-

In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.

-

Join 1,220 other subscribers

Contribute To GMM

Categories

- 3D Printing

- Agriculture

- AI

- Algos

- Apple

- Automation

- Banking

- BFTP

- Bitcoin

- Black Swan Watch

- Bonds

- Brazil

- Brexit

- BRICs

- Budget Deficit

- Capital Flows

- Cartoon of the Day

- Cashless Society

- Chart of the Day

- Charts

- China

- Clean Tech

- Climate Change

- Coach C

- Commodities

- Coronavirus

- COVID

- Credit

- Crude Oil

- Currency

- Cyprus

- Daily Risk Monitor

- Day In History

- Debt

- Demographics

- Disinflaton

- Dollar

- Earnings

- ECB

- Economics

- Economist

- Egypt

- Electric Vehicles

- Emerging Markets

- Employment

- Energy

- Environment

- Equities

- Equity

- Euro

- Eurozone Sovereign Spreads

- Exchange Rates

- Fed

- Finance and the Good Society

- FinTech

- Fiscal Cliff Monitor

- Fiscal Policy

- Food Prices

- France

- Futurist

- Game Theory

- General Interest

- Geopolitical

- Geopolitics

- German Bund

- Germany

- Global Macro Watch

- Global Reset

- Global Risk Monitor

- Global Stock Performance

- Global Trend Indicators

- Gold

- Greece

- Healthcare

- Heat Map

- Hedge Funds

- Housing

- Human Interest

- Immigration

- Impeachment

- India

- Inequality

- Inflation/Deflation

- Infographics

- Innovation

- Institutional Investors

- Interest Rate Monitor

- Interest Rates

- Interviews

- Italian Yields

- Italy

- Japan

- Jobs

- Lectures

- Macro Notes from Conference Calls

- Manufacturing

- Masters

- Mexico

- Monetary Policy

- Movies

- Muni Bonds

- Muni Market

- Natural Gas

- News

- Nonlinear Thinking

- North Korea

- Overbought Markets

- Picture of the Day

- PIIGS

- PMIs

- Policy

- Politics

- Population

- Populism

- Poverty

- President Trump

- Qunat Strategies

- Quote of the Day

- Quotes

- Rare Earth Elements

- Readership

- Reads

- Real Estate

- Relative Strength Index

- Robert Shiller

- RSIs

- S&P500

- Sector ETF Peformance

- Semiconductor prices

- Semiconductors

- Social Media

- Socialism

- Song for the Week

- Sovereign Debt

- Sovereign Risk

- Spain

- Sports

- State and Local Government

- Tail Risk

- Technical Analysis

- Technology

- The Big Reset

- The Weekend Read

- This Day In Financial History

- Trade War

- Trades

- Tweet of the Day

- Ugly Chart Contest

- Uncategorized

- US Releases

- Video

- Volatility

- Wages

- Week Ahead

- Week in Review

- Weekend Reads

- Weekly Eurozone Watch

- Whales

-

Recent Posts

Meta

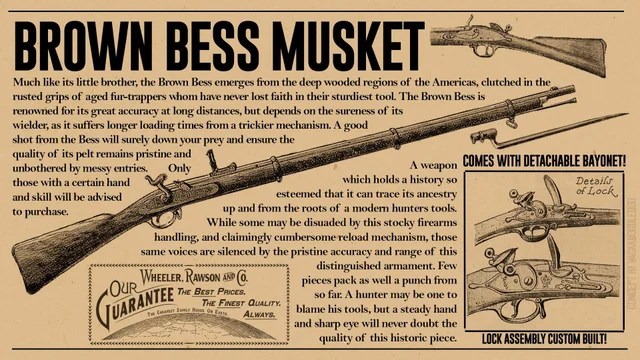

QOTD: The Bastardizing Of The Second Amendment

For Carol K.

