-

In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.

-

Join 1,220 other subscribers

Contribute To GMM

Categories

- 3D Printing

- Agriculture

- AI

- Algos

- Apple

- Automation

- Banking

- BFTP

- Bitcoin

- Black Swan Watch

- Bonds

- Brazil

- Brexit

- BRICs

- Budget Deficit

- Capital Flows

- Cartoon of the Day

- Cashless Society

- Chart of the Day

- Charts

- China

- Clean Tech

- Climate Change

- Coach C

- Commodities

- Coronavirus

- COVID

- Credit

- Crude Oil

- Currency

- Cyprus

- Daily Risk Monitor

- Day In History

- Debt

- Demographics

- Disinflaton

- Dollar

- Earnings

- ECB

- Economics

- Economist

- Egypt

- Electric Vehicles

- Emerging Markets

- Employment

- Energy

- Environment

- Equities

- Equity

- Euro

- Eurozone Sovereign Spreads

- Exchange Rates

- Fed

- Finance and the Good Society

- FinTech

- Fiscal Cliff Monitor

- Fiscal Policy

- Food Prices

- France

- Futurist

- Game Theory

- General Interest

- Geopolitical

- Geopolitics

- German Bund

- Germany

- Global Macro Watch

- Global Reset

- Global Risk Monitor

- Global Stock Performance

- Global Trend Indicators

- Gold

- Greece

- Healthcare

- Heat Map

- Hedge Funds

- Housing

- Human Interest

- Immigration

- Impeachment

- India

- Inequality

- Inflation/Deflation

- Infographics

- Innovation

- Institutional Investors

- Interest Rate Monitor

- Interest Rates

- Interviews

- Italian Yields

- Italy

- Japan

- Jobs

- Lectures

- Macro Notes from Conference Calls

- Manufacturing

- Masters

- Mexico

- Monetary Policy

- Movies

- Muni Bonds

- Muni Market

- Natural Gas

- News

- Nonlinear Thinking

- North Korea

- Overbought Markets

- Picture of the Day

- PIIGS

- PMIs

- Policy

- Politics

- Population

- Populism

- Poverty

- President Trump

- Qunat Strategies

- Quote of the Day

- Quotes

- Rare Earth Elements

- Readership

- Reads

- Real Estate

- Relative Strength Index

- Robert Shiller

- RSIs

- S&P500

- Sector ETF Peformance

- Semiconductor prices

- Semiconductors

- Social Media

- Socialism

- Song for the Week

- Sovereign Debt

- Sovereign Risk

- Spain

- Sports

- State and Local Government

- Tail Risk

- Technical Analysis

- Technology

- The Big Reset

- The Weekend Read

- This Day In Financial History

- Trade War

- Trades

- Tweet of the Day

- Ugly Chart Contest

- Uncategorized

- US Releases

- Video

- Volatility

- Wages

- Week Ahead

- Week in Review

- Weekend Reads

- Weekly Eurozone Watch

- Whales

-

Recent Posts

Meta

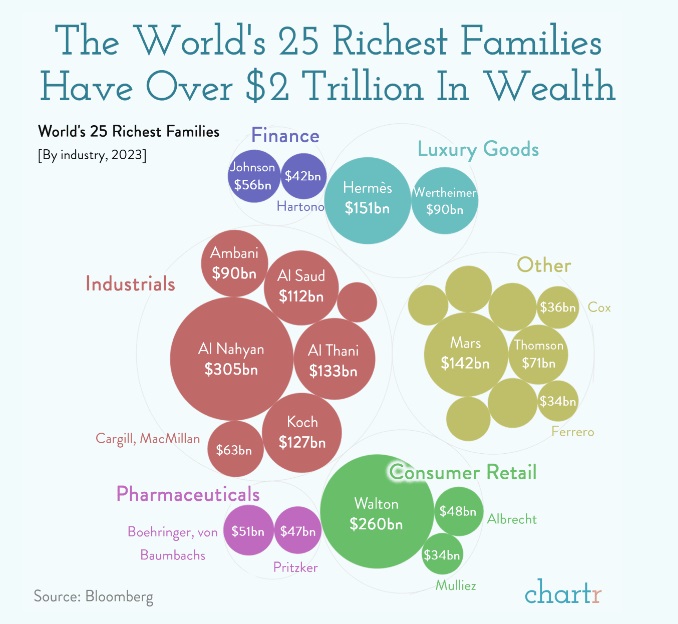

World’s 25 Richest Families

A little context:

The world’s 25 wealthiest families, where wealth has been passed down over at least one generation, are now collectively worth a cool $2.1 trillion, according to a new report from Bloomberg.

With first-generation money excluded, the industries on this list of dynasties look quite different to most modern rich lists, which are often dominated by tech entrepreneurs. Indeed, the majority of families listed owe their prosperity to physical, rather than digital, empires. – Chartr

Note the Musk, Bezos, and Gates families are excluded because their wealth was self-made. Good for them!

Posted in Uncategorized

Leave a comment

‘Twas The Night Before Rate Cuts?

‘Twas the night before interest rate cuts, in markets worldwide, With hopes that central banks would soon turn the tide.

The markets expect, with cuts so precise, the Fed cutting a hundred and ten basis points, to slice.

