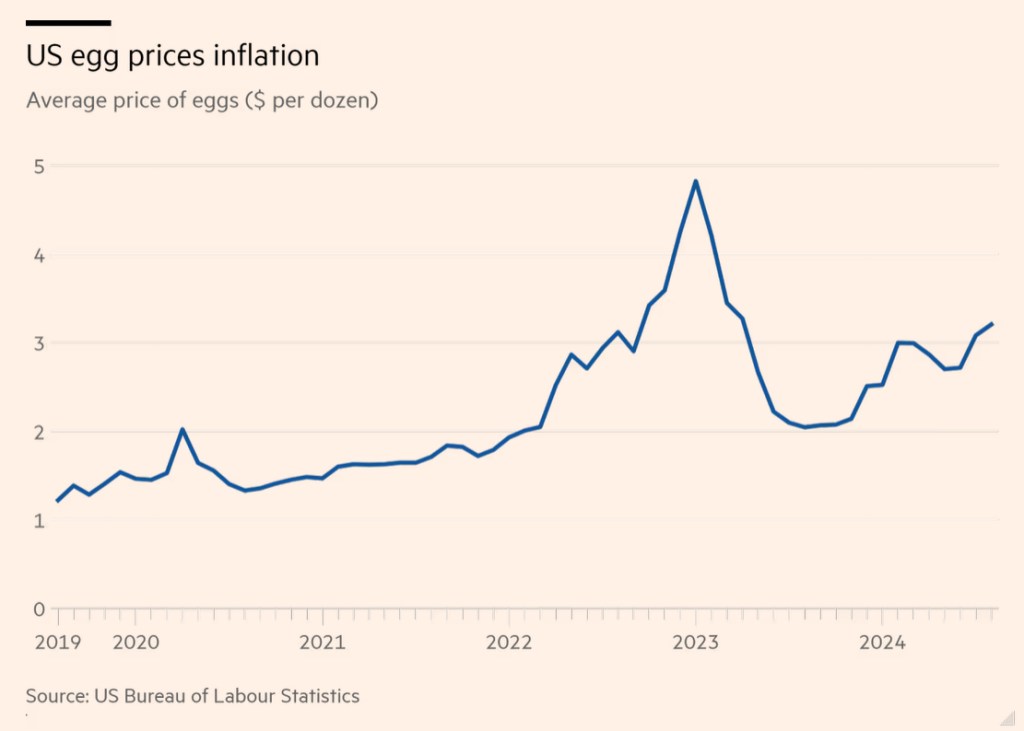

Data has indicated that egg lovers in the US have been subject to big swings in the price in recent years…producers in the US are also grappling with regulations restricting the sale of eggs between states.The price of a packet of a dozen eggs peaked at $4.82 in January 2023, as global feed prices spiked in the wake Russia’s invasion of Ukraine. Yet within months they had halved. By August this year they reached $3.02.

The fluctuations drew criticism from Republican vice-presidential candidate JD Vance in the swing state of Pennsylvania this month as he blamed Kamala Harris, the Democrat presidential candidate, for egg price inflation. – FT

Chart Source: FT

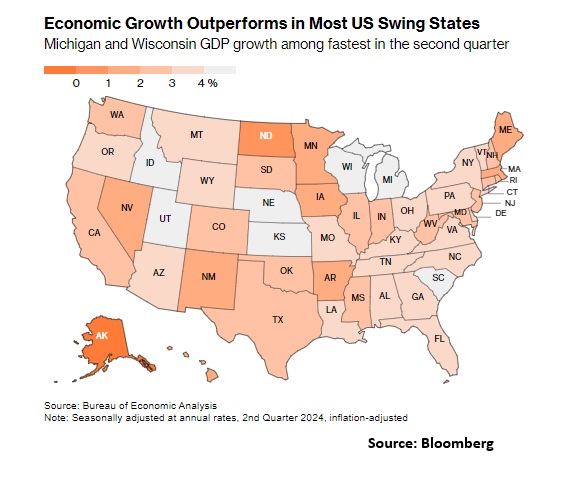

Six of the seven key battleground states in the upcoming U.S. presidential election registered economic growth faster than the national average in the second quarter. Michigan, Wisconsin, and Pennsylvania, which have been slower to recover post-pandemic, experienced a strong economic resurgence. Michigan and Wisconsin were among the top 10 fastest-growing states, and Pennsylvania rebounded after a contraction in the first quarter. The economic momentum in the swing states provides a political boost for Vice President Kamala Harris, who has been narrowing the gap with Donald Trump on economic issues in recent polls.