QOTD: Quote of the Day

“the gun lobby’s interpretation of the Second Amendment is one of the greatest pieces of fraud . . . that I have ever seen in my lifetime.” – William Berger, Chief Justice of SCOTUS, 1969-86, appointed by Richard Nixon

A well regulated Militia, being necessary to the security of a free State, the right of the people to keep and bear Arms, shall not be infringed. – Second Amendment of the U.S. Constitution

How about a strict constructionist interpretation of the Constitution as so many on the hard right advocate, such as:

…the right of every minuteman to bear a Brown Bess

Do the following look like “well regulated” militias?

Welcome to Clarence Thomas’ AmeriKa

Posted in Uncategorized

3 Comments

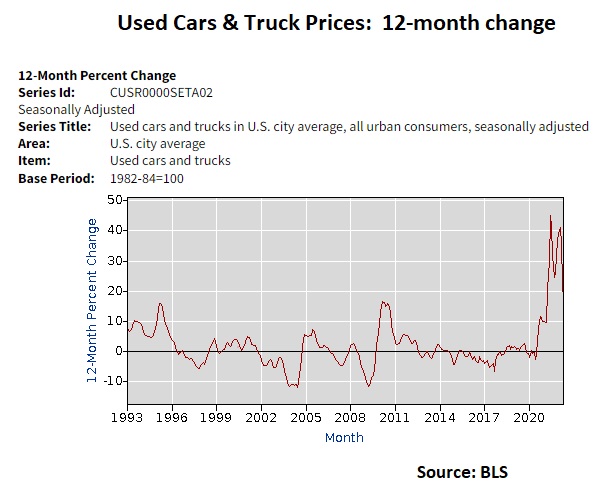

Call The Repo Man

Does anybody remember this cult classic?

Looks like he will soon be back in action with a vengeance:

A record share of new car shoppers are being saddled with monthly payments topping $1,000, according to June data from Edmunds. That’s higher than the average cost of rent in 24 US metro areas on the Zumper National Rent Report. Meanwhile, the average monthly car payment reached $712 in May, according to Cox Automotive. That’s higher than rent for one-bedroom apartments in cities like Wichita, Kansas, and Akron, Ohio. – Bloomberg

What could possibly go wrong? FOMO in the used car market….Geez!

It appears the used car bubble is going to burst. Bummer, my daughter just bought a used VW yesterday. No worries, she is not a flipper and got a very good price.

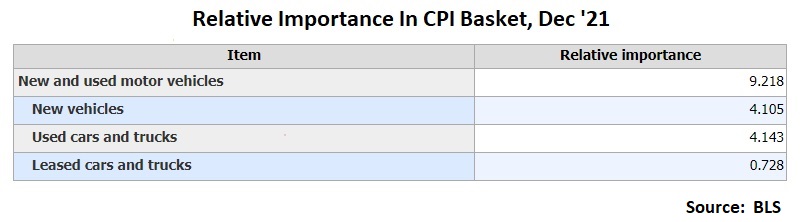

The coming deflation – yes, lower prices and not “disinflation“, which in the words of Wolf Blitzer, is “happening now” – in used car prices will dampen CPI inflation on the margin, even though they are only about 4 percent of the CPI basket.

Stay tuned, folks. It’s about to get interesting.

Posted in Disinflaton, Economics, Inflation/Deflation

Tagged Car payments, Used Cars

Leave a comment

History’s Biggest “Butterfly Effect” Occurred On This Day

The butterfly effect is the concept that small causes can have large effects. Initially, it was used with weather prediction but later the term became a metaphor used in and out of science.

In chaos theory, the butterfly effect is the sensitive dependence on initial conditions in which a small change in one state of a deterministic nonlinear system can result in large differences in a later state. The name, coined by Edward Lorenz for the effect which had been known long before, is derived from the metaphorical example of the details of a tornado (exact time of formation, exact path taken) being influenced by minor perturbations such as the flapping of the wings of a distant butterfly several weeks earlier. Lorenz discovered the effect when he observed that runs of his weather model with initial condition data that was rounded in a seemingly inconsequential manner would fail to reproduce the results of runs with the unrounded initial condition data. A very small change in initial conditions had created a significantly different outcome. — Wikipedia

On this day in history, June 28, 1914, the driver for Archduke Franz Ferdinand, nephew of Emperor Franz Josef and heir to the Austro-Hungarian Empire, made a wrong turn onto Franzjosefstrasse in Sarajevo.