In the Eurozone too, cuts are now in sight, one hundred thirty-three basis points, to ease the tight plight.

The U.K. not far, with its own rate decree, Seventy-four basis points, to set finances free.

Canada’s stance, firm yet cautiously bold, a hundred and six bps cut, measured and told.

Each bank in its wisdom, may see the need clearly, to curb rising interest costs, that companies so fear.

For debt service bites, with a relentless claw, eating at bottom lines, exposing the flaw. The cuts couldn’t come quicker, the markets do plea, a global chorus, calling and set for a financial spree.

So as the world is waiting, with bated breath, for central banks’ to move, to dodge the debt’s death. The hopes were all pinned on this monetary dance, to revive the economies, and give growth a chance.

In boardrooms and exchanges, eyes all did fix, on central bankers’ play, their monetary tricks. Will their moves be enough, to calm the troubled sea? Or is more needed, for a stable economy spree?

‘Twas a global effort, a synchronized plan, to steer the ship safe, as best as they can. So here’s to the rate cuts, in the coming new year, may they bring relief swift, so economies’ can cheer.

Posted in Uncategorized

Leave a comment

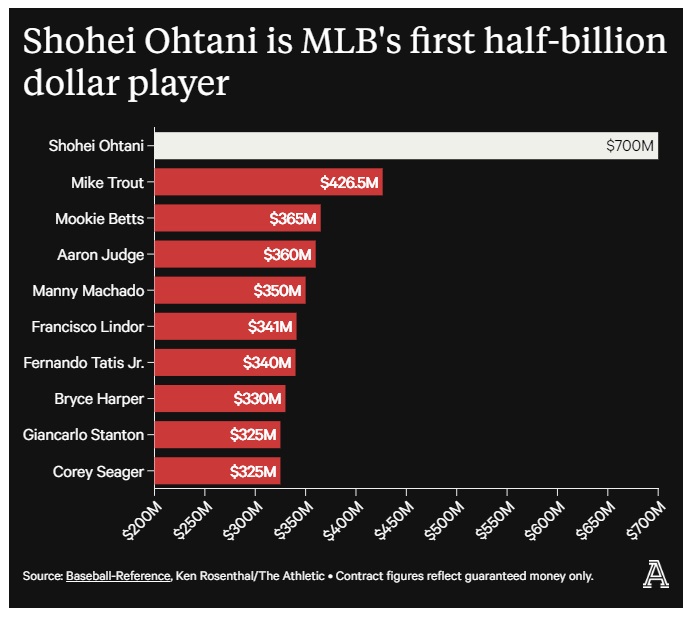

Inflation Over? Think Again…O, O, Ohtani!

Shohei Ohtani’s singular pursuit of history, one man’s quest to rewrite the baseball world’s understanding of what is possible, reached another summit on Saturday when he agreed to the largest contract in the annals of major North American team sports, a 10-year, $700 million contract with the Los Angeles Dodgers, per league source. – The Athletic

OK….maybe there is just a spike in the relative price of ballplayers.

Posted in Uncategorized

Leave a comment

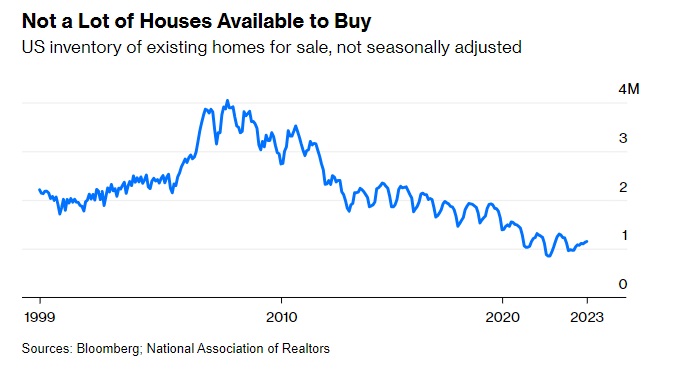

The New Supply-Side Of Housing & Landlord Nation 2.0

We are reposting a piece we wrote back in ancient days about how this housing bubble, or “everything bubble” would be different from the last (also see here). One major factor why the economy is holding up and not responding to the very aggressive interest hikes by the Fed is that the supply curve for many factors has shifted left.

Housing Supply Curve

Theoretically, home prices should move inversely with mortgage rates but the lack of supply has ruptured that relationship during the current rodeo. This, in turn, affects consumption through the wealth effect as home prices remain intact. It’s amazing in our neck of the woods, a 1200 sq foot home or shack that sold for, say, $400k five years ago is now trading at close to $900k, if you can find one, that is. That’s an increase of more than 300 percent in the monthly mortgage payment. Simply stunning.