The “Sunbelt” battleground states—Arizona, Georgia, and North Carolina—also recorded growth above the national average. Nevada was the outlier where growth lagged, primarily due to challenges in its accommodation and food services sectors that are vital to the state’s economy.

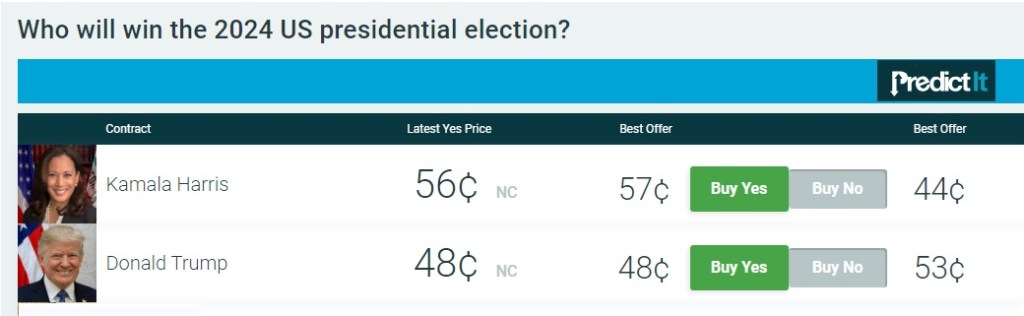

Voters have consistently ranked the economy as their top concern, with Trump leading Harris on the issue in most polls. Harris is catching up, however, particularly on matters related to the cost of living and middle-class welfare. A recent Bloomberg/Morning Consult poll shows that Harris is nearly tied with Trump on handling everyday costs and holds an 11-point lead in helping the middle class.

A big caveat is that despite these positive trends, many Americans still feel economic pressure due to high prices, even as inflation slows. GDP growth doesn’t always translate to votes, as voters’ concerns remain focused on the tangible costs they face.

Source: Bloomberg

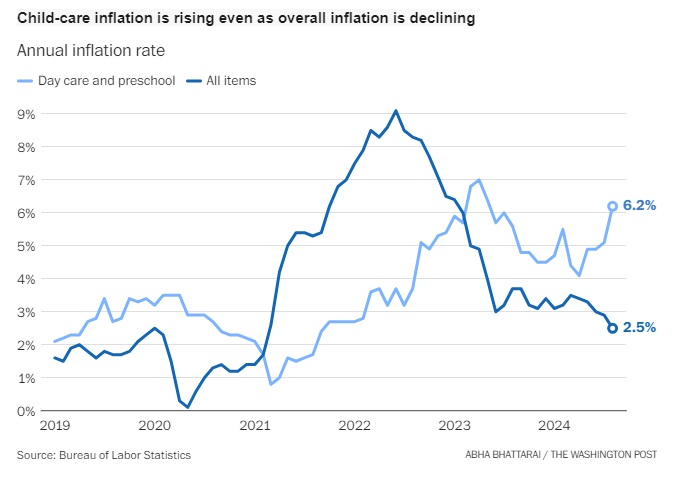

Along with housing prices, child-care costs are among the last remnants of inflation haunting Americans — a point that Biden administration economists have conceded. Although gas, cars and groceries, including bread, bacon and vegetables, have all become cheaper in the past year, day-care costs have risen 6.2 percent — more than double the rate of overall inflation.

Those high costs are increasingly factoring into how people plan to vote in the presidential election, just over six weeks away. More than one-third of mothers who are registered to vote said they worry “a lot” about affording child care, according to a recent KFF poll. – Washington Post