Just hours earlier, Franz Ferdinand narrowly escaped assassination as a bomb bounced off his car as he and his wife, Sophie, traveled from the local train station to the city’s civic city. Rather than making the wrong turn onto Franz Josef Street, the car was supposed to travel on the river expressway allowing for a higher speed ensuring the Archduke’s safety.

Yet, somehow, the driver made a fatal mistake and tuned onto Franz Josef Street.

The 19-year-old anarchist and Serbian nationalist, Gavrilo Princip, who was part of a small group who had traveled to Sarajevo to kill the Archduke, and a cohort of the earlier bomb thrower, was on his way home thinking the plot had failed. He stopped for a sandwich on Franz Josef Street.

Seeing the driver of the Archduke’s car trying to back up onto the river expressway, Princi seized the opportunity and fired into the car, shooting Franz Ferdinand and Sophie at point-blank range, killing both.

That small wrong turn, a minor perturbation to the initial conditions, or deviation from the original plan, set off the chain events that led to World War I.

Stumbling Into The Great War

Fearing Russian support of Serbia, Franz Josef would not retaliate by invading Serbia unless he was assured he had the backing of Germany. It is uncertain as to whether the Kaiser gave Franz Josef Germany’s unequivocal support. Russia, fearing Germany would intervene, mobilized its troops forcing Germany’s hand.

The great European powers thus stumbled into a war they didn’t want through complicated entanglements and alliances, and miscalculation. Russia backing Serbia; France aligned with Russia, Germany backing the Austro-Hungarian Empire; and Britian, who really didn’t have a dog in the fight except her economic interests, aligned with France and Russia.

Later the U.S. would enter the war due to Germany’s unrestricted submarine warfare threatening American merchant ships and the Kaiser floating the idea of an alliance with Mexico in the famous Zimmerman Telegram, which was intercepted by the British.

Of course, some will argue that Great War in Europe was inevitable

The great Prussian statesman Otto von Bismarck, the man most responsible for the unification of Germany in 1871, was quoted as saying at the end of his life that “One day the great European War will come out of some damned foolish thing in the Balkans.” It went as he predicted. – History.com

Nevertheless, maybe the course of history would have been different if not for that wrong turn on June 28, 1914, which created the humongous butterfly effect, which we still experience the consequences this very day.

The botched Treaty of Versailles sowed the seeds the for World II. The War contributed to the Russian revolution and Cold War. The redrawing of borders in the Middle East after the War created the conditions for the instability and breakdown to tribalism the region experiences today.

A map marked with crude chinagraph-pencil in the second decade of the 20th Century shows the ambition – and folly – of the 100-year old British-French plan that helped create the modern-day Middle East.

Straight lines make uncomplicated borders. Most probably that was the reason why most of the lines that Mark Sykes, representing the British government, and Francois Georges-Picot, from the French government, agreed upon in 1916 were straight ones. — BBC News

If Franz Ferdinand had not been murdered on this day in history, that conflict between the Serbs and the Austro-Hungarian Empire may have been contained to just the Balkans. Maybe.

The butterfly effect. Think how many small events, decisions, mistakes, one small turn, or “minor perturbations” in plans have had enormous consequences in your own personal life.

Posted in Economics, Geopolitical, Uncategorized

Tagged Butterfly Effect, Franz Ferdinand, World War I

16 Comments

Gimme Shelter…Inflation Receding?

Inflation peaking? Doubt it.