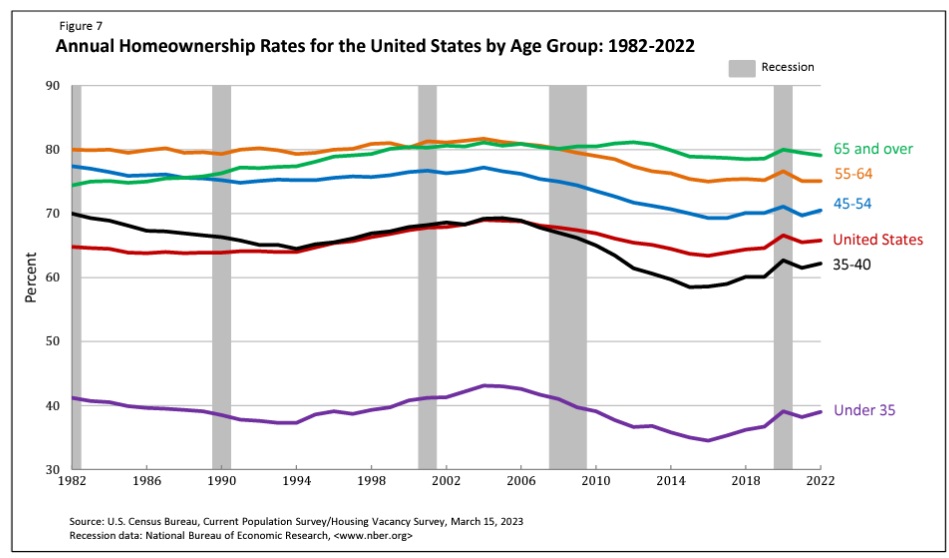

Note that 66 percent of Americans own their own homes. As always, we caution about getting lost in the averages. The home-ownership rate is vastly different among various age cohorts.

We have always maintained an increase in the relative price of housing — faster than wage increases, for example — is an intergenerational transfer of wealth from the young to the old. The following chart from the Census Bureau reinforces our point, kind of.

Doom Spending?

If homeowners still think they are millionaires, why not spend, spend, spend ’till daddy takes the T-Bird away? CNBC refers to it as “doom spending,”

Consumer spending has remained remarkably resilient in the face of some stiff economic headwinds.

Nearly all Americans, 96%, are concerned about the current state of the economy, according to a recent report by Intuit Credit Karma.

Still, more than a quarter are “doom spending,” or spending money despite economic and geopolitical concerns, the report found. – CNBC

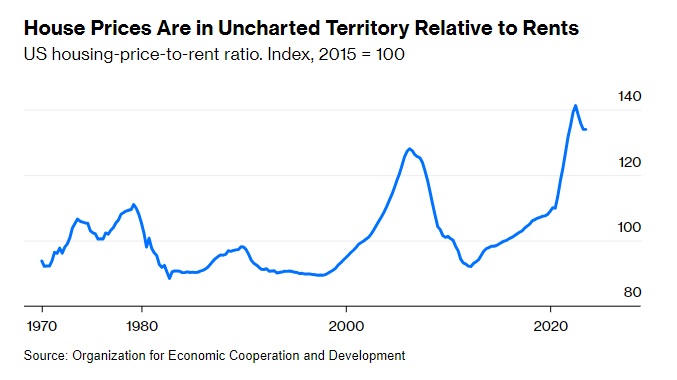

Overvalued As It Ever Has Been

The following chart from Bloomberg this morning illustrates how overvalued housing prices — even more so than the 2007 housing bubble. Eventually, rents will have to catch up, which means mo’ inflation or prices must come down to reality. The third way is that mortgage rates drop back to 3 percent, which would signal economic doom. You choose, folks.

Rents are to house prices what dividends or earnings are to stocks — the flow of income that justifies the value of the asset. When prices and rents get out of kilter, something presumably has to give eventually. As Federal Reserve Board economist Joshua Gallin put it at the June 2005 meeting of the interest-rate-setting Federal Open Market Committee, “rents provide a loose tether for house prices; prices deviate from their long-run relationship with rents for extended periods, but not indefinitely.” About a year and a half after that, US house prices began a five-year, 26% slide, going by the S&P CoreLogic Case-Shiller US National Home Price Index. – Bloomberg

The New Supply-Side Of Housing & Landlord Nation

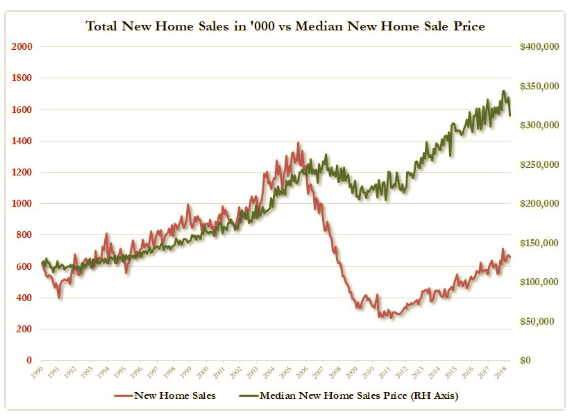

David Stockman tweeted the following Zero Hedge chart this morning.