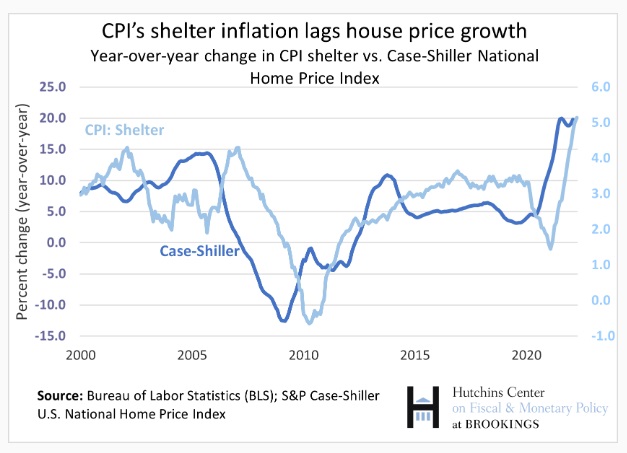

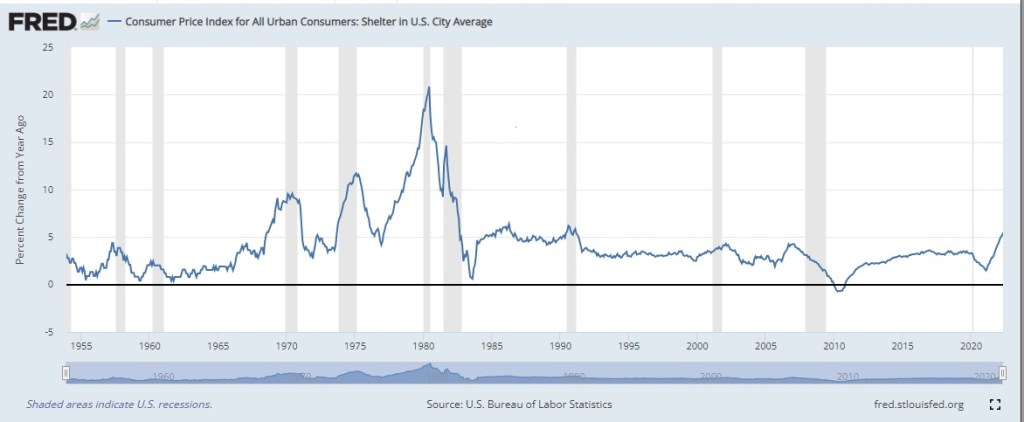

The price of shelter, which is about one-third of the CPI basket, is screaming higher.

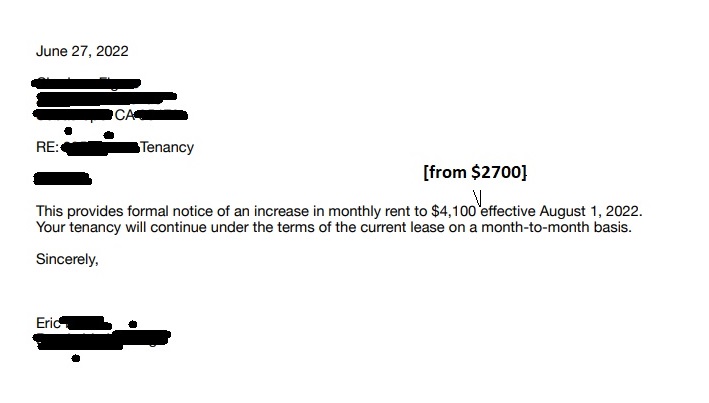

Last month, we wrote about our old baseball buddy, who was slammed with a rent increase.

We caught this article this morning,

Click here for article

Then a friend sent this over earlier today.

She has been levied a 50 percent rent increase! That is frickin’ hyper, folks.

She has been levied a 50 percent rent increase! That is frickin’ hyper, folks.

We hope it’s not a nationwide trend in terms of percent increases lest the country’s homeless rate is about to double.

Where is the supply chain issue here? Anybody?

Housing makes up over 40 percent of the CPI basket, including rents at a little over 7 percent.

The Post-1983 Housing Inflation Measurement To Be Tested

We suspect some strange (as in upside suprises) CPI prints coming as shelter goes vertical. The new methodology (post-1983) of using survey data to measure housing ownership inflation has never been tested in a high inflation environment.

Over time, changes in house prices do predict changes in rents—although the relationship is far from 1 – to-1 and occurs with long lags. Xiaoqing Zhou and Jim Dolmas of the Dallas Fed find house price growth’s correlation with OER inflation peaks at about 0.75 after 16 months; the correlation with rent inflation peaks at after 18 months. – Brookings

Brace for weirdness.

CPI Inflation’s Big Problem: Housing

#CKStrong

Updated: Post-CPI release @ 9:12 pm PT, May 11, 2022

But the Fed seems to be learning lessons from its 2021 experience. – NY Times

The Fed is under a lot of heat for letting inflation get out of control, which is now generating super hawkishness even among the most gentle of monetary doves. The scorching is illustrated in the above NY Times headline.

We are reposting our piece from last April 2021, Just In Case, You Think The Fed Has A Clue, in which we questioned the Fed’s economic sanity to keep buying mortgages while the housing market was in a massive bubble.

Bond yields are now spiking, and the stock market suffers because of the monetary authorities’ ineptitude as the economy contemplates a bond and stock market without central banks. The major buyers of Treasury securities since the beginning of the century have now morphed into net sellers in aggregate.

Nevertheless, making monetary policy is difficult, especially in the last few years, so we grant policymakers considerable grace.

Valuations and multiples have to come down as interest rates rise.

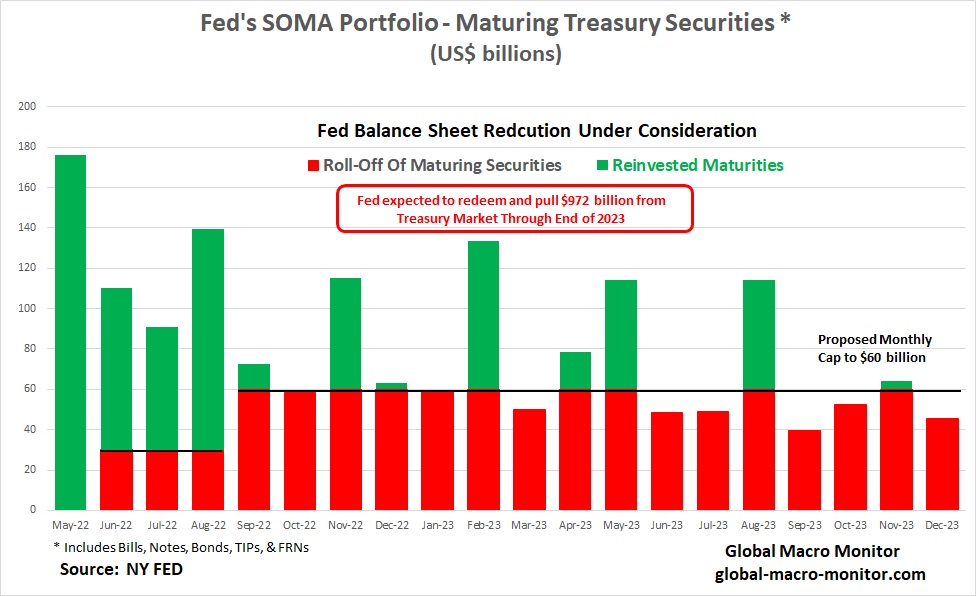

Given the FOMC’s latest statement on balance sheet reduction, we estimate the Fed will be extracting almost $1.5 trillion from the economy throughout 2023, approximately $972 billion from the Treasury market, and a maximum of just over $500 billion in mortgages.

Inflation As The End Game

However, we doubt the Fed and the American body politic have that high of a pain threshold for the subsequent economic and financial pain such a monetary tightening will bring. We, therefore, expect inflation will be the end game but only after, at the very least, a few deflation scares. When the going gets tough, the Fed will default to the mantra of most central banks and monetary authorities throughout history,

Print [debase], baby, print [debase]!

Housing Is Now The Problem, And Its Measurement Is Fatally Flawed

We estimate the Fed bought over $525 billion in mortgages between March 2021 and March 2022. During this period, the housing market was in Fuego with FOMO panic buying, driving up the National Price Index by 18 percent during the same period.