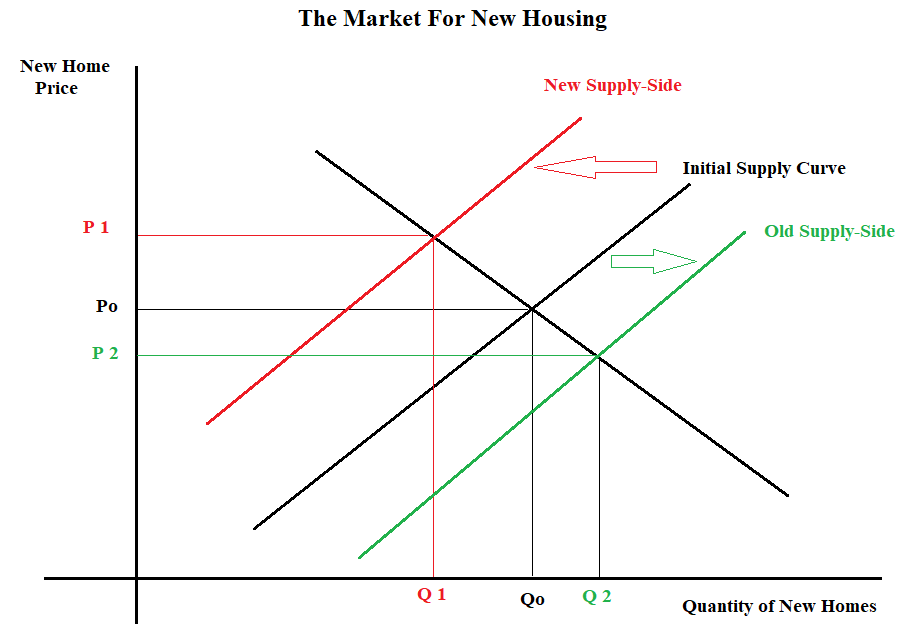

Clearly, a shift in the supply curve for new homes to the left.

OK – and some buying at irrational prices fueled by artificially low-interest rates and excess money. The irrational panic buying will take care of itself as interest rates rise and the Fed reduces its balance sheet making money tighter.

This is not the highly leveraged housing market of 2006-07, where even our range boy at the local golf club owned mortgaged three homes, quit his job, and bought an Escalade financed by a home equity loan (true story). This market is driven primarily by restricted supply and will be more difficult to pop. The price adjustment will also take place over a much longer period.

The New Supply-Side Economics Is Not Good

We have written how private equity has taken a yuuuge supply of existing homes off the market through their mega 2012-14 bankruptcy purchases, and now rent out the homes to the same people they foreclosed on. Existing housing is a perfect substitute for new homes.

Rising Costs

The rising costs of building, primarily labor shortages in the construction sector, and restrictive zoning laws are constraining building and the supply of new homes.

The lack of enough skilled workers and a narrow talent pipeline has added extra hurdles, time, and costs to many current projects, according to builders, hindering the current boom time in the industry.

“The number one issue is the cost and availability of labor,” says Randy Strauss, owner of Strauss Construction in Amherst, Ohio, roughly 40 miles east of Cleveland.

The issue is a nationwide one. Contractors in areas such as Houston, which were battered by Hurricane Harvey last year, have struggled to staff up, and the National Association of Home Builders recently found that 82 percent of its members believe the cost and availability of labor are their biggest issues. In 2011, only 13 percent named labor costs as their biggest worry. — Curbed

The immigration crackdown has played a significant role in the labor shortage in the construction sector.

One study from the National Bureau of Economic Research found that over 1.1 million undocumented immigrants, many of them skilled in essential trades such as framing, work in the construction industry. – CITYLAB

Lumber Prices

The parabolic rise in lumber prices isn’t helping either. Lumber prices are down over 12 percent from last week’s high, however, with several days of limit down in the futures markets. Look no further than the long-term lumber price chart to understand what tariffs do to prices and input costs, which ultimately hurt the majority.

Last April, the Trump administration placed a 20.83 percent tariff on Canadian lumber, to the benefit of politically valuable voters in Maine. Within the construction industry, these imports commonly turn into framing lumber, which is used to build single-family homes and small multifamily buildings.

– CITILAB

Bad timing by the administration unless you belong to the small minority of those who make their living in the framing lumber business.

Policy Relief Needed

Shortages are breaking out and are now ubiquitous throughout the economy.

The housing market is one of the hardest hit sectors. Shortages of new and existing homes; shortages of buildable land, shortages of skilled construction workers. Inflation is running rampant in the sector. Yet it hardly registers in the inflation indices because of the way the government measures housing costs.

The new supply-side of housing (shifting the curve left) is not working for most Americans. Taking existing homes off the market for rentals or the restriction of new supply through rising input costs, labor shortages, and zoning restrictions are severely reducing affordability and turning the country into a Landlord Nation.

Since most of the problems are policy-induced, they can be fixed by better and a more comprehensive housing policy. That is getting back to the old supply-side economics of the Reagan era where the supply curve shifts to the right, illustrated in the simple graph below. Lower prices with more supply of homes (P 2, Q 2).

Higher prices and lower supply may work for some, but it is certainly not good economics and only adds to an already toxic political environment.

It is time for disruption in housing.