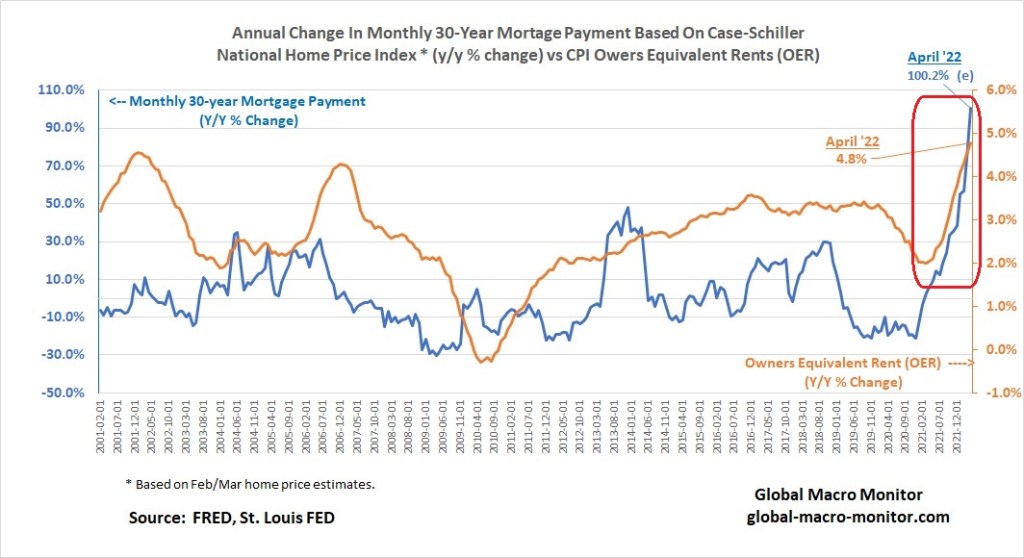

Moreover, the 30-year fixed-rate mortgage rate was up 150 bps, or 47.3 percent, driving up the cost of the monthly mortgage payment on the average house price in the United States by almost 75 percent. Let’s repeat that, folks, our best approximation of the cost of a monthly 30-year fixed-rate mortgage payment is up 75-100 percent in the past year.

The official measure for owners’ residential home inflation in the CPI basket is up a relatively measly 4.5 percent year-on-year as measured by Owners Equivalent Rent (OER), 24 percent of the CPI basket. What a complete joke.

Watch this space in tomorrow’s CPI release. [OER came in today up 4.8 percent y/y, which kept the overall number hotter than expected.]

The spike in mortgage payments has priced out most first-time buyers, forcing them into the rental market (7.4 percent of the CPI), raising rents by over 4 percent in the past year.

Different Housing Market Than The GFC

Of course, the housing market is in a much different condition than it was at the onslaught of the Great Financial Crisis (GFC), as all cash payments — an acute reflection of too much “money” in the system — have replaced the funky, highly levered subprime mortgages.

The result should be the reverse of the GFC, where housing prices collapsed almost overnight. This time, we expect a slow and chronic leak in housing prices with fewer forced bankruptcies, and less sensitivity to mortgage rates as they continue to climb until the Fed gets rolling in draining the excess money from the economy.

OER Starting To Track Real Housing Costs

Let us beat this dead horse one more time.

The above chart also illustrates that OER is starting to track the monthly mortgage payment for the first time, which is not a positive for the Fed or inflation.

The reason for this apparent disconnect is that most homeowners and renters did not move in 2021. They thus did not have to pay the spot price for shelter as it rose rapidly. Instead, many had to pay the rate that they signed for earlier in the year or the rate they signed for years earlier that had been modified slightly by their landlord or bank. These prices should tend to converge to the market price, but the lag time may be significant and the convergence incomplete. – VOX.eu

If homeowners have changed their perfunctory answer to the BLS survey question used to calculate 24 percent of the CPI

“If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?” – BLS

to one where homeowners perceive themselves as real renters that track real mortgage costs, or if they get the Airbnb bug, the measured inflation rate for shelter will continue to rise. This may or may not be happening but keep it on the radar.