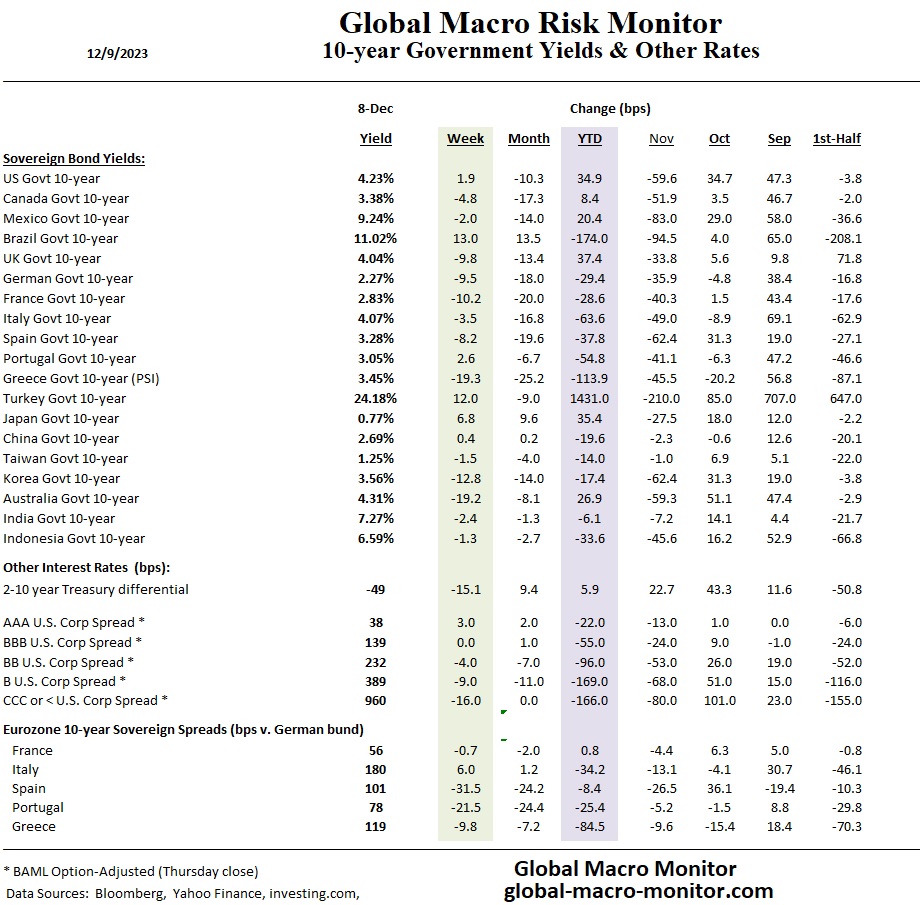

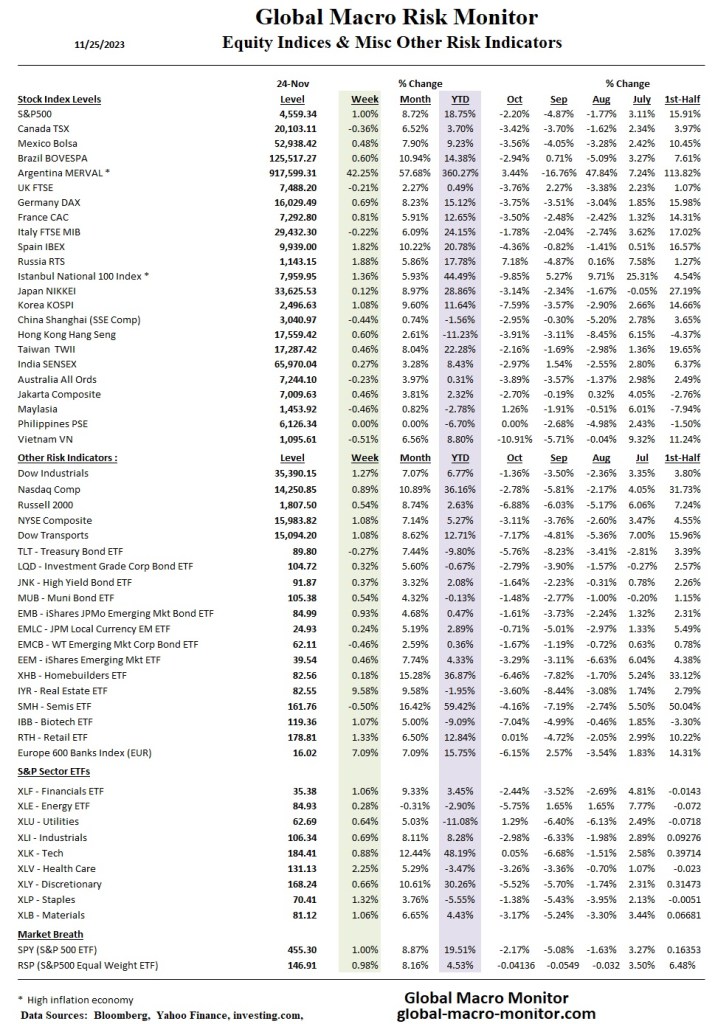

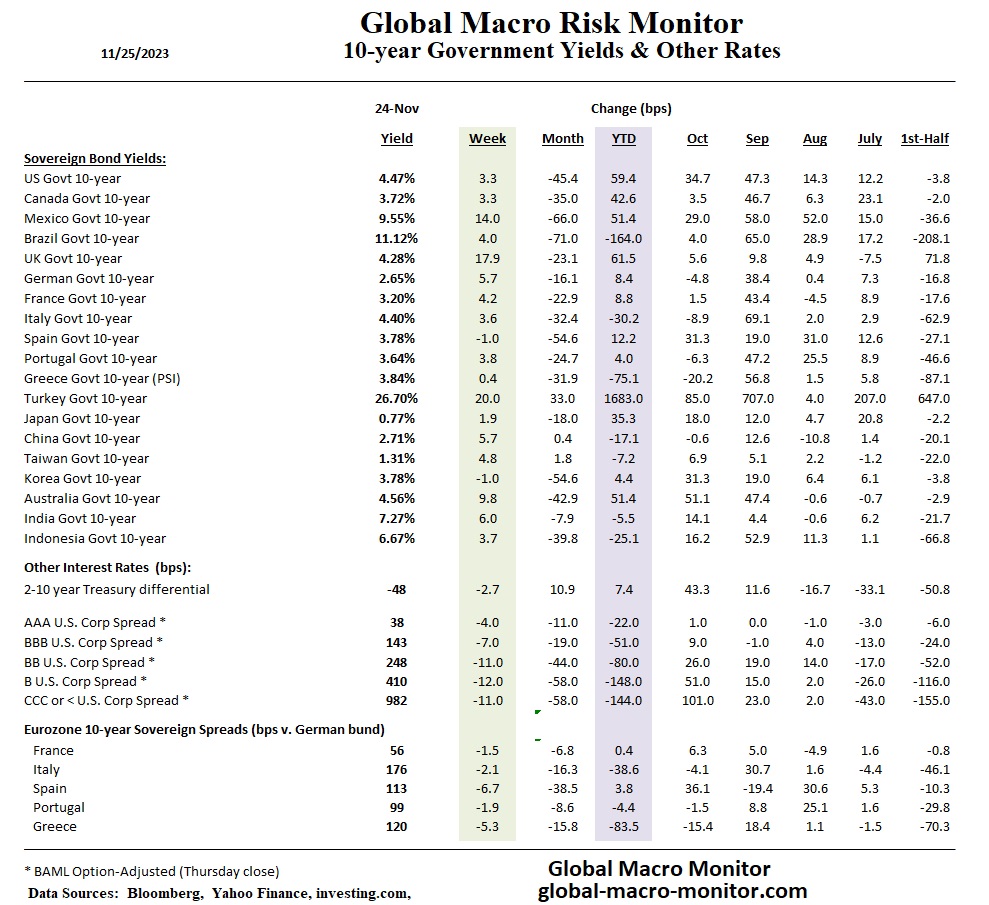

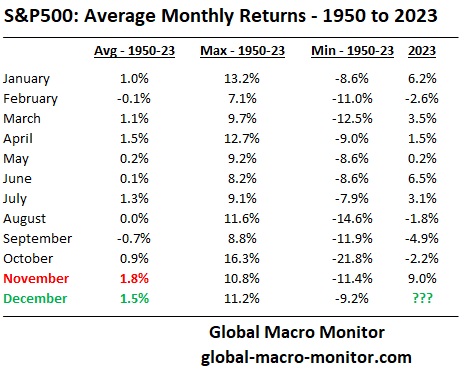

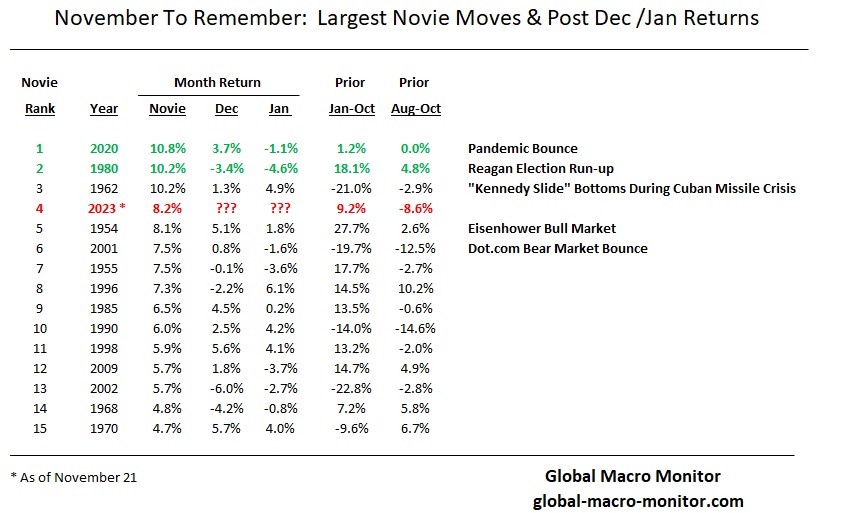

Month In Review: A November To Remember

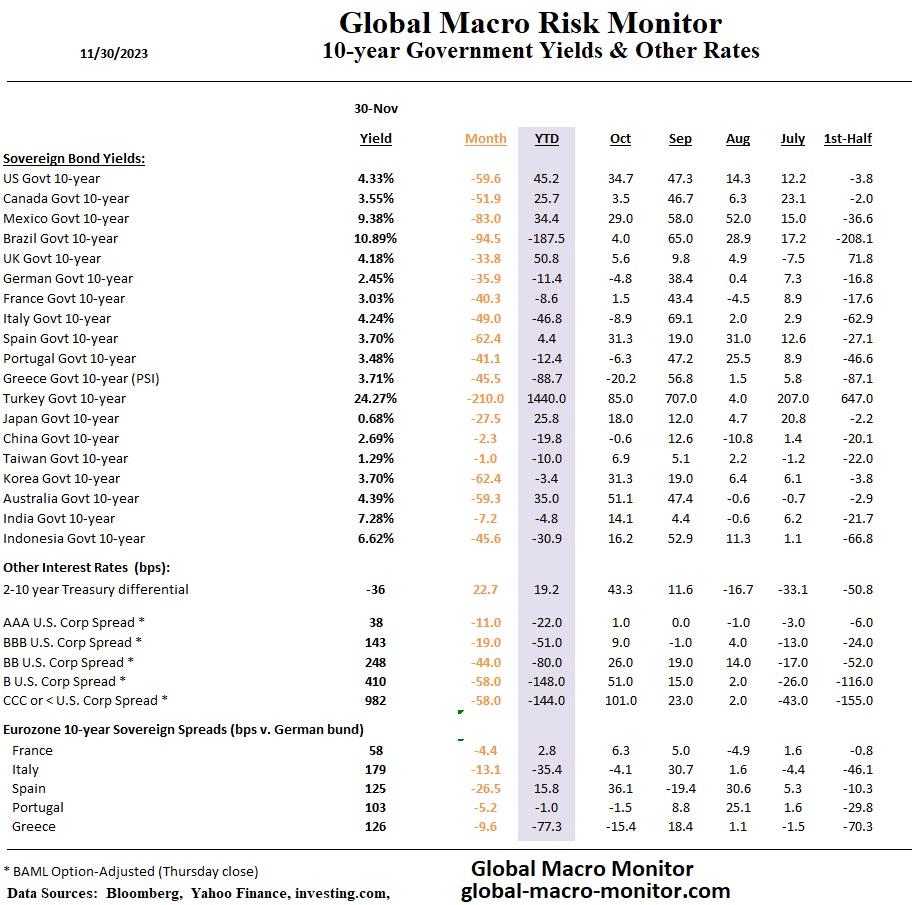

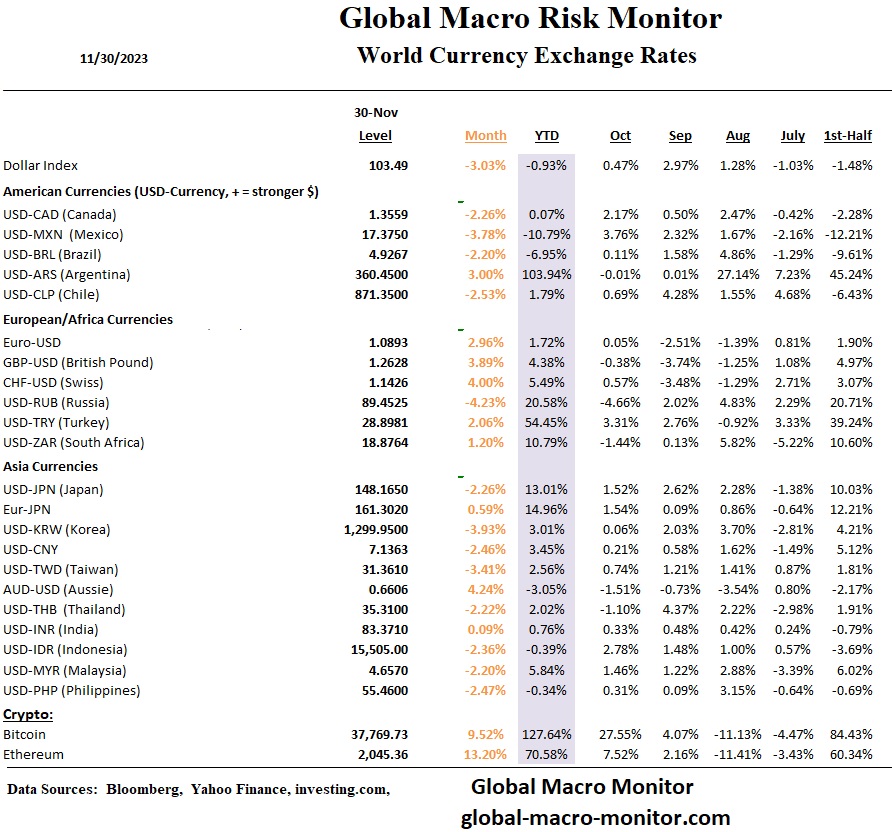

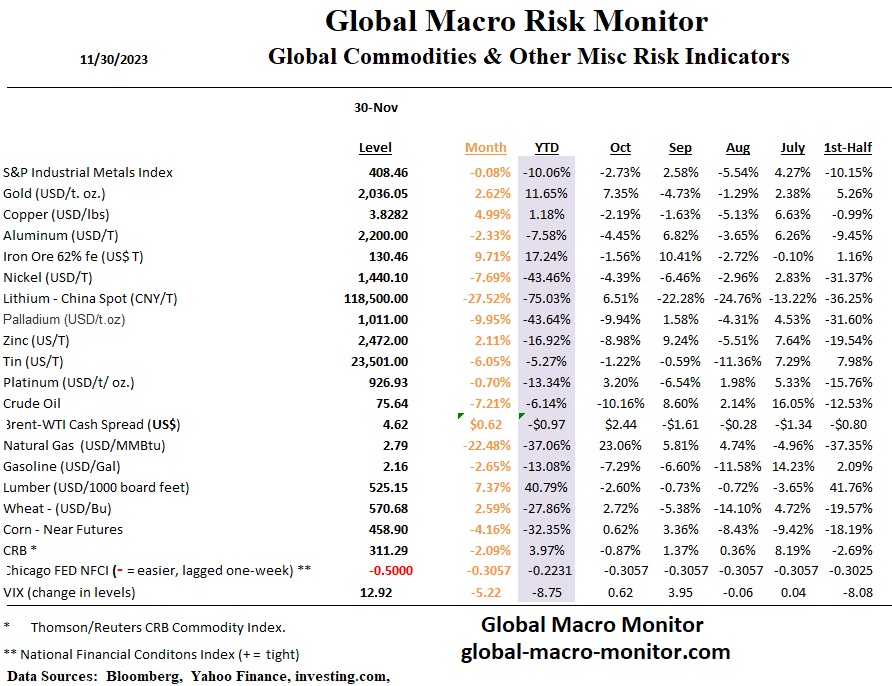

This month’s price move in the S&P500 ranks as the fourth-best November in the post-war period. Credit spreads came in quite a bit, and the Chicago Fed’s National Financial Conditions Index eased 20 points, simply stunning. With such a significant easing, the Fed’s job is more challenging. However, don’t tell Ms. Market; she is pricing several rate cuts next year.

We now begin the second-best month of the year, on average, for the S&P500, and Ms. Market is certainly not on the side of recessionistas. Watch credit spreads.

Posted in Uncategorized

Leave a comment

Coming Soon: The Best Trading Days Of The Year