If it does, expect the Washington bureaucrats to start tinkering with the cost of shelter in the CPI as they did in 1983. See our post, Today’s Inflation Rate And Nolan Ryan’s Fastball.

Best & Worst Time To Purchase A House

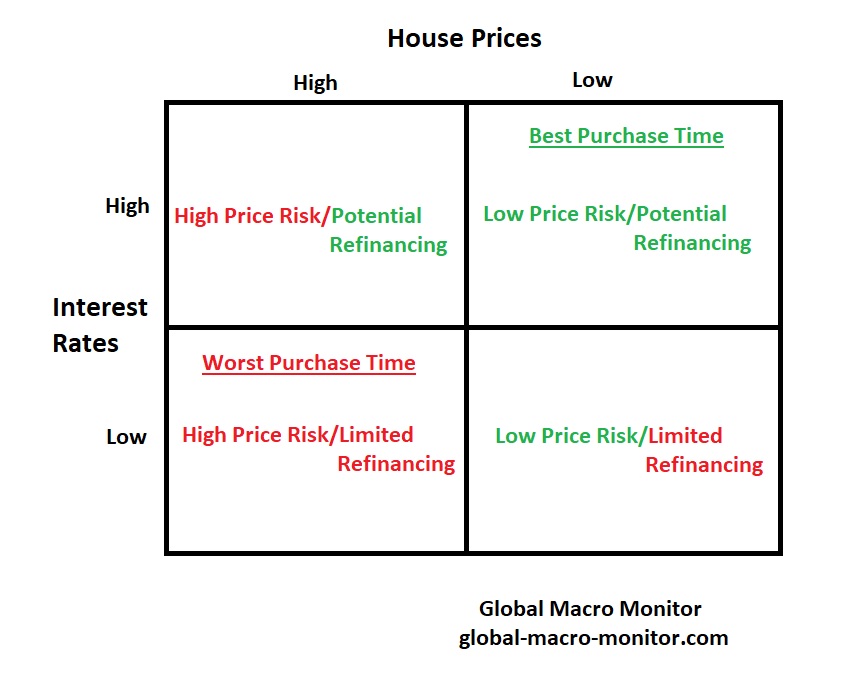

We feel for first-time homebuyers caught up in the FOMO bubble of the past year. We concede they may have some inside knowledge of a potential spooky inflation to come, but stretching to buy a starter home on a limited budget when interest rates are at artificial and historic lows, and prices at record highs can, and most likely, will be a toxic cocktail. Of course, we are not talking about the properties or “LifeStyles Of The Rich And Famous.”

Just In Case You Think The Fed Has A Clue

Originally Posted on April 29, 2021 by macromon

This should dispel the notion.

Can’t wait to hear the Chairman justify zero rate policy and deficit monetization with inflation roaring at > 5 percent. It would be entertaining if it weren’t so damaging.

Where To Inflation?

Here’s a pretty good theoretical model (follow the entire thread) estimating that U.S. inflation may reach double digits by Q1 2022. One of the premises is that monetary authorities have no way out of this rabbit hole and are constrained by the risk of severely disrupting financial markets in an asset dependent economy.

Recall our view that deflation/inflation is a corner solution and Wall Street’s “Goldilocks” scenario is still just a marketing gimmick. Deflation as markets try to move back to mean valuations – a lot lower – or inflation, and lots of it.

h/t CG

Anyone with a better model, lay it on the table. Stop with the “fake news” or “don’t worry” nonsense. CPI prints > 4 percent in May and you heard it here first.

GMM’s Health Wars

CK and I are battling some serious health issues. Mine, an acute skirmish, which I am now recovering.

CK’s, a three-front protracted war. Her courage to get up and fight everyday has been such an inspiration during my little battle. She also saved my life by forcing me to “ignore my primary doctor’s diagnosis of “all is well” and aggressively pursue my symptoms.” If not for that, the Grim Reaper would have liquidated my position and GMM would be no more. Thanks, CK.

Posted in Uncategorized

1 Comment

The Six Constants Of Markets – Caveat Emptor

It can be very hard for ordinary investors to separate fact from hype.

— U.S. Department of Labor, warning against investing in cryptocurrency in 401(k) plans

1) Greed, 2) Grift, 3) Hype, 4) Enabling Delusions, 5) Overshoot, and 6) Shattered Dreams

h/t: The Polish Rifle

Don’t think even the great, but duped Tom Brady can bring this one back. The Fed, alone, began the extraction of over $1 trillion of liquidity from the economy over the next 18 months on Wednesday. We suspect not crypto positive.

Bitcoin is down 50 percent since the onslaught of the Super Bowl commercials trying to sucker in a new pool of greater fools. One helluva store of value currency.

The Super Bowl commercials were clearly a signal that marked the top of dot.com mania, which crashed a few months later in March.

Fast forward to the 2022 Super Bowl. – GMM, February 12, 2022

The Crypto Craze will go down as The GOAT of delusional financial bubbles. We are open to be proved wrong but doubt it.

Matt Damon, where are you? It was sad to see the super principled Steph Curry caught up hyping the sector. Where are the Lakers going to play next year?

One Last Thing

The creation of what was once a $3 trillion speculative asset class, created out of thin air, fueled by free money and delusuions with absolutely zero productive capacity, helped feed the inflation we now all experience. The crypto crash does take some marginal pressure off monetary policy, however.

The Crypto vs Dot.com Super Bowl

Remember the 2000 Super Bowl at the peak of the dot.com mania, where newly minted dot.com companies spent most of their entire IPO proceeds to buy Super Bowl commercials to generate “eyeballs” to their websites to drive their stock price higher?

Super Bowl XXXIV (played in January 2000) featured 14 advertisements from 14 different dot-com companies, each of which paid an average of $2.2 million per spot.[1][note 1] In addition, five companies that were founded before the dot-com bubble also ran tech-related ads, and 2 before game ads, for a total of 21 different dot-com ads. These ads amounted to nearly 20 percent of the 61 spots available,[1] and $44 million in advertising. In addition to ads which ran during the game, several companies also purchased pre-game ads, most of which are lesser known. All of the publicly held companies which advertised saw their stocks slump after the game as the dot-com bubble began to rapidly deflate.

The sheer amount of dot-com-related ads was so unusual that Super Bowl XXXIV has been widely been referred to as the “Dot-Com Super Bowl”, and it is often used as a high-water mark for the dot-com bubble. Of these companies, 4 are still active, 5 were bought by other companies, and the remaining 5 are defunct or of unknown status.[when?] – Wikipedia

The Super Bowl commercials were clearly a signal that marked the top of dot.com mania, which crashed a few months later in March.

Fast forward to the 2022 Super Bowl.

Cryptocurrency’s biggest boosters would do well to remember tech’s most infamous sock puppet. The year was 2000; it was what would later be known as the “Dot-Com Super Bowl,” an NFL face-off during which tech companies bought up some 20 percent of the advertising real estate during the Big Game. A few years later, many of the companies that bought those ads were defunct or swallowed up by other firms—including Pets.com, which had run a commercial featuring a singing puppet made from a sock.

This warning comes not because crypto companies are looking to turn stockings into mascots (at least, not that we know of), but because they are currently pumping millions of dollars into buying up ad space during Super Bowl LVI. Crypto.com, which has been flooding the market with its Matt Damon-starring commercials lately, has a big spot running; cryptocurrency exchange FTX plans to give away bitcoin during its Super Bowl spot. Coinbase is also reportedly running an ad. The companies are playing coy about who will appear in them. Regardless, the message seems to be that crypto is hot and everyone should get on board. But as multiplearticleshave pointed out in the past week, the Crypto Bowl has echoes of those ill-fated tech-company ads of the past. – Wired

The dot.coms needed more eyeballs and the ads were generated to lure in more “greater fools” to keep buying their worthless stocks to remain viable. Ditto for crypto.

We don’t know how this all ends but know thy history, folks. Just sayin’.

The winner of the 2000 Super Bowl? The Rams, gulp!

Posted in Uncategorized

Leave a comment