“But as any mathematician knows, averages can be deceptive. Andrew Robinson, CEO of famed advertising agency BBDO, once said, “When your head is in a refrigerator and your feet on a burner, the average temperature is okay. I am always cautious about averages.” — Eric Barker

Since our post, A November To Remember?, the S&P500 continues to rise as one of the best-performing Novembers since 1950, advancing to the 4th best on an average monthly return basis, and it’s only the 21st! Who would have thunk it? And that is probably a good reason of this November to remember stellar performance, “nobody thunk it.”

In our years of market watching, we have deduced that short to medium-term stock moves are based on the rate of change, or first derivative, of the factors that drive prices, such as earnings and interest rates. What drove markets down in the recent bear market was the change in interest rates, and the recent rally has been driven by the change in interest rates, just with a different sign, for example.

Levels will eventually matter. Just as the still high level of liquidity central banks injected into the global economy during the pandemic matters, even as the rate of change is negative, is confounding economists, who have been forecasting a recession for the past year.

The level of interest rates, if the Fed is true to their word, “higher for longer,” will eventually bite both the markets and the economy.

There is no doubt markets are hooked on the monetary crack and the financial dopamine created by the anticipation of interest rate cuts and central bank liquidity injections, which drive the market multiples.

Hopes of interest rate cuts spring eternal.

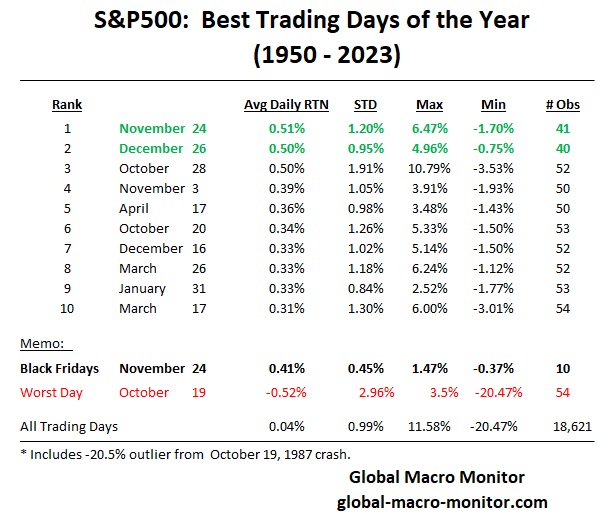

Best Trading Days of the Year

We have also analyzed the best trading days of the year, with November 24th ranked numero uno — that’s this Black Friday, folks — with December 26th a close second. Black Friday has fallen on November 24th, about 25 percent of the observations, so all can not be attributed to the urge to splurge on Christmas gifts. Let’s just say traders tend to get lathered up around the Thanksgiving holiday.

Twenty-two Standard Deviation Event

The table below also illustrates how one giant outlier, such as the 20 percent plus October 19, 1987, one-day crash, can skew the averages.

Before Monday, October 19, 1987 (now known as Black Monday), such a massive drop in the market wasn’t considered possible because statistics put such a decline at an impossibly rare twenty-two standard deviation event. How rare is a twenty-two standard deviation event? Writing about the drop in his 2000 book When Genius Failed, reporter Roger Lowenstein of the Wall Street Journal noted, “Economists later figured that, on the basis of the market’s historical volatility, had the market been open every day since the creation of the Universe, the odds would still have been against it falling that much in a single day. In fact, had the life of the Universe been repeated one billion times, such a crash would still have been theoretically ‘unlikely.’”

Yet it happened. – Forbes

Grateful

We can always find many things to be thankful and grateful for, even if the world seems to be rapidly moving sideways.

Happy Thanksgiving, folks.

Posted in Uncategorized

Leave a comment